Trading position (short-term; our opinion): Long positions with a stop-loss order at $86.27 are justified from the risk/reward perspective. Initial price target: $96.

Although crude oil climbed to almost $93 after an unexpected drop in crude supplies, news that Saudi Arabia lowered the official selling prices for its crude oil watered down the price of the commodity. As a result, light crude lost 0.68% and slipped to the recent lows. What’s next?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories decreased by 1.4 million barrels in the week ended September 26, beating analysts‘ expectations for a gain of 0.7 million barrels. Additionally, gasoline inventories decreased by 1.8 million barrels, compared to forecasts for a decline of 0.8 million barrels, while distillate stockpiles declined by 2.9 million barrels. These bullish numbers supported the commodity and triggered a rally to an intraday high of $92.96.

Despite these favorable circumstances, crude oil reversed and declined sharply on news that Saudi Arabia cut its November oil prices. The Kingdom lowered its selling price by $1 a barrel compared with the prior month for Arab Light crude being sold in Asia. Additionally, Saudi Arabia's oil company also lowered its prices for oil sold in Europe and the U.S. This news suggested that oversupplied conditions are going to continue for a while, which watered down the price of the commodity and pushed it to around the recent lows. What’s next? (charts courtesy of http://stockcharts.com).

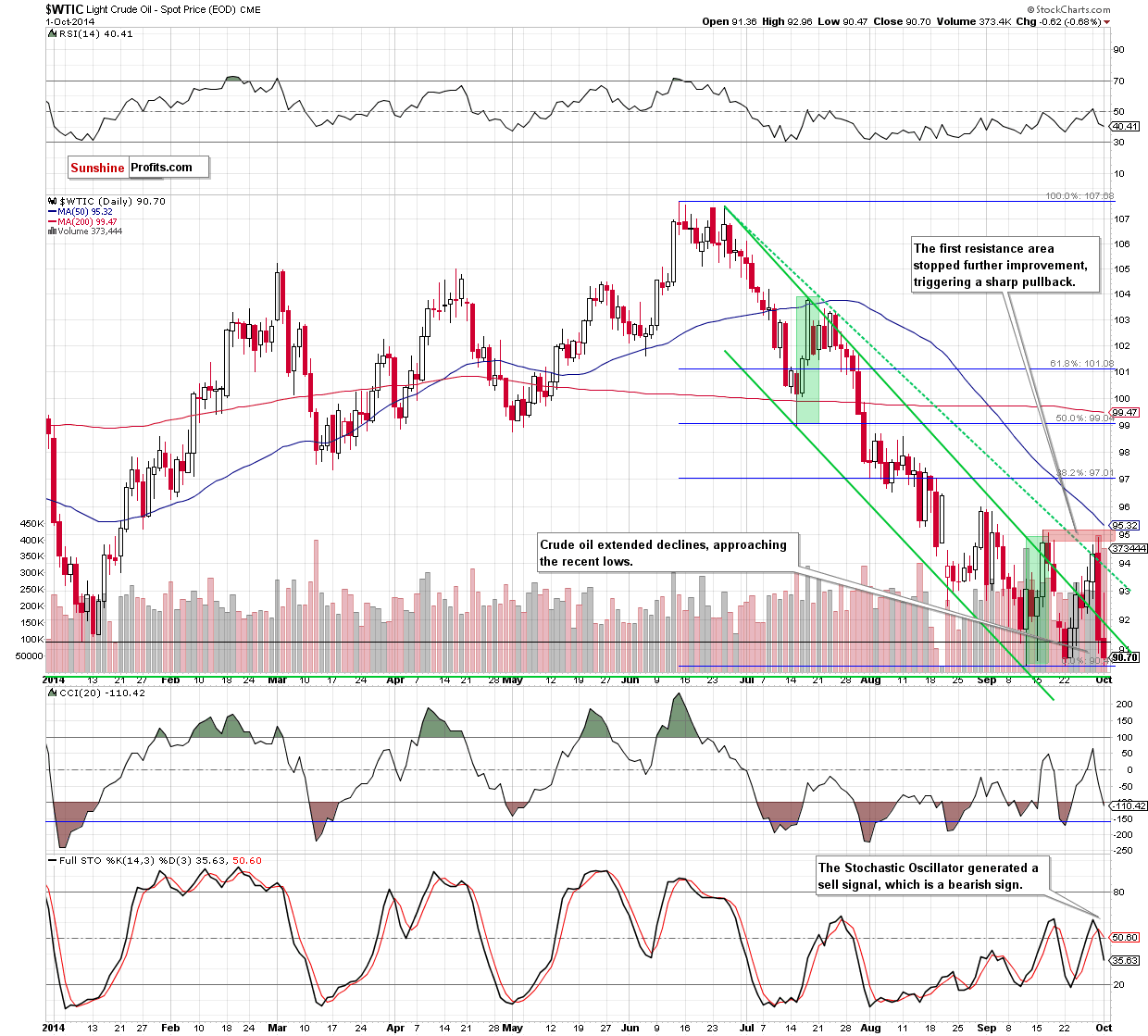

From this perspective, we see that although crude oil climbed above the upper line of the declining trend channel, this improvement was only temporarily. As you see, the commodity reversed and declined sharply to around the recent lows. Taking into account only this chart and yesterday’s closing price, we could assume that we will see a triple bottom – especially when we factor in the medium-term support zone created by the long-term declining support line and the 61.8% Fibonacci retracement.

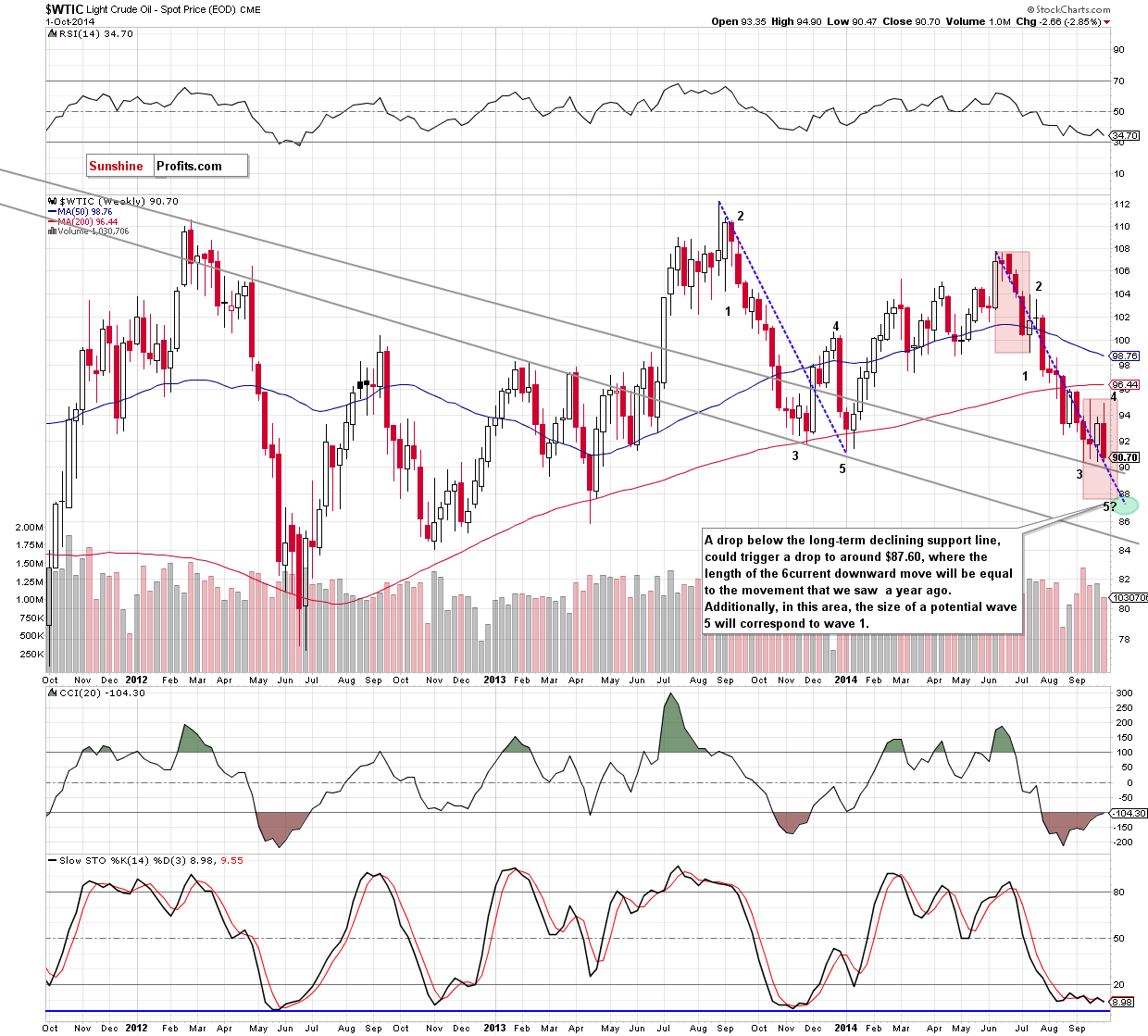

However, crude oil futures for delivery in November fell to a session low of $88.20 per barrel during European morning hours. Therefore, we decided to take a closer look at the weekly chart from different perspective to see how low could the commodity fall.

Looking at the above chart, we see that the next solid support is around $86.60 (marked with green). Why here? Firstly, when we compare the current downward move (from Jun until now) to the decline that we saw in the previous year, we see that they both will be equal at $86.68. Secondly, when we factor in the Elliott Wave Theory, we can notice that the size of a potential wave 5 will correspond to wave 1 also in this area. Thirdly, there are still positive divergences between the indicators and the price, which suggest that a bigger upward move is just around the corner.

Summing up, although crude oil closed yesterday’s session above the recent lows, today’s drop in crude oil futures for delivery in November suggests that the price of crude oil could move a little lower before the final bottom is in. At the same time it is still the case that the situation in the USD Index could cause a sharp upswing in crude oil in the following days (or even later today) and it seem that keeping long position intact is a good idea. In case if we see more volatility shortly, we have decided to move the stop-loss order slightly lower. You will find it below.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $86.27. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts