Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Friday, crude oil moved a bit higher and closed the previous week above $53, but did this increase change the short-term picture of the commodity?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

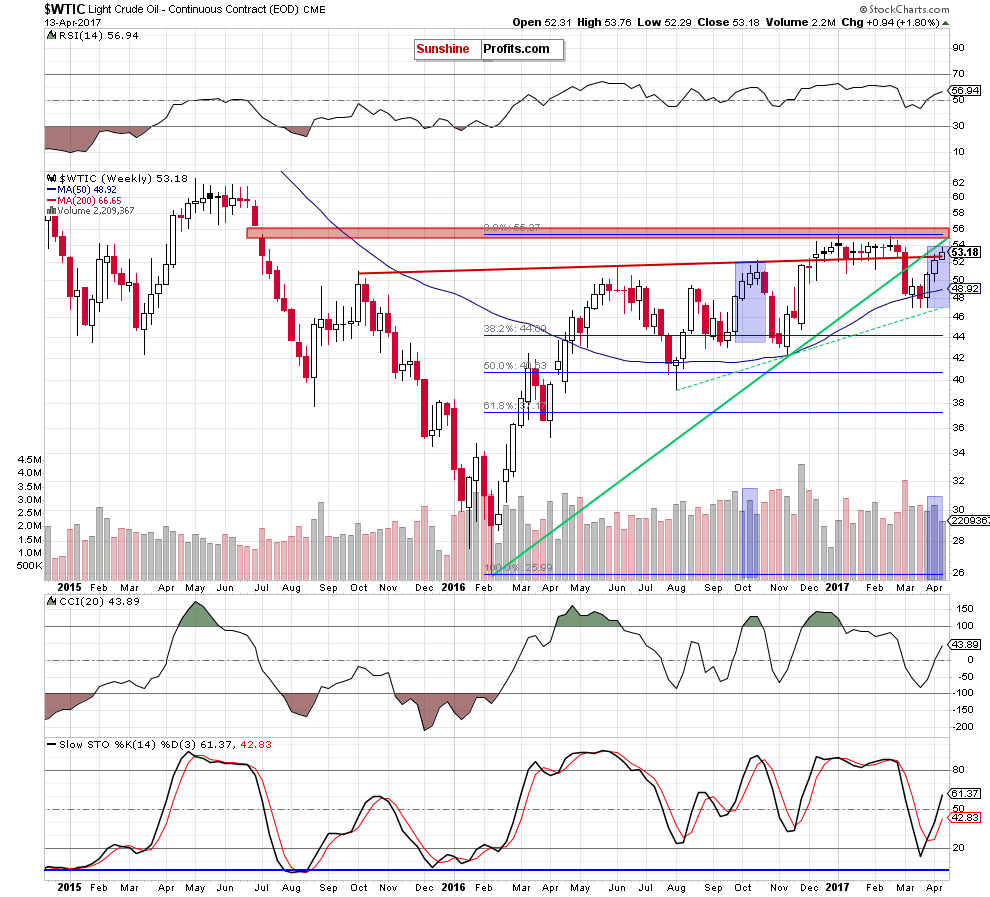

From the medium-term perspective, we see that although crude oil moved a bit higher in the previous week, the commodity is still trading under the long-term rising resistance line based on the February and November lows, which suggests that the recent increases could be nothing more than a verification of the earlier breakdown and as long as there is no invalidation of the breakdown reversal and lower prices are more likely than not.

This scenario is also reinforced by the size of the recent candlesticks. As you see on the chart, from week to week, their bodies were getting smaller, suggesting that oil bulls are losing strength. We saw a similar situation in October (we marked both of them with blue). Back then, smaller bodies materialized on decreasing volume preceded a reversal and a bigger decline, which increases the probability that we’ll see a similar situation in the coming weeks.

Are there any other negative signals, which could encourage oil bears to act? Let’s examine the very short-term chart and find out.

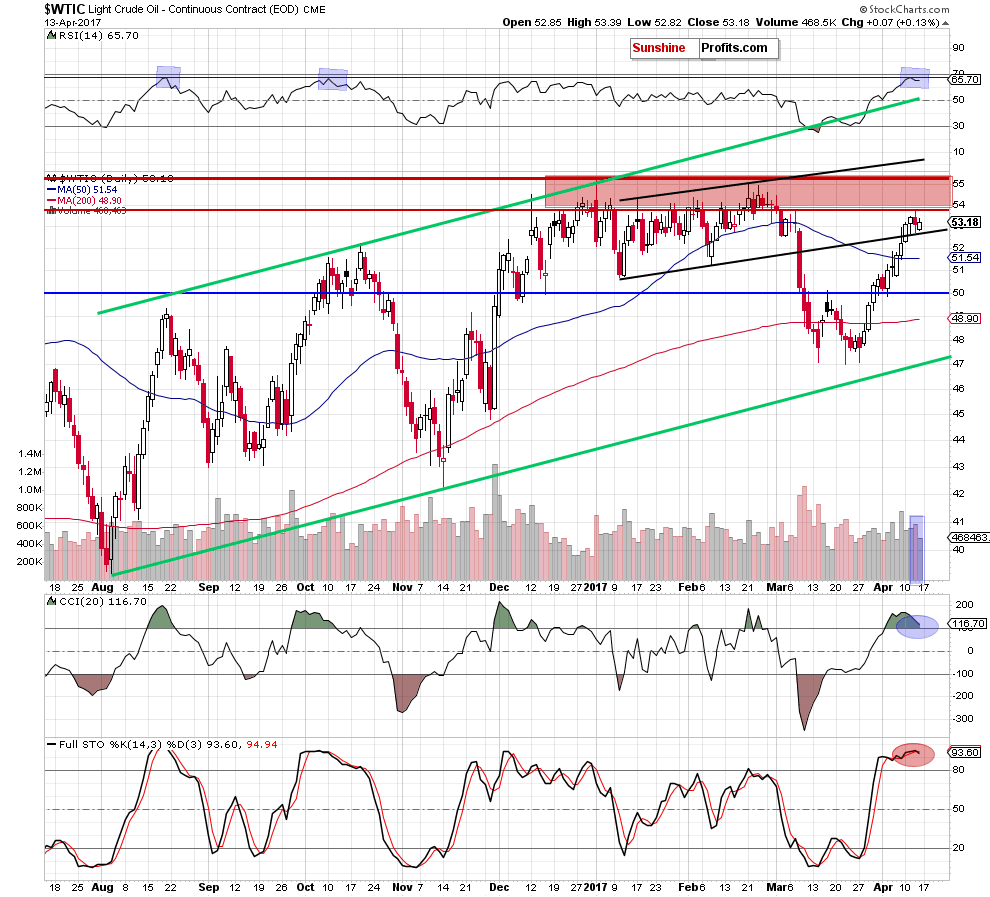

Crude oil bounced off the previously-broken lower border of the black rising trend channel, which looks like a verification of the earlier breakout at the first sight. Will we see further improvement? In our opinion, even if light crude moves a bit higher from current levels, the space for gains is limited as the key red resistance zone, which stopped oil bulls many times in the previous months (between the March high of $53.80 and the January high of $55.24) is quite close.

Additionally, Friday’s increase materialized on smaller volume than Thursday’s decline, which suggests that oil bulls may not be as strong as it seems. On top of that, the RSI approached the level of 70 – similarly to what we saw in August and October. In both cases, such increases preceded reversals and lower values of crude oil. There is also a negative divergence between the CCI and the price, which together with the sell signal generated by the Stochastic Oscillator increases the probability of declines in very near future.

Summing up, short positions continue to be justified as crude oil remains under the key resistance zone, which could encourage oil bears to act and trigger another downswing in the coming day(s) – similarly to what we saw in the past.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts