Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

In today’s alert we will focus on something that we haven’t covered in a while (at least not in the daily alerts – we have discussed this important ratio in the latest Oil Investment Update, though) – the link between the USD Index and the price of crude oil. This all-important ratio can tell us quite a lot about the next big (and likely tradable) move in the black-gold commodity. Let’s see what and how (charts courtesy of http://stockcharts.com).

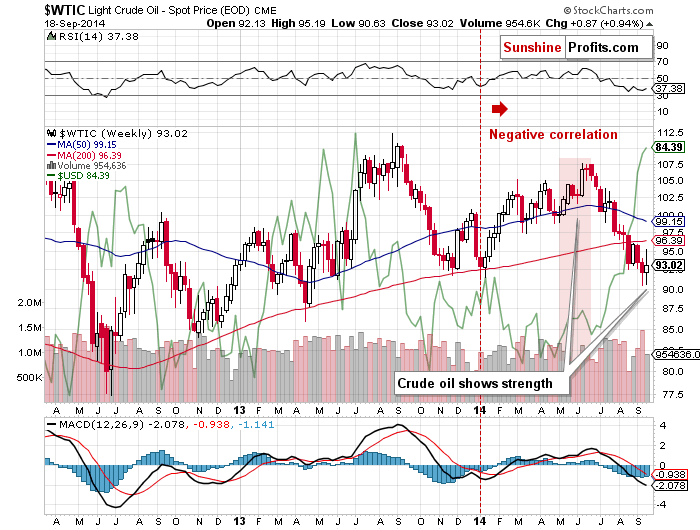

The thing that makes the above chart so useful is that more or less since the beginning of this year crude oil has been negatively correlated with the USD Index. When the USD Index rallied, the crude oil price has generally declined, and while the USD Index declined, then we have generally seen upswings in the price of crude oil.

The above is just the average way in which these 2 markets have traded relative to each other – there has been an exception, which also tells us something. In May and in the first part of June crude oil managed to rally even though the USD Index hasn’t declined. In other words, crude oil showed strength. Please note that USD Index’s bottoming process that we’ve seen from March to May meant a horizontal – yet slightly rising – trend in the crude oil. On average, crude oil “wanted” to move higher.

We have been seeing the same type of reaction for the past 10 trading days or so. The USD Index continued to climb, but the price of crude oil refused to move even lower. It formed a double bottom and it was yesterday visibly above its lows even though USD moved to new 2014 highs.

The above is a very important observation, as it tells us that even if the USD Index moves higher, then we are quite likely not (!) to see a much lower crude oil prices. The latter has been showing strength recently, so we expect it to show strength also in case the USD Index moves a bit higher from here, before it finally corrects (which could ignite a bigger move up in crude oil).

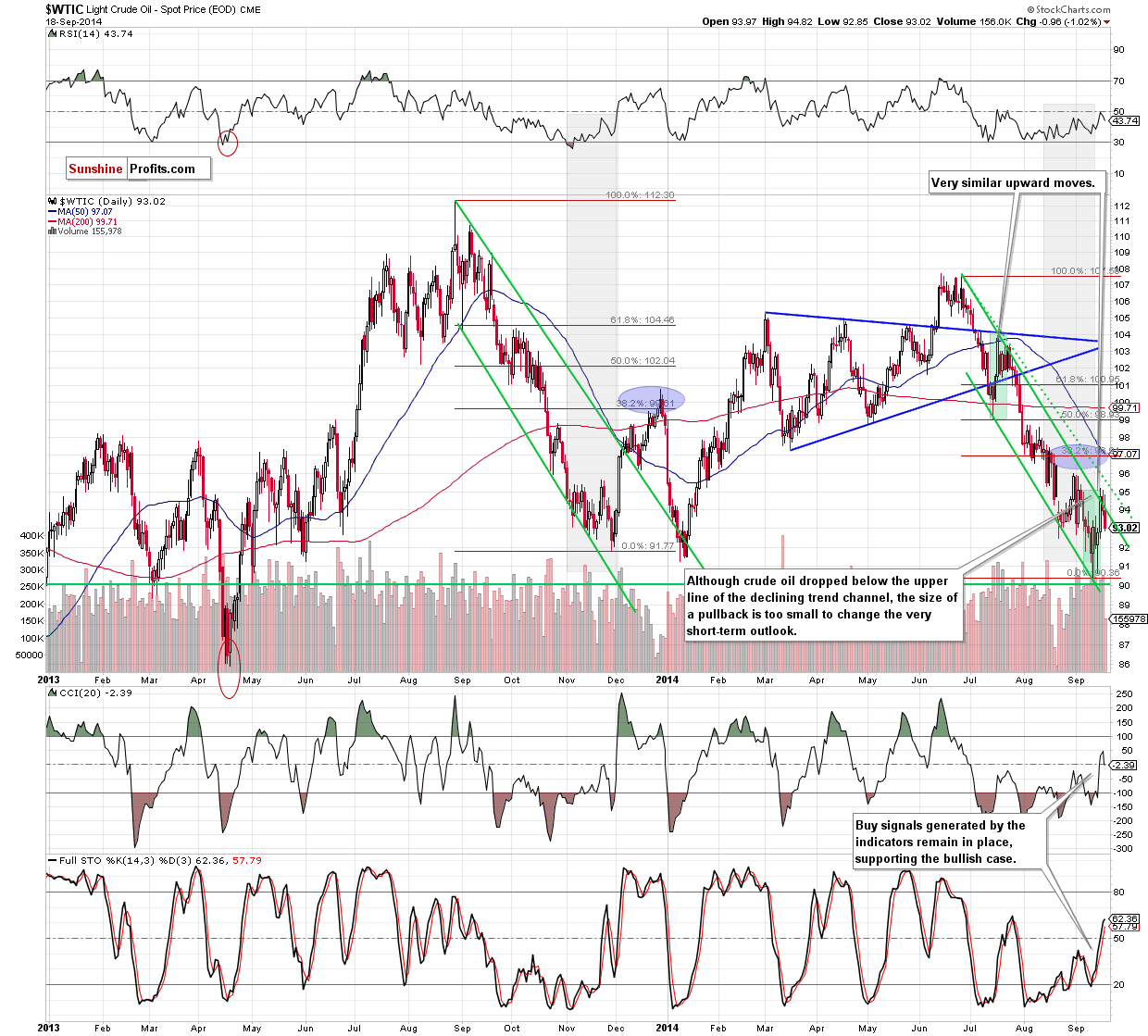

Keeping the above in mind let’s take a look at the crude oil chart.

Generally, we continue to think that even though the short-term trend is down, the next big move is going to be to the upside. The long-term support line was reached (not visible on the above chart) and after support of this significance is reached, we expect to see a more profound reaction than just a weekly rally that doesn’t change the short-term trend.

Please note that yesterday’s decline materialized on relatively low volume, which suggests that it wasn’t the true direction in which the market is heading.

Finally, combining the above 2 charts we get a coherent picture in which even if the crude oil market declines somewhat it’s not likely to move much lower. On the other hand we could have a surprise to the upside in case the USD Index declines shortly or even trades sideways. In this situation, in our opinion it seems justified to keep long positions intact. Exiting the position at this time seems rather premature because of the risk of missing the upside.

Summing up, we believe that keeping long positions (which are still profitable) is justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts