Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

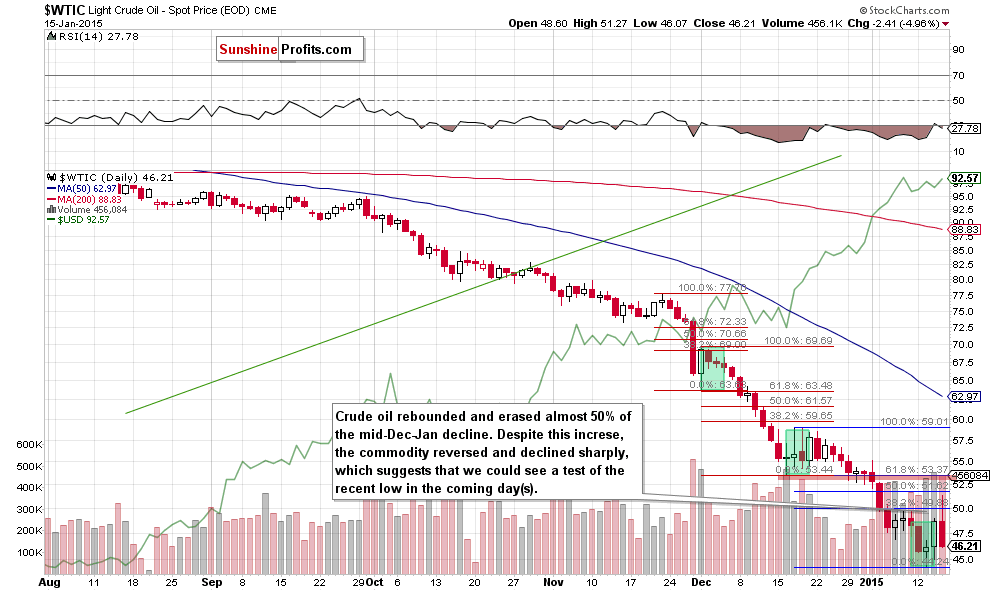

Although crude oil extended gains after the market’s open, the commodity reversed and declined sharply as ongoing concerns over ample global oil supplies and a stronger U.S. dollar weighed on the price. As a result, light crude lost 4.96% and erased most of Wednesday’s rally. Will we see new lows in the coming days?

Yesterday, the Federal Reserve Bank of New York showed that its general business conditions index climbed to 10.0 in January from a reading of -3.6 in December, beating analysts’ expectations for a rise to 5.0. This bullish numbers overshadowed data from the U.S. Department of Labor, which showed that the initial jobless claims in the week ending January 9 increased by 19,000 to 316,000, missing analysts’ expectations for a decline by 6,000. As a result, the USD Index, climbed to a fresh multi-year high, making crude oil more expensive to buyers using foreign currencies.

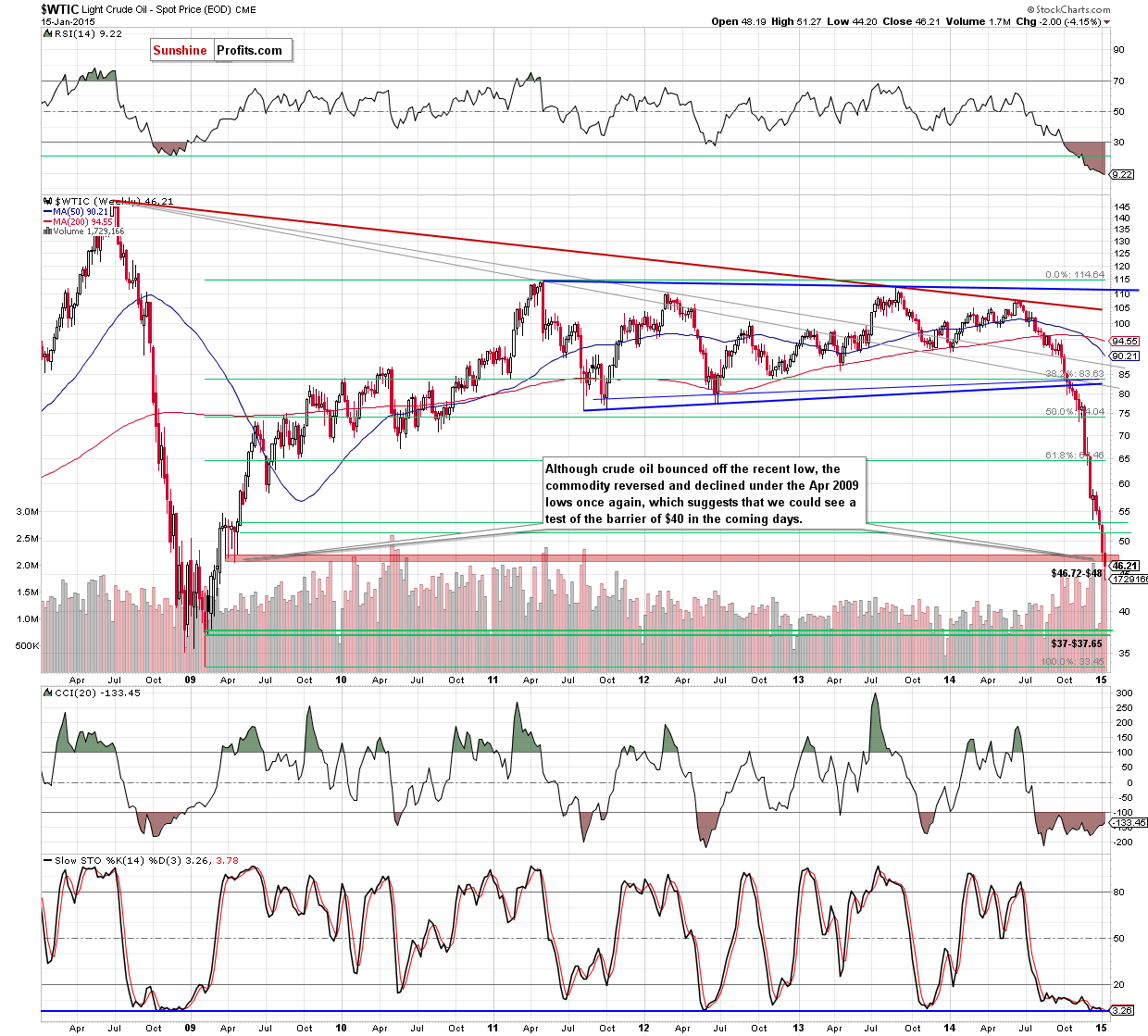

On top of that, Bank of America Merrill Lynch lowered its oil price forecasts. The bank now sees Brent crude falling as low as $31 a barrel, and U.S. oil prices tumbling to $32, by the end of the first quarter as global petroleum inventories continue to fill up. Does it mean that lower values of light crude are still ahead us? (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that although crude oil moved higher after the market’s open, showing some strength, this improvement was only temporary. As you see on the above charts, the previously-broken support area created by the 76.4% and 78.6% Fibonacci retracement levels (which serves as resistance on the weekly chart) in combination with the 50% Fibonacci retracement based on the mid-Dec-Jan decline successfully stopped further rally, encouraging oil bears to act. As a result, the commodity reversed and declined sharply, erasing most of Wednesday’s rally. Such price action confirms what we wrote in our previous Oil Trading Alert:

(…) While the first sign of strength is significant, it was just one day that the strength was present. Can one day change a lot? Technically, in some cases it can (in case of breakouts or breakouts above major resistance/support levels that happen on significant volume), but at this time it seems that we need to wait for an additional confirmation of the strength. The odds are that yesterday’s price action was an “outlier in the data” or simply put “an accident”.

What’s next? Taking all the above into account, and combining with the fact that crude oil dropped below Apr 2009 lows once again, it seems to us that we’ll see a test of the recent low in the coming day(s). If it withstand the selling pressure, oil bulls will likely try to break above the resistance zone, which stopped yesterday’s. However, if it is broken, the next downside target would be the barrier of $40.

Summing up, from today’s point of view, we see that although crude oil rallied on Wednesday and climbed above $50 on the next trading day, this improvement was only temporary. As we have pointed out before, light crude reversed and declined sharply, erasing most of earlier gains and slipping below Apr 2009 lows once again. All the above suggests that a test of the recent low in the coming day(s) should not surprise us.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

The markets in the US will be closed on Monday, Jan 19, 2015, so we will post our next Oil Trading Alert on Tuesday, Jan 20, however if something urgent happens, we will post in on Monday anyway.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts