On Tuesday, crude oil was trading in a narrow range as oil investors tried to puzzle out the impact of inflation data from the U.S. Light crude hit its intraday high of $98.15, however, in the following hours it gave up the gains and closed the day slightly above the Monday’s closing price.

Yesterday, the Department of Labor reported that the U.S. consumer price index came in flat in November after falling 0.1% in October. The annual rate of inflation rose 1.2% in November (just a little bit below expectations for 1.3% reading) from a four-year low of 1.0% in October. Meanwhile, U.S. core inflation, stripped of volatile food and energy items, rose 0.2% in November from October, beating expectations for a 0.1% gain, while the year-on-year rate for November rose 1.7%.

Looking at the shape of yesterday’s candlestick (doji), it seems that oil investors were confused as they didn’t get enough indications as to whether the Fed will taper asset purchases now or in 2014. Therefore, investors awaited the outcome of the Federal Reserve's policy meeting later in the day, which will likely be the most important factor that will affect the price this week.

Market players also looked ahead to data from the U.S. Energy Information Administration on oil and fuel inventories later in the day to gauge the strength of demand from the world’s largest oil consumer. Today’s the EIA report is expected to show that crude oil stockpiles fell by 2.3 million barrels last week, while gasoline inventories were forecast to increase by 1.85 million barrels.

Please note that yesterday, after markets closed the American Petroleum Institute, said that U.S. crude inventories fell by 2.5 million barrels in the week ended December 13, compared to expectations for a decline of 4 million barrels.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

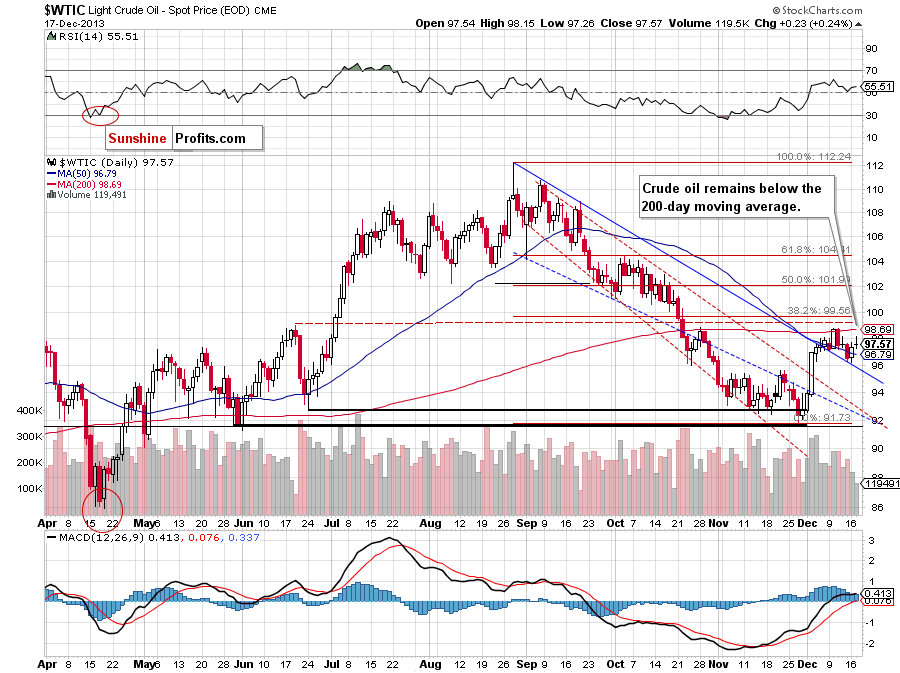

Looking at the above chart, we see that the situation hasn’t changed much. Yesterday, after the market open, crude oil extended its gains and rose to an intraday high of $98.15. In this way, oil bulls almost realized their own pro growth scenario (we wrote more about this issue in our previous Oil Trading Alert). However, after reaching its first upside target, crude oil gave up the gains, reversed course and closed the day slightly above Monday’s closing price.

As you can see on the above chart, crude oil still remains above its 50-day moving average and the upper line of the declining trend channel, which serves as major short-term support. The nearest major short-term resistance which keeps further growth in check is still the 200-day moving average.

Having discussed the current situation in crude oil, let’s take a look at WTI Crude Oil (the CFD).

Quoting our previous Oil Trading Alert:

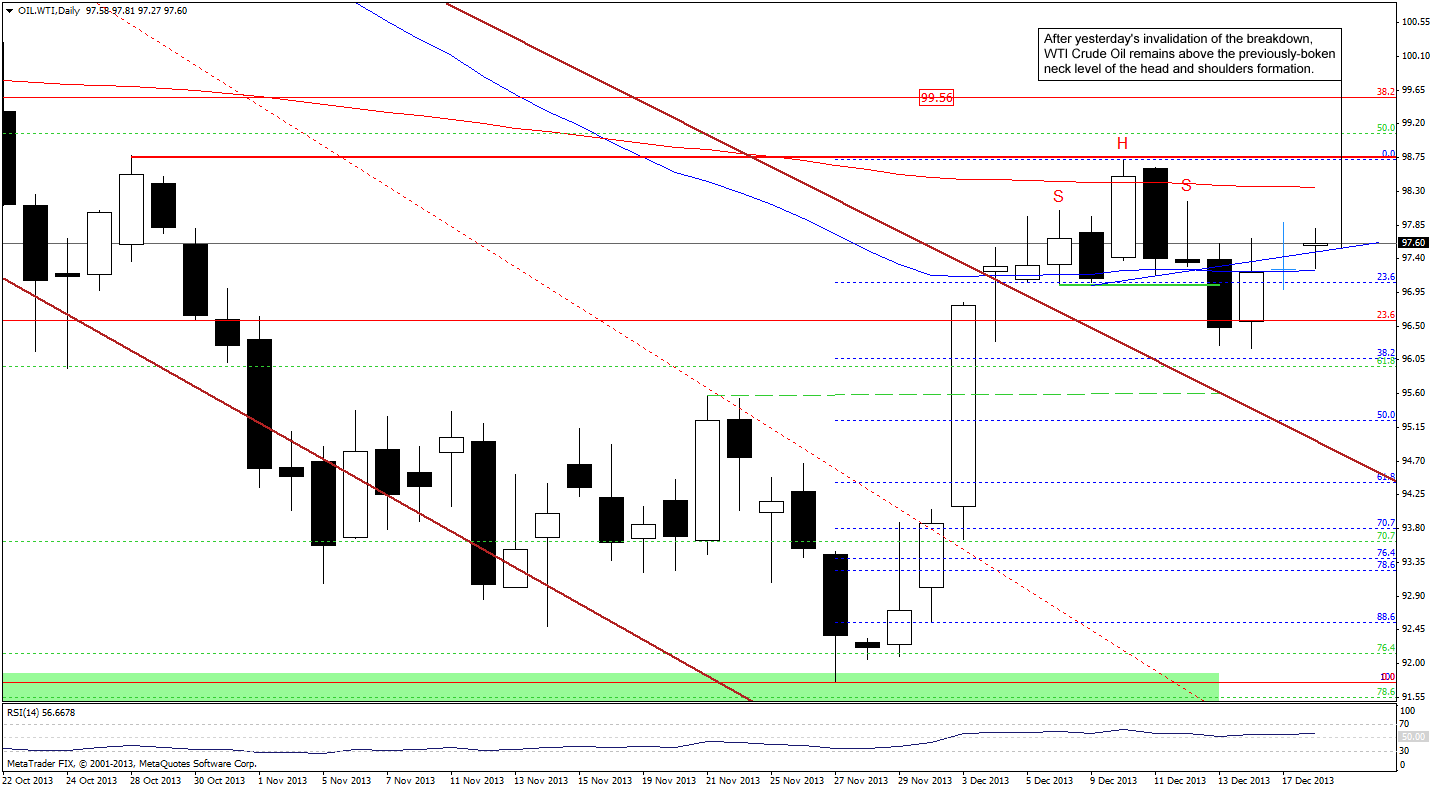

(…) WTI Crude Oil extended its growth and invalidated the breakdown below the neck line, which is a strong bullish signal. According to what we wrote yesterday, the first upside target is around $98.16. If it is broken, the next one will be the 200-day moving average, which stopped further growth in the previous week.

On the above chart, we see that although oil bulls didn’t manage to push the CFD to its upside target, WTI Crude Oil remains above the previously-broken neck line, which is a positive signal. From this perspective, it seems that as long as the CFD remains above this line a move to the upside is still likely to be seen.

Please note that our last week’s assumption remains up to date: “(…) taking into account the fact that crude oil and WTI Crude Oil move together in the same direction, it seems that a move in the CFD will trigger a similar move in light crude.”

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) weekly chart.

Quoting our last Oil Trading Alert:

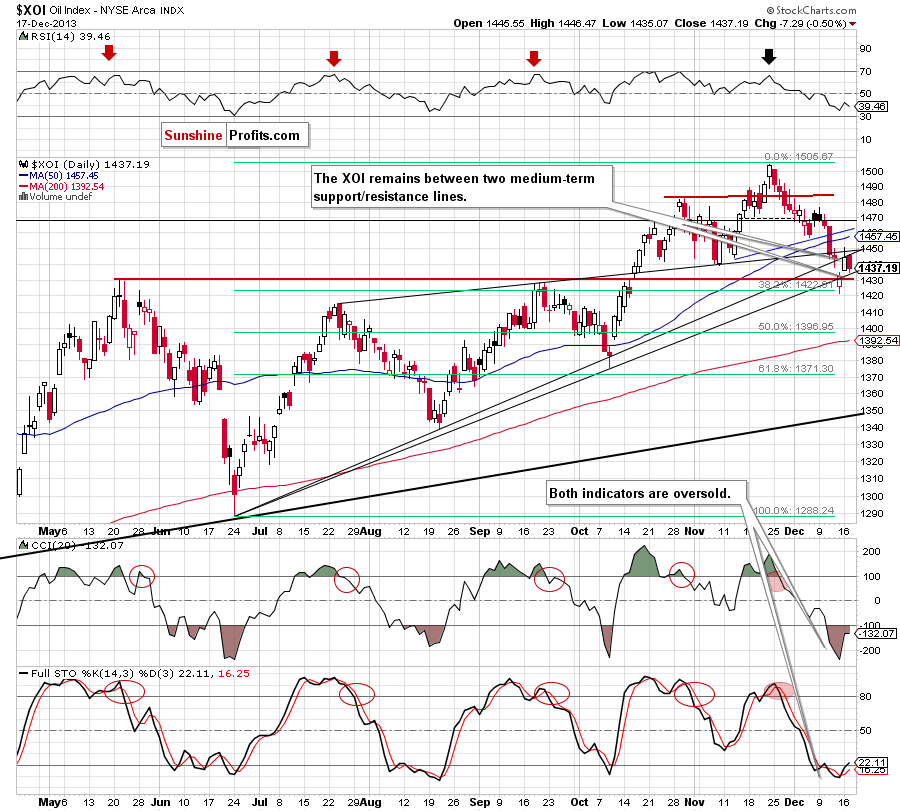

(…) the combination of the previously-broken upper medium-term rising support line and the upper line of the rising wedge stopped further improvement and the oil stock index closed the day below this resistance zone. If the buyers do not give up and the oil stock index comes back above this lines, we will may see an upward corrective move to at least 1,456-1,461 where the 50-day moving average and the previously-broken neck line of the head and shoulders pattern are. On the other hand, if the buyers fail, we will likely see a pullback to the lower rising support line (currently around 1,435) or even to the Friday low at 1,421.

Looking at the above chart, we clearly see that the upper medium-term rising support/resistance line encouraged sellers to act after the market open and resulted in a decline. With this downward move, the XOI reached the lower rising support line. As you see on the daily chart, the oil stock index rebounded slightly after reaching this support, however, it still remains below the strong resistance zone created by the upper medium-term rising support line and the upper line of the rising wedge. Taking this fact into account, we may see further deterioration and the downside target will be around the Friday low at 1,421. On the other hand, if the buyers do not give up, we will likely see an upward corrective move to the resistance zone.

Summing up, after reaching its first upside target, crude oil gave up the gains and declined slightly. However, it still remains above the 50-day moving average, which may encourage the buyers to push the price higher once again. Consequently, the situation remains bullish.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed with bullish bias

LT outlook: mixed

Trading position (short-term): Long. Stop-loss order for this position: $91.55. Stop-loss order for WTI Crude Oil (CFD): $91.30. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts