Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Friday, crude oil lost 1.34% as the combination of a stronger U.S. dollar and ongoing worries that global supply is plentiful weighed on the price. Because of these circumstances, light crude declined below $92 to its lowest level since Sep15. Did this move change anything in the short-term perspective?

On Friday, there were no disturbing news or fundamental developments that could drive the price of crude oil higher or lower. Therefore, ongoing concerns over signs of an abundance of light crude in combination with a stronger greenback (which moved higher against most major currencies once again, making oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies) weighed on the price of the commodity and pushed it below $92. Is it as bearish sign as it looks at first glance? Let’s check the chart below and find out (charts courtesy of http://stockcharts.com).

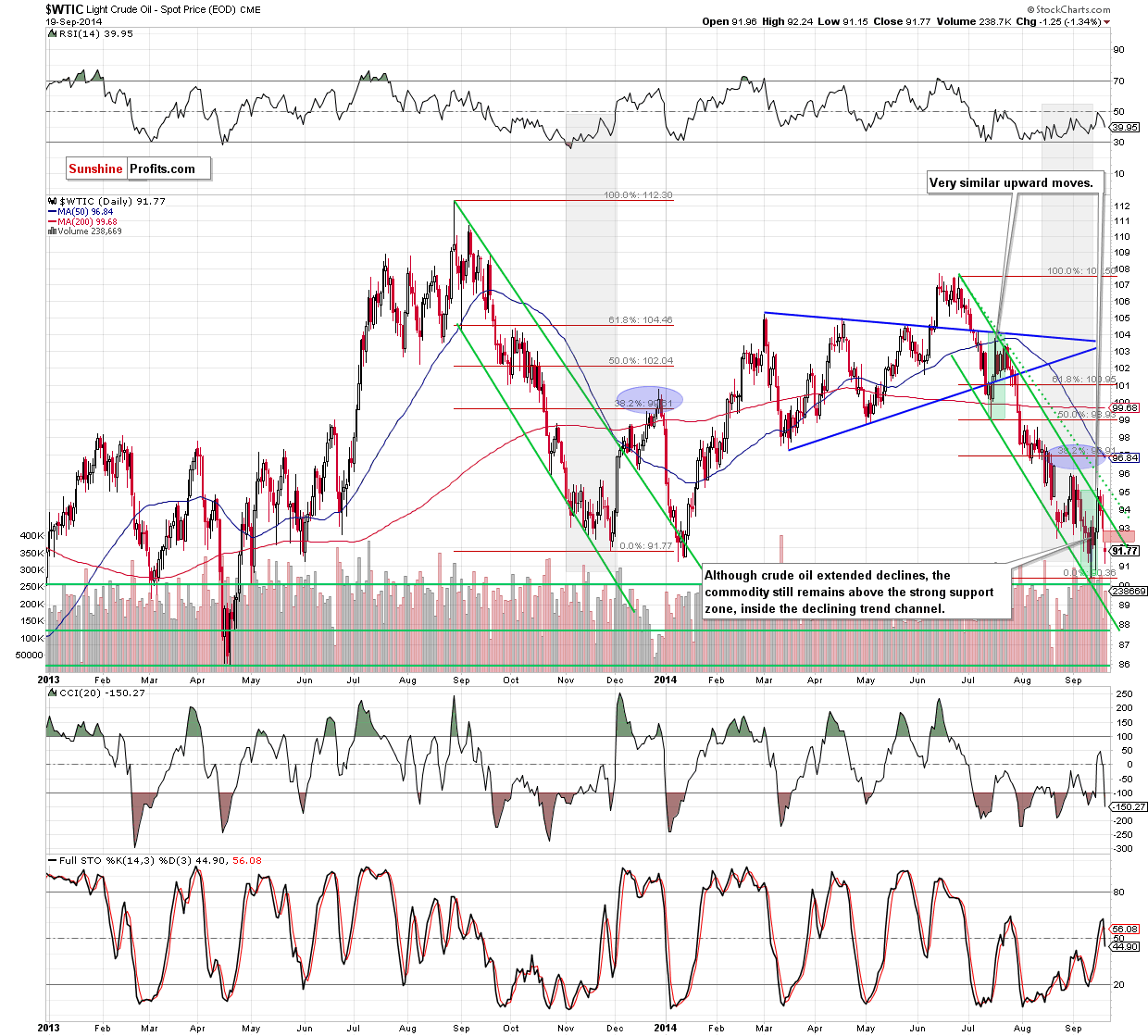

The first thing that catches the eye on the above chart is a gap (marked with red), which appeared after the market’s open. As you see, oil bulls tried to push crude oil higher, but they failed, which resulted in a drop to an intraday low of $91.15. Although this is a bearish signal, we should keep in mind that the commodity is still trading above the support zone created by the May 2013 and recent lows. Are the any other supportive circumstances, which may encourage oil investors to push the buy button? Let’s zoom out our picture and find out.

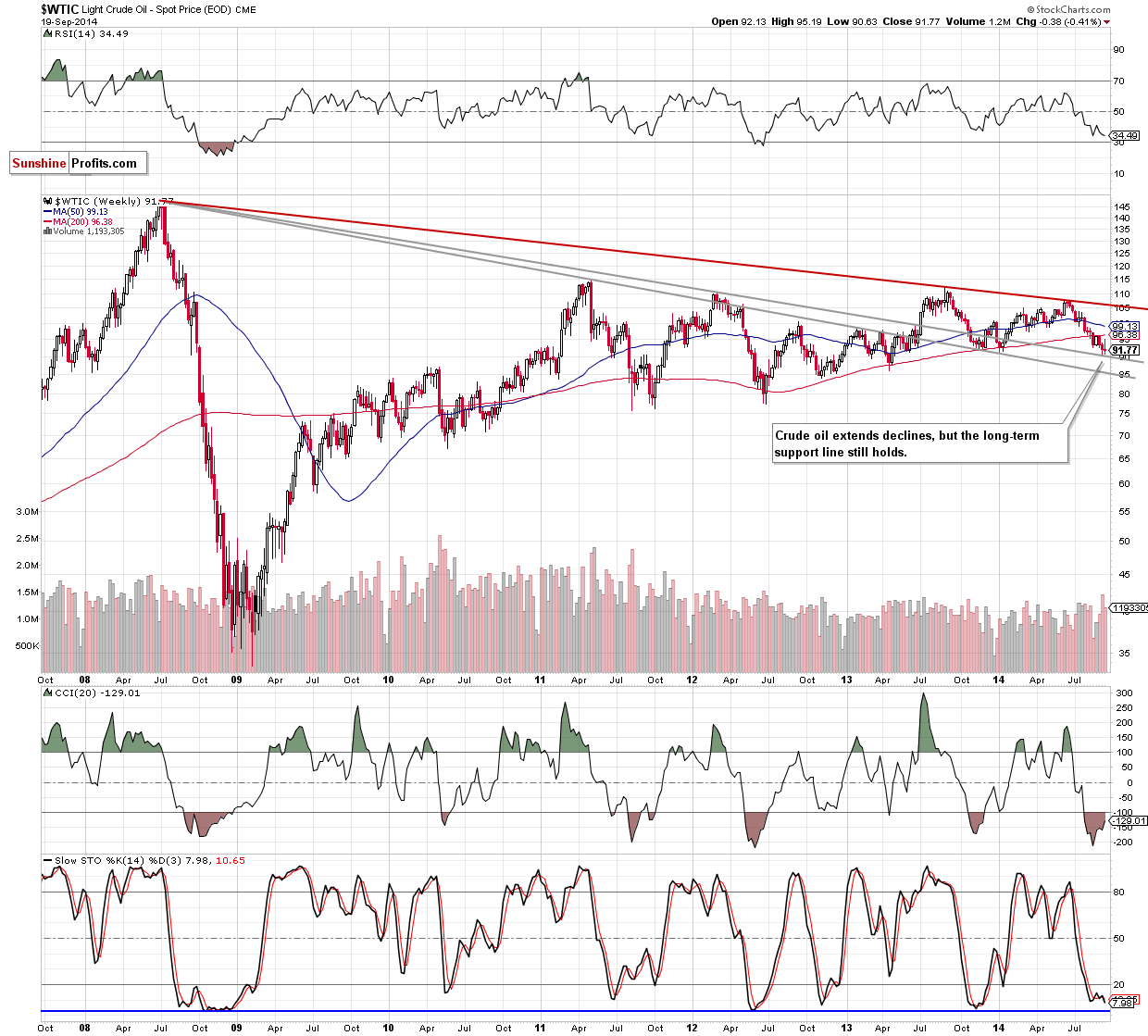

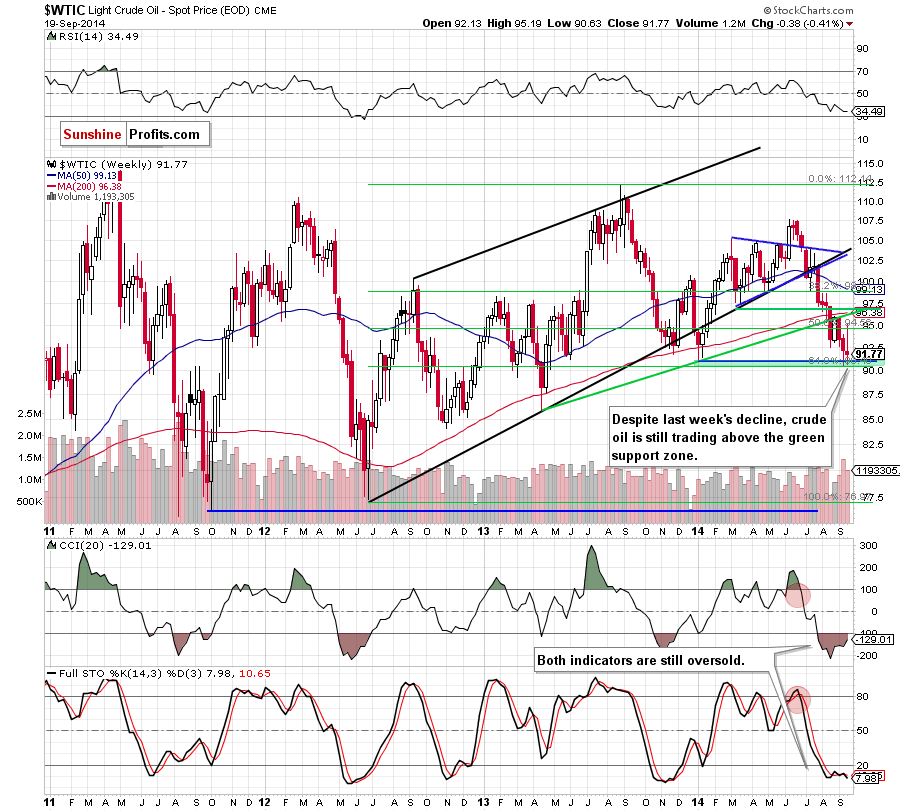

Looking at the above charts we clearly see that despite Friday’s drop, the situation in the medium term hasn’t changed as crude oil is still trading above the solid support zone created by the long-term declining support line and the 61.8% Fibonacci retracement, which successfully stopped further deterioration in the previous week. Therefore, we are convinced that as long as there is no breakdown below these levels, another sizable downward move is not likely to be seen.

Finishing today’s Oil Trading Alert, we would like to draw your attention to the fact that although the USD Index hit a fresh multi-month high of 84.91, we didn’t see a new low in the case of crude oil. What does it mean for the commodity? We think that the best answer to this question will be our last commentary:

(…) In May and in the first part of June crude oil managed to rally even though the USD Index hasn’t declined. In other words, crude oil showed strength. Please note that USD Index’s bottoming process that we’ve seen from March to May meant a horizontal – yet slightly rising – trend in the crude oil. On average, crude oil “wanted” to move higher.

We have been seeing the same type of reaction for the past 10 trading days or so. The USD Index continued to climb, but the price of crude oil refused to move even lower. It formed a double bottom and it was yesterday visibly above its lows even though USD moved to new 2014 highs.

The above is a very important observation, as it tells us that even if the USD Index moves higher, then we are quite likely not (!) to see a much lower crude oil prices. The latter has been showing strength recently, so we expect it to show strength also in case the USD Index moves a bit higher from here, before it finally corrects (which could ignite a bigger move up in crude oil).

Summing up, although crude oil moved lower, we believe that the space for further declines is limited as the medium- and short-term support zones are still in play. Additionally, the current relation between crude oil and the USD Index also seems to be encouraging. Taking all the above into account, we believe that keeping long positions is justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts