Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Tuesday, crude oil lost 2.09% as the comination of dissapointing U.S. consumer confidence data and signs of a lack of agreement among OPEC members weighed on the price. In this environment, light crude declined sharply, slipping below two important support lines. Does it mean that the recent rally was the last stop before new lows?

Yesterday, crude oil moved higher after the market’s open supported by report from the Commerce Department, which showed that U.S. gross domestic product grew by 3.9% in the third quarter, beating expectations for a reading of 3.3%. Despite this improvement, the disappointing consumer confidence report watered down earlier gains. The Conference Board showed that its index of consumer confidence dropped to 88.7 in November, missing analysts’ expectations for an increase to 95.9. This surprising deterioration fueled concerns that demand in the U.S. may still face headwinds and pushed the price lower.

Also yesterday, Saudi Arabian Oil Minister Ali al-Naimi met with his counterparts from Venezuela, Russia and Mexico in Vienna before Thursday's meeting of the OPEC. However, news that the meeting ended without announcing any kind of proposal pushed crude oil to its lowest level since Nov 14. In this way, the commodity approached the 2014 low. Will we see a post double-bottom rally or rather new lows in the coming days? (charts courtesy of http://stockcharts.com).

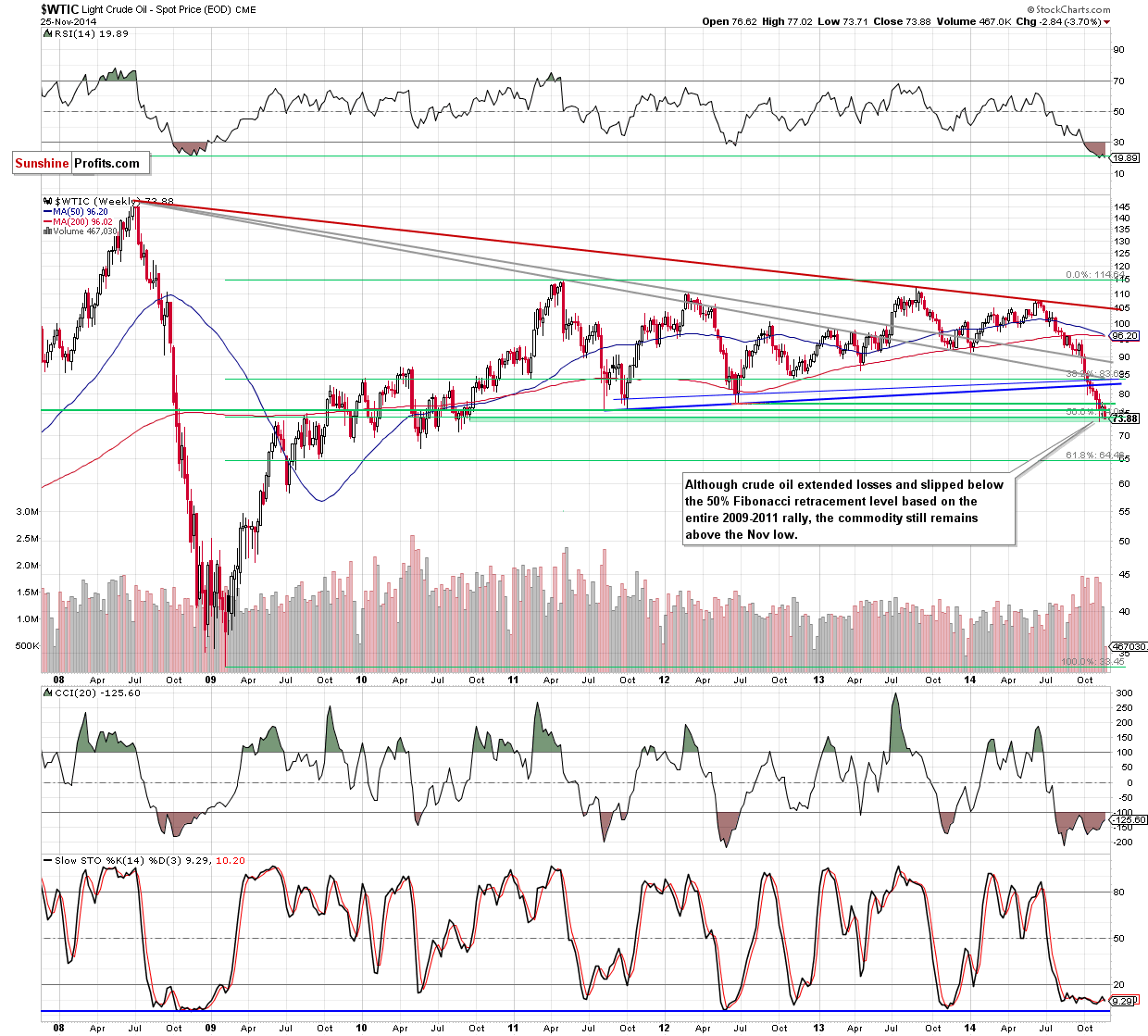

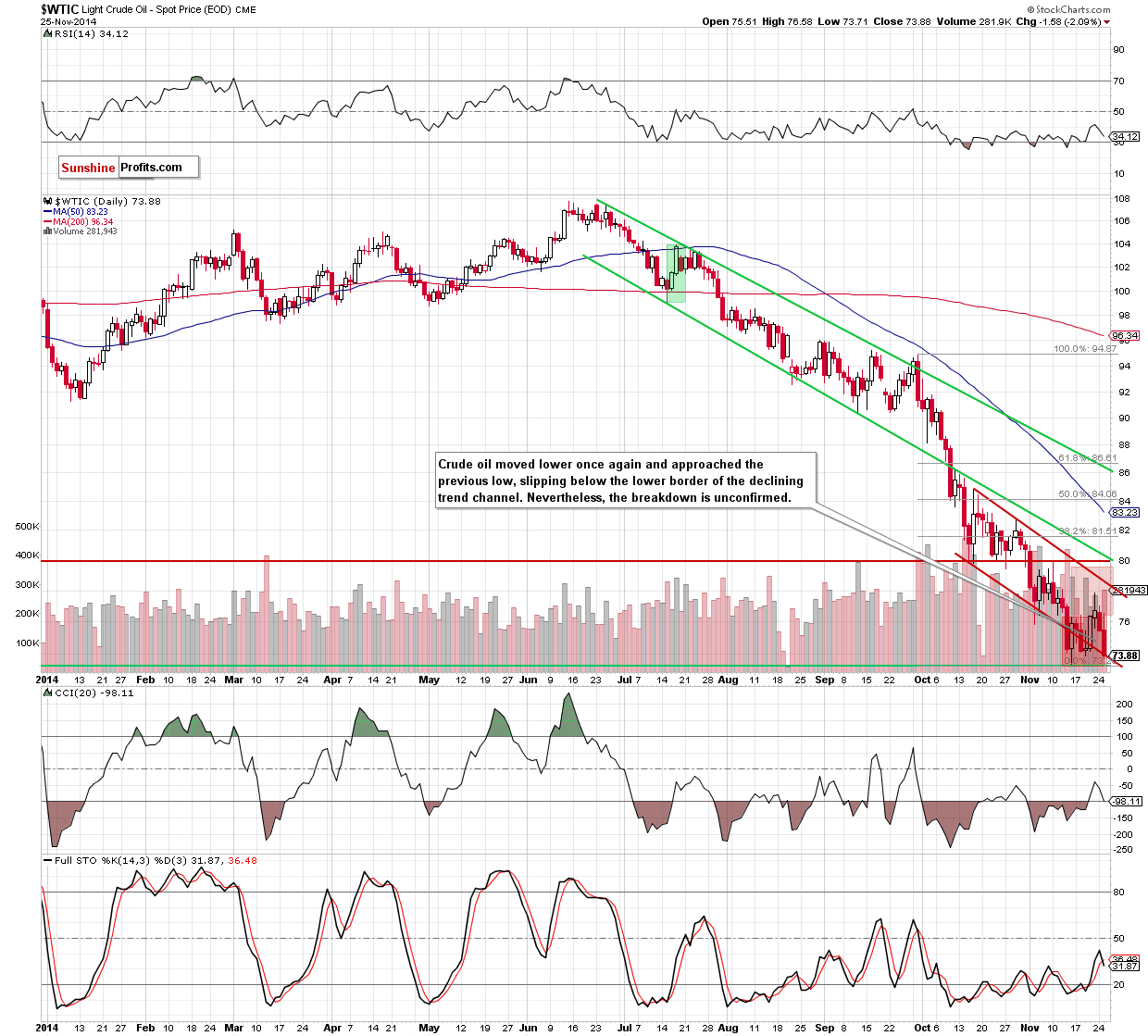

Looking at the above charts, we see that the overall situation has deteriorated as crude oil moved lower once again and slipped below the lower line of the declining trend channel and the 50% Fibonacci retracement. Although this is a strong bearish signal, the breakdown is not confirmed at the moment (in terms of daily or weekly closing prices). Additionally, the commodity is still trading above the Nov 14 low of $73.25. At this point it’s worth noting that we saw similar breakdowns below the lower border of the trend channel in mid-Nov, but none of them resulted in a fresh multi-year low. Therefore, it seems to us that as long as there will be no the OPEC meeting’s outcome we won’t see any particular changes on the charts. If OPEC won’t cut output (or the cut will be symbolic), crude oil could fall further. However, a surprise large cut could bring some extra volatility and a sharp rally to at least $78 per barrel. The latter outcome seems more probable in our opinion.

Summing up, although crude oil extended losses and broke below support lines, the breakdown is unconfirmed and the commodity is still trading above the Nov low. The outlook is not a bullish as it’s been in the past several days as we’ve seen a daily close on lower levels. There is a lot of uncertainty because of the upcoming OPEC’s meeting. The price moves that will follow could be significant. The rally seems more likely so we are keeping long positions intact – the potential gain is significant. However, at the same time we realize that the potential decline is also significant and that’s why we’re keeping the stop-loss at its current level – which is relatively close to the current price. Should crude oil decline significantly, longs will be closed very soon and the loss will be very small. With big potential gain and small potential loss, it seems that keeping long positions is still justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, the markets in the U.S. will be closed on Thursday and we expect the trading activities to be limited on Friday as well. Consequently, we there will be no Oil Trading Alerts on Thursday and Friday. The alerts will be posted until Wednesday and will then be posted normally beginning on Monday, Dec 1.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts