Trading position (short-term; our opinion): Crude oil dropped below the medium-term support/resistance line and because of this, the main reason we opened long positions stopped to be current. Therefore, they are no longer justified. The above happened shortly after we finished writing the analysis based on yesterday's closing prices, so we will provide it below anyway, so that it's useful in some way (you can see what our approach is) anyway. However, please keep in mind that overall we don't suggest having any trading position open at this time.

On Monday, crude oil moved higher as better-than-expected economic data and ongoing concerns over the Ukraine crisis weighted on the price. Despite these circumstances, light crude reversed and lost 0.23%. Does this mean that investor sentiment waned or can we still see a sizable upswing in the near future?

Yesterday, the Conference Board reported that its index, which measures future economic activity, increased 0.8% in March, beating expectations for a 0.7% gain. This better-than-expected reading fueled hopes that U.S. economy would demand more fuel and energy and had a positive impact on crude oil. Also yesterday, the Chicago Fed National Activity Index decreased to 0.20 in March from 0.53 in February, but this drop was in line with expectations and didn’t affect negatively the price of light crude.

As mentioned earlier, ongoing concerns over the Ukraine crisis supported prices as well. Although Russia, Ukraine and the West signed an agreement last Thursday to try to stabilize the situation, a weekend attack on a checkpoint in eastern Ukraine fueled fears that the instability in the country will escalate and disrupt Russian oil exports.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

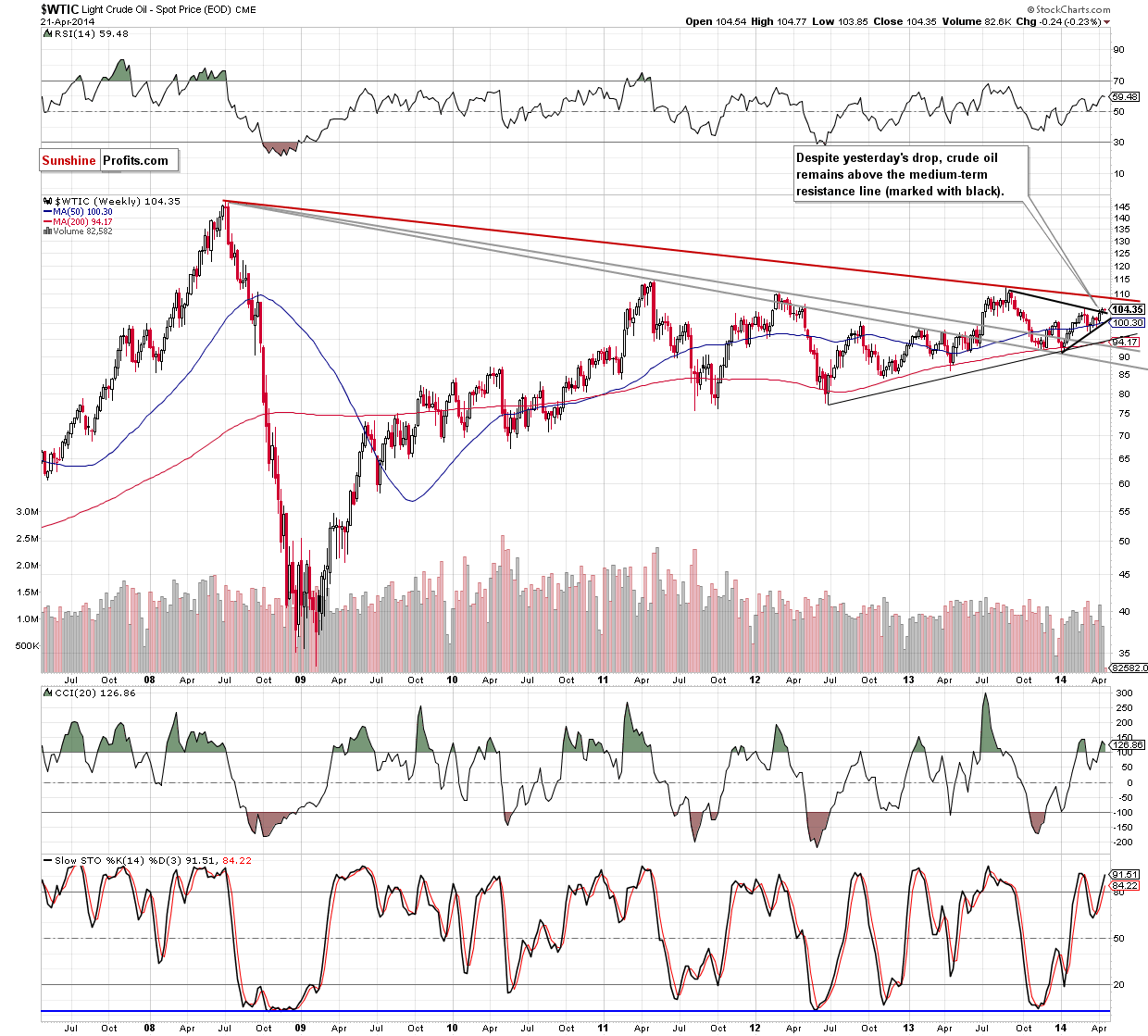

As you see on the weekly chart, the situation hasn’t changed much. Although crude oil gave up some gains, it still remains above the medium-term resistance line (marked with black). Therefore, what we wote in our last Oil Trading Alert, is still up-to-date.

(…) crude oil broke above the medium-term resistance line based on the September and March highs (which is also the upper line of a triangle) (…). According to theory, such price action should trigger further improvement and an increase to around $108, where the long-term resistance line (marked with red) is (…).

Having disscussed the above, let’s zoom in on our picture and move on to the daily chart.

In our previous Oil Trading Alert, we wrote the following:

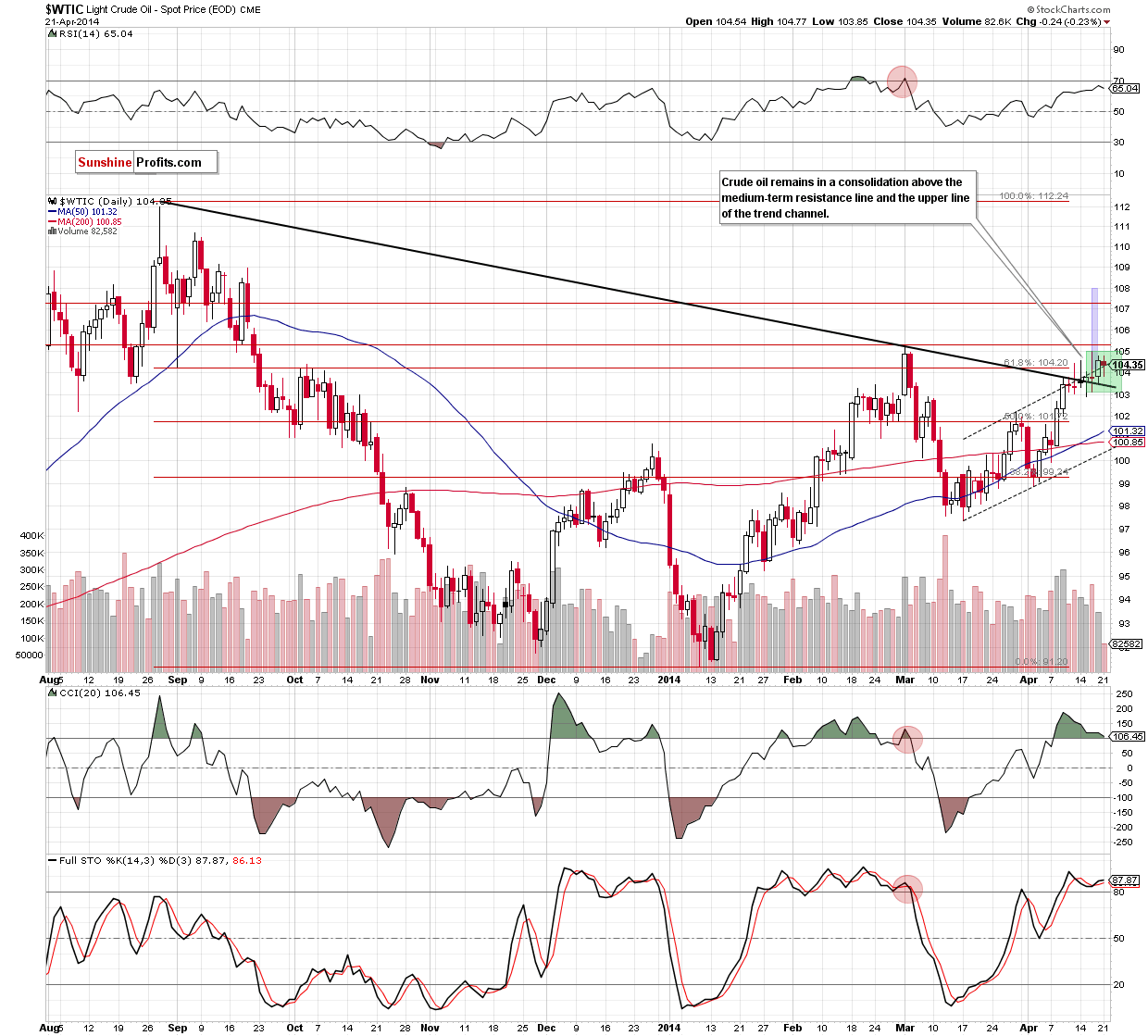

(…) the commodity closed the day above the medium-term black line for the third time in a row, which means that the breakout is confirmed. This is a strong bullish signal, which suggests that we will likely see further improvement in the coming days. Nevertheless, taking into account the resistance zone created by the April and 2014 highs, we may see a pause before another sizable upswing.

Looking at the above chart, we see that crude oil paused on its way to higher levels and remains in a consolidation (marked with green) between the previously-broken medium-term support line and the resistance zone. If oil bulls do not give up and push the price above the April high, we will likely see further improvement (a breakout above the 2014 high) and an increase to around $106,90, where the price target (after a breakout above the upper line of the consolidation) is. At this point, it’s worth also noting that if the breakout above the upper line of the rising trend channel (marked with dashed line) is not invalidated, we may see an increase to around $108 (we wrote about this pro growth scenario on Friday). However, if the buyers fail, we may see a drop below the upper border of the rising trend channel, which will likely trigger a decline to the medium-term black line (currently around $103.50).

Summing up, although crude oil gave up some gains, it still remains above the upper line of the rising trend channel and the previously-broken medium-term black line (which serves as support at the moment). From today’s point of view it seems that as long as this major support line is in play, the space for declines will be limited.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts