Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil gained 3.68% on news that Nigeria would reduce exports of its crude in February. As a result, light crude bounced off the recent lows and erased over 60% of Thursday’s decline. Did this increase change the short-term picture of the commodity?

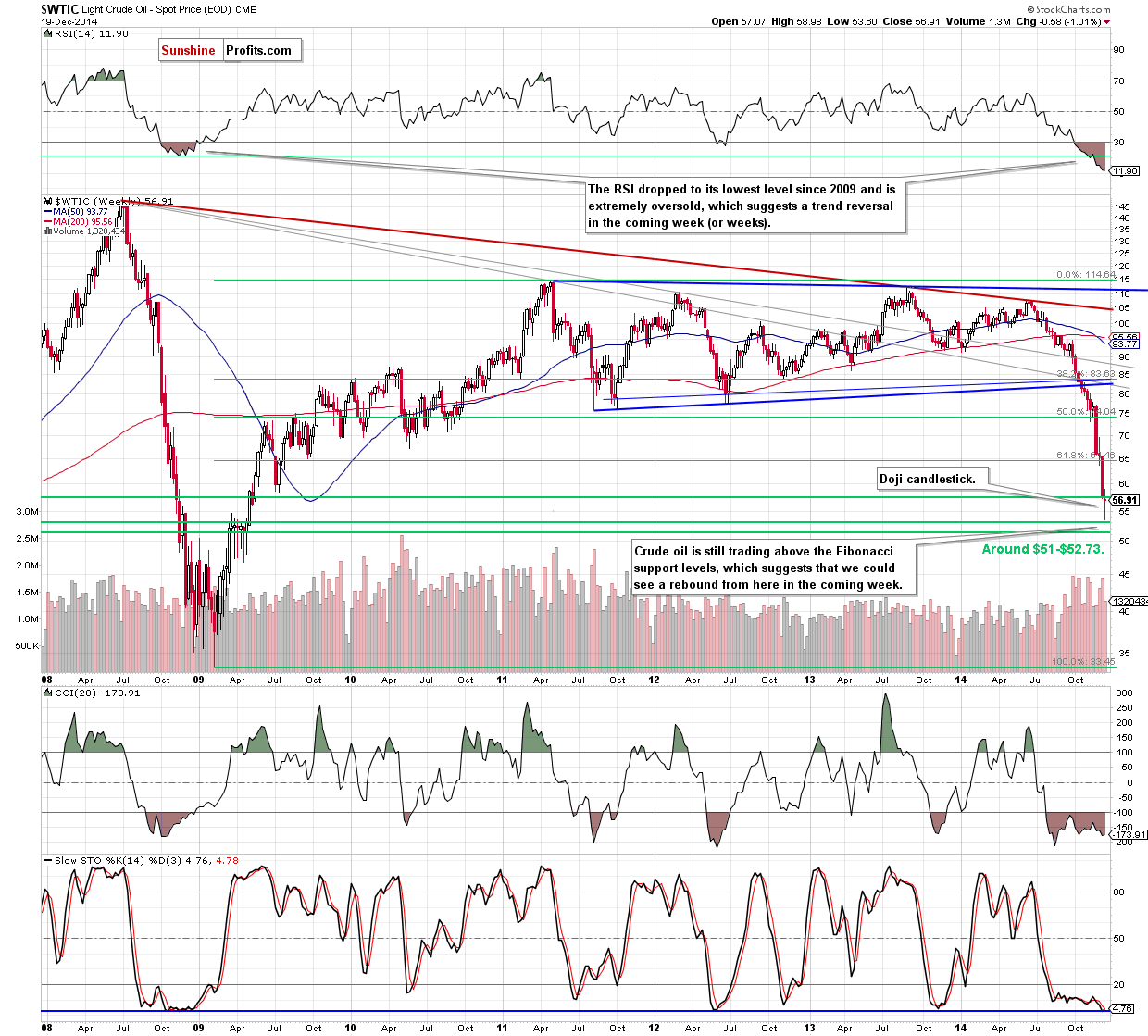

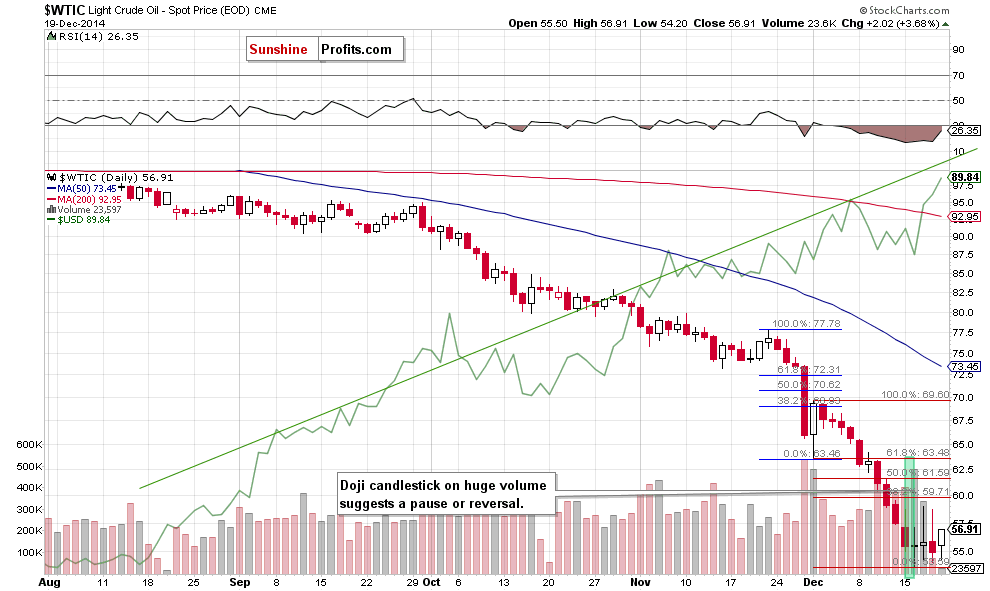

On Friday, the price of light crude moved higher supported by report that Nigeria would reduce exports to 271,000 barrels per day in February, down from 398,000 barrels per day in January. Despite this increase, crude oil posted its fourth consecutive weekly drop. Will we see the commodity above $60 later this week? (charts courtesy of http://stockcharts.com).

In our previous Oil Trading Alert, we wrote the following:

(…) crude oil declined sharply, approaching the recent low. Although this is a negative signal, we should keep in mind that yesterday’s downswing materialized on tiny volume (compared to the previous days), which suggests that oil bears were not as strong as it seemed on the first glance. Taking this fact into account and combining it with the proximity to the recent low and the support zone (created by the 76.4% and 78.6% Fibonacci retracement levels and reinforced by the doji candlestick), it seems to us that we could see a rebound from here in the coming days.

As you see on the daily chart, oil bulls pushed the commodity higher as we expected. With this upswing, light crude increased to almost $57, which resulted in a doji candlestick on the weekly chart . This is a positive signal, which suggests that oil bears are getting weaker and losing conviction for further declines (as a reminder, on Tuesday, we noticed the same candlestick pattern on the daily chart, which has a positive impact on the price on the following trading day). Despite this factor, crude oil is still trading in a narrow range between the 38.2% Fibonacci retracement (based on the entire Dec decline) the above-mentioned support zone. Therefore, we think that as long as there is no successful breakout above this resistance (or breakdown under this support), opening any positions is not justified from the risk/reward perspective. The reason? When we take a closer look at the daily chart, we see that there was a bigger and sharp corrective upswing at the beginning of the month. Back then, although crude oil corrected over 38.2% of earlier downward move, oil bulls didn’t manage to push the commodity higher, which translated to a fresh 2014 low. Therefore, we think that a trend reversal (and an upward move to the initial upside target around $70) will be likely only if we see an upswing above $59.50, which won’t be followed by a fresh low. Until this time, another pullback and test of the recent low is likely.

Summing up, although crude oil bounced off the recent lows, the current situation in the commodity is a bit unclear as light crude is trading in a narrow range. Nevertheless, if oil bulls manage to push light crude above the 38.2% Fibonacci retracement (based on the entire Dec decline), we’ll consider opening long positions. Until this time, no positions are justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts