Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Monday, crude oil moved higher after the market’s open supported by the upbeat Chinese manufacturing data. Despite this improvement, the commodity reversed after a disappointing U.S. manufacturing report as profit taking weighted on the price. In reaction to this, light crude lost 0.42% and declined to the medium-term support line. Will it be strong enough to stop further deterioration?

The official data released on Saturday showed that China’s manufacturing purchasing managers’ index rose to a five-month high of 50.8 in May, beating expectations for 50.6 and up from 50.4 in April. As we mentioned earlier, this better-than-expected data supported the commodity after the market’s open. However, disappointing U.S. manufacturing report released later in the day, encouraged oil investors to lock in gains and pushed crude oil to slightly above $102. As a reminder, yesterday, the Institute of Supply Management reported that its manufacturing PMI ticked down to 53.2 in the previous month, missing expectations for a rise to 55.5.

How these fundamental factors influenced the technical picture of crude oil? Let’s check (charts courtesy of http://stockcharts.com).

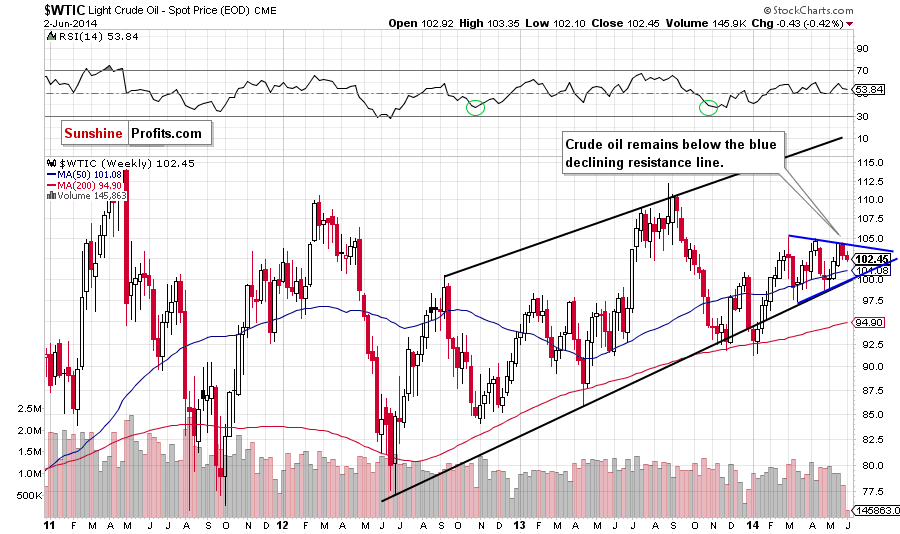

From the weekly perspective, w see that situation remains unchanged as crude oil still remains below the blue resistance line based on the recent highs (the upper border of the triangle). Therefore, we think that the proximity to this line will continue to be supportive for oil bears and we’ll see futher deterioration and a pullback to around the 50-week moving average (currently at $101.08) in the coming week (or weeks).

Having said that, let’s focus on the very short-term picture.

Quoting our previous Oil Trading Alert:

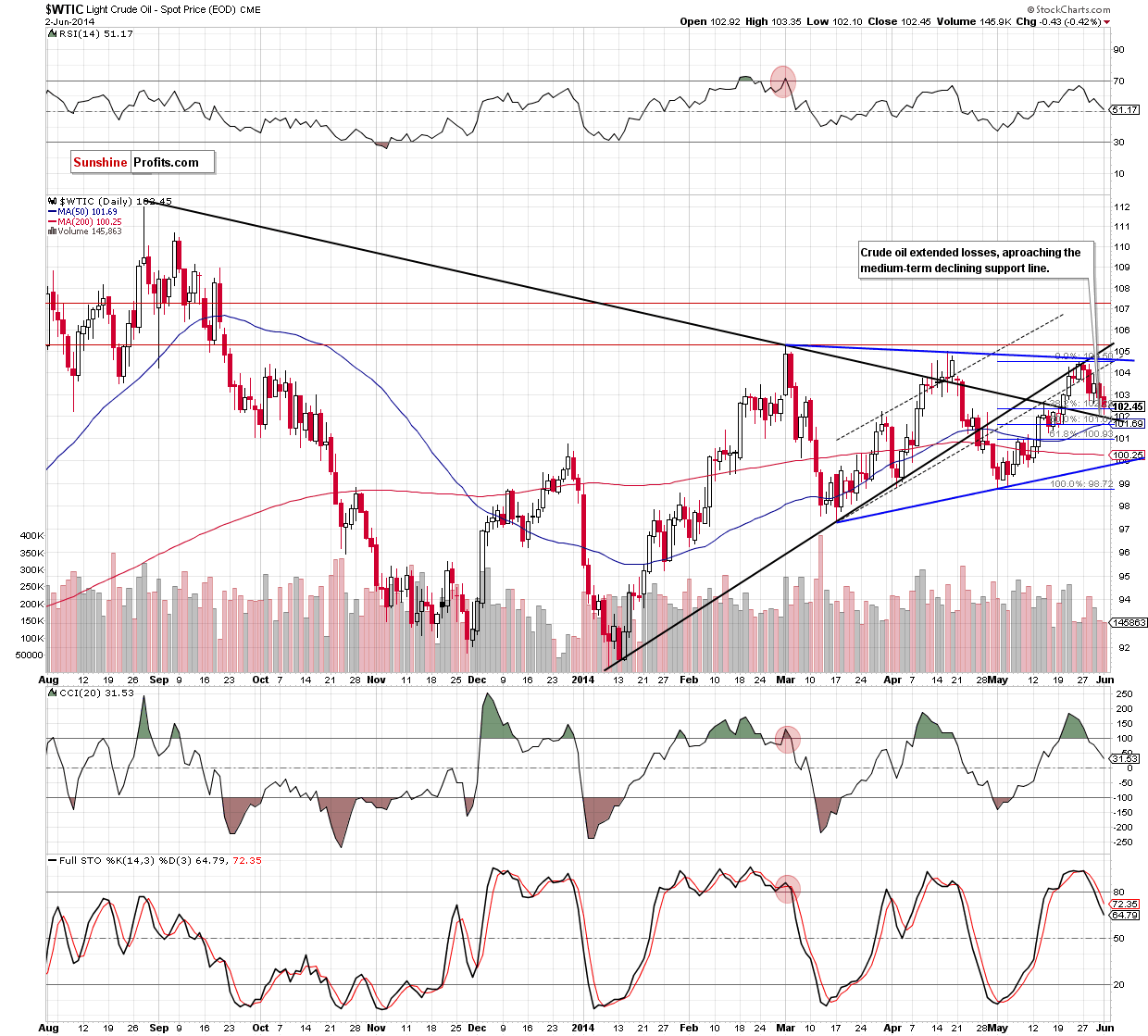

(…) If the support level created by the 38.2% Fibonacci retracement holds, we may see a rebound in the coming day. Nevertheless, if it doesn’t stop the selling pressure, we will see further deterioration and the next target for oil bears will be the black medium-term declining support line (currently around $102).

Looking at the daily chart, we see that oil bears almost realized the above-mentioned scenario, pushing the commodity to the daily low of $102.10. Taking into account the importance of the black medium-term declining line, we should consider two scenarios. On one hand, if this strong support encourages oil investors to push the buy button, we may see a corrective upswing to around $103.56, where the Friday high is. On the other hand, if it is broken, we will see a drop to around $101.62-$101.69, where the next Fibonacci retracement and the 50-day moving average are. Please keep in mind that sell signals generated by the CCI and Stochastic Oscillator are still in play, supporting the bearish case.

Summing up, crude oil extended losses, approaching its next downside target. Although the commodity could rebound from here as it reached an important support line, we remain bearish. The reason? First, sell signals generated by the indicators remain in place. Second, the breakdown below the lower border of the rising trend channel was verified, but even more importantly, light crude is still well below the strong resistance zone created by the lower line of the trend channel, both medium-term resistance lines and the April high. Connecting the dots, all the above suggests that we’ll see lower values of crude oil in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts