Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved sharply higher on Monday’s news (Saudi Arabia and Russia agreed to cooperate to stabilize the price of the commodity), the black gold gave up some of earlier gains later in the day. As a result, light crude tested the strength of resistance lines. What’s next?

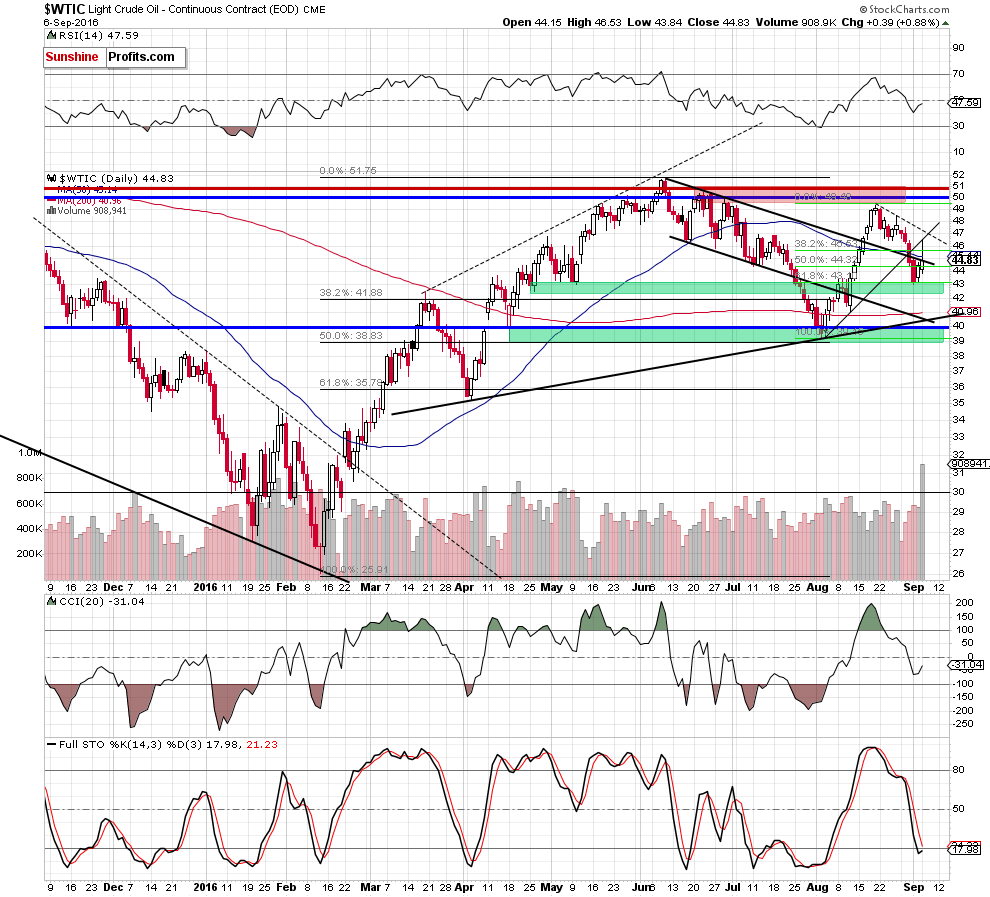

Let’s try to find an answer to this question on the daily chart (charts courtesy of http://stockcharts.com).

On the above chart, we see that crude oil moved sharply higher after the market’s open and climbed above the upper border of the black declining trend channel. This positive event encouraged oil bulls to act, whch resulted in a sharp increase to an intraday high of $46.53. With this upswing light crude moved to the previously-broken black rising line based on the Aug lows, which looks like a verification of earlier breakdown below this resistance. This scenario is also reinforced by the fact that light crude gave up almost 62% of earlier increase and closed the day under the upper line of the declining trend channel, invalidating yesterday’s breakout. On top of that, sell signals generated by the indicators remain in place, supporting oil bears.

What’s next? In our opinion, all the above suggests that another attempt to go south and lower values of crude oil are just around the corner. If this is the case, and light crude declines once again, we’ll see a re-test of the green support zone in the coming day(s). However, if it is broken, crude oil could slide all the way back to the rising black support line around $40 - $41.

Summing up, although crude oil moved sharply higher, the previously-broken black rising line based on the Aug lows stopped further improvement, triggering a pullback, whch took the commodity to the black declining trend channel. Taking this negative event into account and combining it with sell signals generated by the indicators, we think that lower values of the commodity are just around the corner.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts