Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

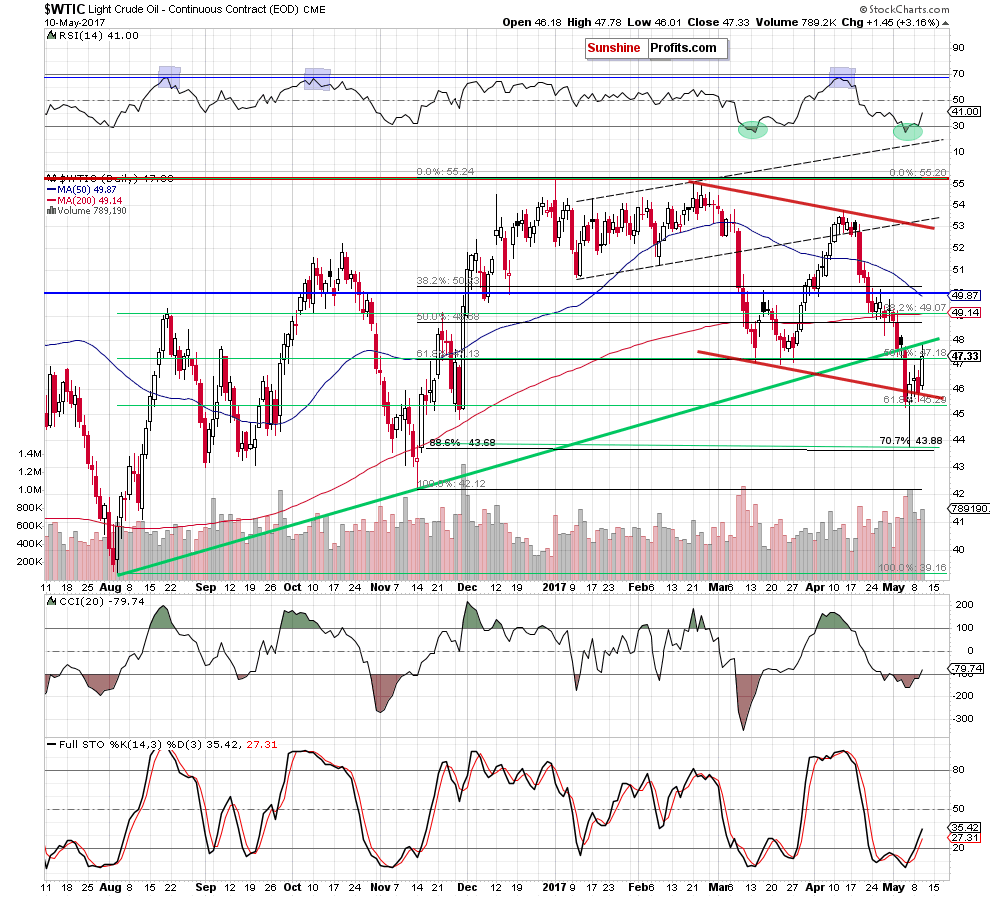

On Wednesday, crude oil gained 3.16% after the EIA report showed that crude inventories dropped more-than-expected. Thanks to this news light crude bounced off the lower border of the declining trend channel and increased to the first resistance line. Will it manage to stop oil bulls?

Although the Energy Information Administration reported that gasoline inventories dropped by only 0.150 million against expectations for a draw of 0.538 million barrels, the report also showed that crude oil inventories dropped by 5.25 million barrels, beating expectations of a draw of 1.79 million barrels. On top of that, distillate stockpiles declined by 1.6 million barrels, beating forecasts of a 1 million decline. Thanks to these bullish umbers, light crude bounced off the lower border of the declining trend channel and increased to the first resistance line. Will it manage to stop oil bulls in the coming days?

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

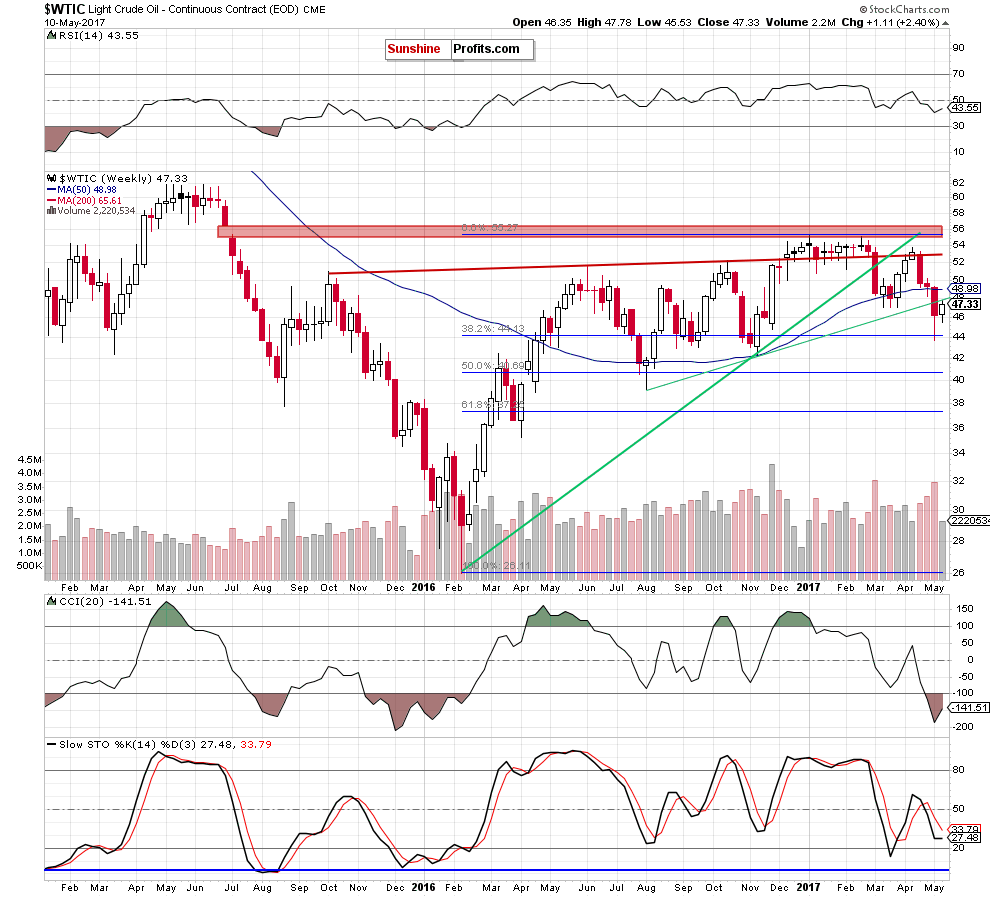

(…) crude oil moved lower, which resulted in a drop to the previously-broken lower border of the red declining trend channel. Such price action looks like a verification of the earlier breakout and suggests another attempt to move higher.

This scenario is also reinforced by the buy signals generated by the Stochastic Oscillator and the RSI. (…) it is worth keeping in mind that (…) yesterday’s decline materialized on smaller volume than earlier increases, which suggests that oil bulls are stronger at the moment.

If this is the case, and light crude rebounds from here, the initial upside target will be around $47.87, where the previously-broken long-term green line (based on the August and November lows) currently is.

Looking at the daily chart, we see that oil bulls pushed the black gold higher as we had expected. Thanks to yesterday’s increase crude oil bounced off the previously-broken lower border of the red declining trend channel and climbed to our first upside target - the long-term green line based on the August and November lows.

What’s next? On one hand, the buy signals generated by the indicators together with the size of volume, which accompanied yesterday’s increase, suggest further improvement in the coming days. However, on the other hand, Wednesday’s move looks like a verification of the breakdown under the long-term green line, which could encourage oil bears to act and result in a comeback to the previously-broken lower border of the red declining trend channel.

All the above make the very short-term picture a bit unclear and suggest that waiting at the sidelines for another profitable opportunity is justified from the risk/reward perspective at the moment.

Summing up, crude oil increased to the long-term green line, which looks like a verification of the earlier breakdown and increases the probability of a pullback in the coming day(s).

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts