Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Wednesday, crude oil gained 0.84% as the EIA report showed a larger-than-expected drop in crude-oil supplies. Thanks to this bullish news, light crude broke above the lower border of the rising trend channel and reached the key resistance line. What’s next? Are there any other encouraging signs on the horizon?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil stockpiles dropped by 7.2 million barrels in the week ending May 16, far surpassing expectations for a 750,000 barrels build. At this point, it’s worth noting that this was the biggest weekly decline in more than four months. This drop was largely attributed to a slide in imports of crude to a 17-year low, but it’s hard to draw bigger implications about price direction from a single week's data. Despite this larger-than-expected drop, total U.S. crude oil inventories remain near record highs and stood at 391.3 million barrels as of last week. Nevertheless, the report also brought other bullish data for the oil market, showing a continued decline in stockpiles in Cushing, Oklahoma.

Will crude oil correct this rally in the coming days? Let’s look for answer on the charts (charts courtesy of http://stockcharts.com).

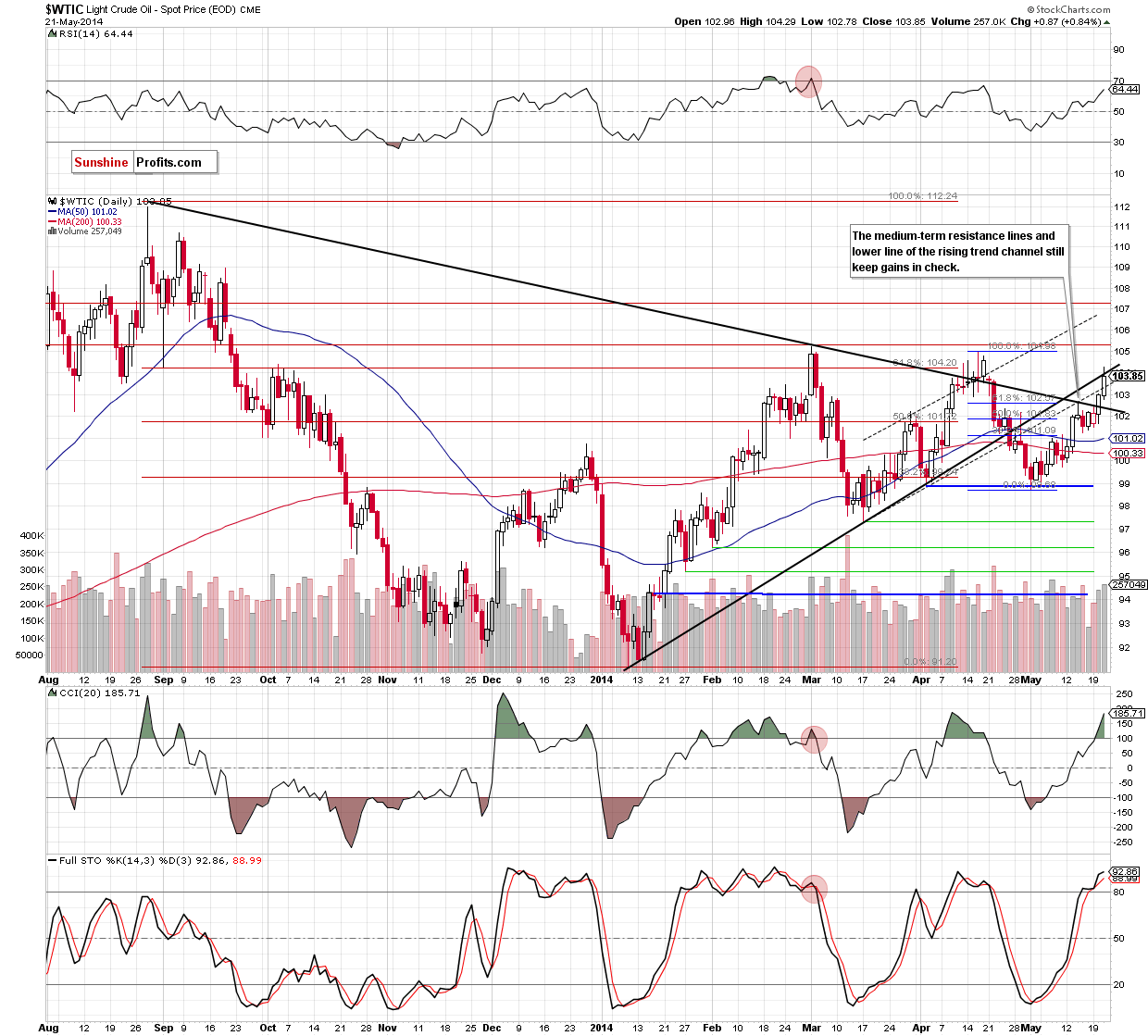

Despite yesterday’s upward move, crude oil still remains below the lower border of the triangle, which means that the medium-term situation hasn’t changed. Once we know the above, let’s focus on the very short-term changes.

As you see on the above chart, crude oil extended gains and broke above the lower line of the rising trend channel, reaching the medium-term resistance line. This is the point where we should consider two scenarios. On one hand, if the combination of the rising black line and the 88.6% Fibonacci retracement based on th entire recent decline(at $104.28) is strong enough to stop further improvement, we’ll see a pullback in the coming days and the first downside target will be the previously-broken upper line of the triangle (currently around $102.40). In our opinion, it’s quite likely as the CCI and Stochastic Oscillator are overbought, while the RSI reached a similar level as in mid-April. However, if oil bulls succesfully breaks above the lower border of the triangle, we’ll see further improvement and the next upside target will be the April high of $104.99. Alhough this is the less likely of scenarios to play, it cannot be ruled out as an option.

Summing up, crude oil moved higher once again and broke above the lower line of the rising trend channel, but we remain bearish as crude oil is still trading below the key resistance line (the lower border of the medium-term triangle). Although the commodity could go both north and south from here, we think that the bearish scenario is more likely at the moment. Nevertheless, as long as light crude remains above the dashed rising line (which serves now as support), another test of the strength of the medium-term resistance can’t be ruled out.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Taking into account the fact that the medium-term resistance line is currently higher than at the beginning of the month (when short positions were opened), we decided to raise the stop-loss order to $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts