Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will probably re-open the short positions shortly, but we are not doing so today.

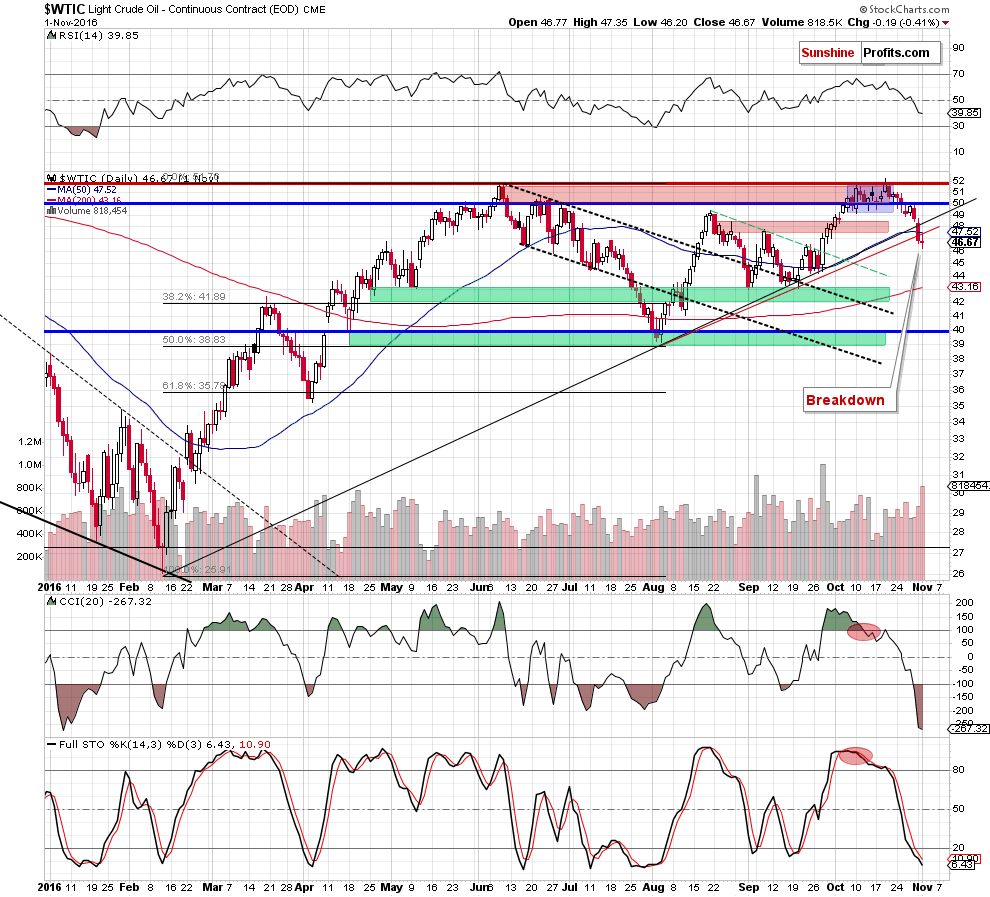

Crude oil continues to slide, breaking below the rising support line based on the February, August and September lows. The price of black gold moved decisively below the 50-day moving average as well. Will the slide continue for much longer?

Let’s take a closer look (charts courtesy of http://stockcharts.com).

In short, it’s quite likely as the breakdown below both rising support lines is now clearly visible (at the moment of writing these words, crude oil is trading at about $45.20). However, let’s keep in mind that no market moves in a straight line without period corrections and it appears that after about 2 weeks of almost daily declines, crude oil will finally bounce.

We have not yet seen a decisive buy signal from Stochastic, but its already below 10 and CCI is extremely oversold. The above combination makes a rebound quite likely and in light of the above-mentioned breakdown, a move back to the $46.50 or so (the rising red support / resistance line) would be quite likely. If seen, it would most likely provide us with another shorting opportunity at favorable risk to reward ratio. At this time the risk appears to be too high due to the likelihood of seeing a rebound. After breakdown is verified, the likelihood of seeing a bigger upswing will be much lower.

The above likelihood is currently increased by a good possibility of seeing a turnaround on the currency markets and in case of the precious metals sector. Since no market moves totally on it’s own, it could easily be the case that turnarounds in the above-mentioned markets would translate into a turnaround in crude oil. Therefore, it seems that waiting for additional bearish confirmations before re-opening short positions appears justified at this time. As always, we’ll keep you – our subscribers – updated.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts