Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.38% as U.S. car makers reported strong sales, indicating stronger demand for gasoline. Despite this small increase, the commodity was trading near the previous session’s low. Will we see a consolidation before next sizable move?

Yesterday, U.S. car makers reported their strongest sales since the 2008 financial crisis, which in combination with economic data on manufacturing growth from Monday supported the price of light crude, suggesting stronger consumer demand for gasoline. As a reminder, a week ago, the EIA report showed a larger-than-expected drop in U.S. gasoline supplies, which overshadowed bigger-than-expected build in crude oil stocks, pushing crude oil to slightly below $104.

Despite this small increase, crude oil was trading in a narrow range as market players were waiting for key U.S. weekly supply data from the EIA to gauge the strength of oil demand.

Before we know the EIA weekly report, let’s examine technical factors, which could drive crude oil higher or lower in the nearest future (charts courtesy of http://stockcharts.com).

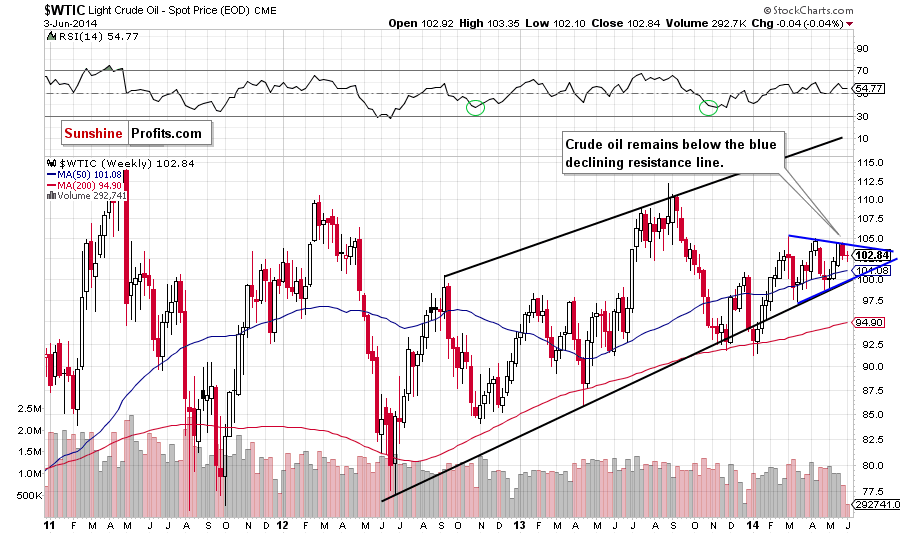

The situation in the medium term remains unchanged as crude oil is still trading below the blue resistance line based on the recent highs (the upper border of the triangle). Therefore, we still believe that the proximity to this line will continue to be supportive for oil bears and we’ll see futher deterioration and a pullback to around the 50-week moving average (currently at $101.08) in the coming week (or weeks).

Once we know the above, let’s check on the very short-term picture.

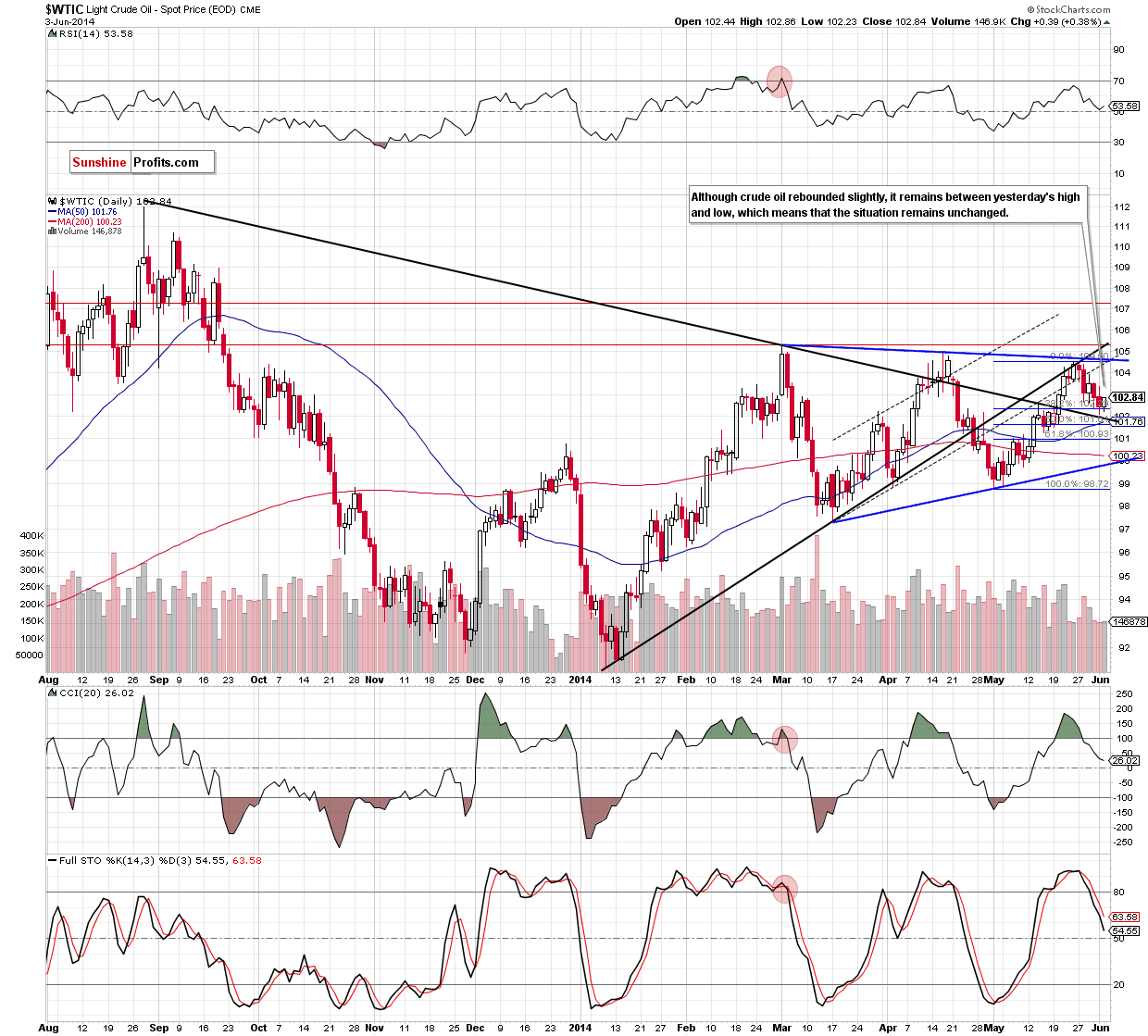

Looking at the daily chart, we see that although crude oil rebounded slightly, the situation hasn’t changed much as the commodity remains between Monday’s high and low. Taking this fact into account, what we wrote in our previous Oil Trading Alert is up-to-date:

(…) Taking into account the importance of the black medium-term declining line, we should consider two scenarios. On one hand, if this strong support encourages oil investors to push the buy button, we may see a corrective upswing to around $103.56, where the Friday high is. On the other hand, if it is broken, we will see a drop to around $101.62-$101.69, where the next Fibonacci retracement and the 50-day moving average are. Please keep in mind that sell signals generated by the CCI and Stochastic Oscillator are still in play, supporting the bearish case.

Summing up, although crude oil moved little higher, the very-short term outlook didn’t change and we remain bearish as sell signals generated by the indicators remain in place, the breakdown below the lower border of the rising trend channel was verified and light crude remains well below the strong resistance zone (created by the lower line of the trend channel, both medium-term resistance lines and the April high). In our opinion, all the above suggests that we’ll see lower values of crude oil in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts