Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after the markets open on Friday, a weakening greenback supported the price of the commodity in the following hours. In this environment, light crude 1.12%, but did this increase change anything in the overall picture of crude oil?

On Friday, official data showed that U.S. gross domestic product in the second quarter (a preliminary reading) increased less than analysts expected, which disappointed market participants and pushed the USD Index sharply lower. A weaker U.S. dollar made crude oil more attractive for buyers holding other currencies, which pushed the commodity higher. As a result, light crude came back above $41, but did this increase change anything in the overall picture of crude oil? Let’s examine charts below and find out (charts courtesy of http://stockcharts.com).

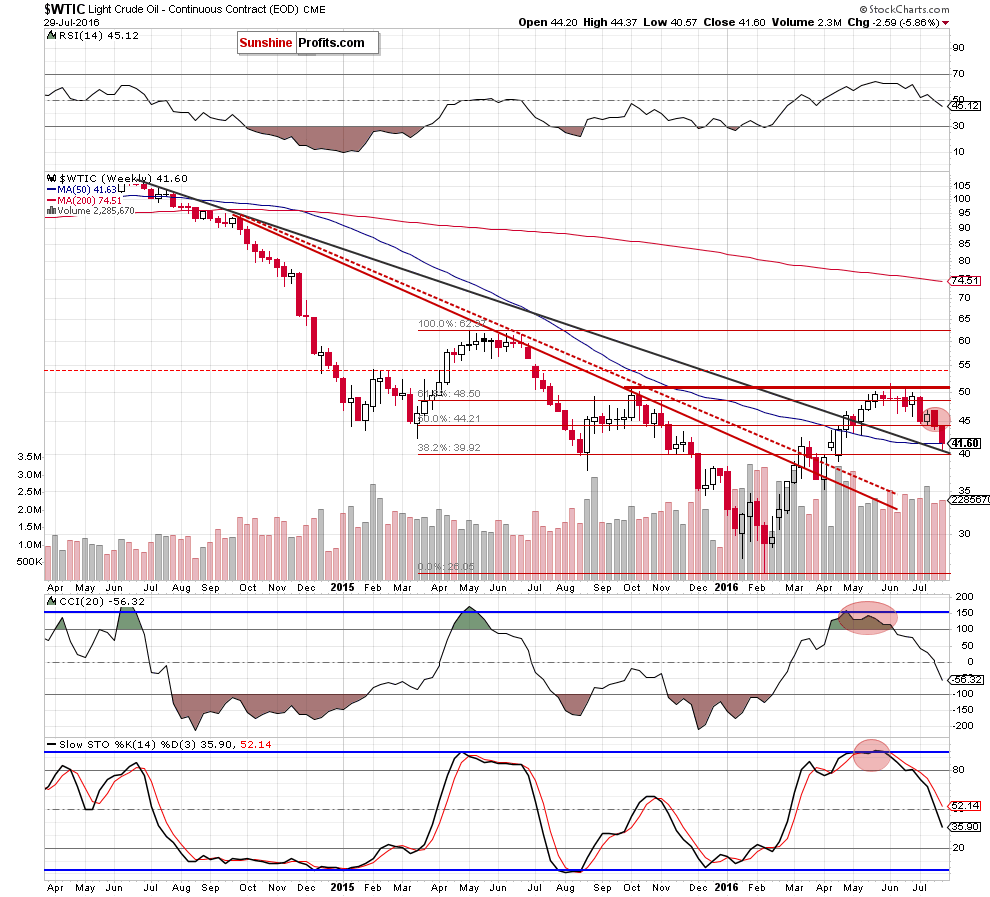

Looking at the weekly chart, we see that crude oil extended losses and reached the previously-broken long-term black declining support line on Friday. Although sell signal generated by the indicators remain in place, we think that this area may encourage oil bulls to act in the coming week.

Are there any other factors that could support this pro growth scenario? Let’s examine the daily chart and find out.

Quoting our Thursday’s alert:

(…) when we consider fundamental factors, increasing volume during recent declines, confirmed breakdown (by three consecutive daily closures) under the lower line of the black trend channel and sell signals generated by the weekly indicators we see that oil bears still have many important factors on their side. Therefore, in our opinion, as long as there won’t be invalidation of the breakdown under the lower black line, another downswing is likely (…).

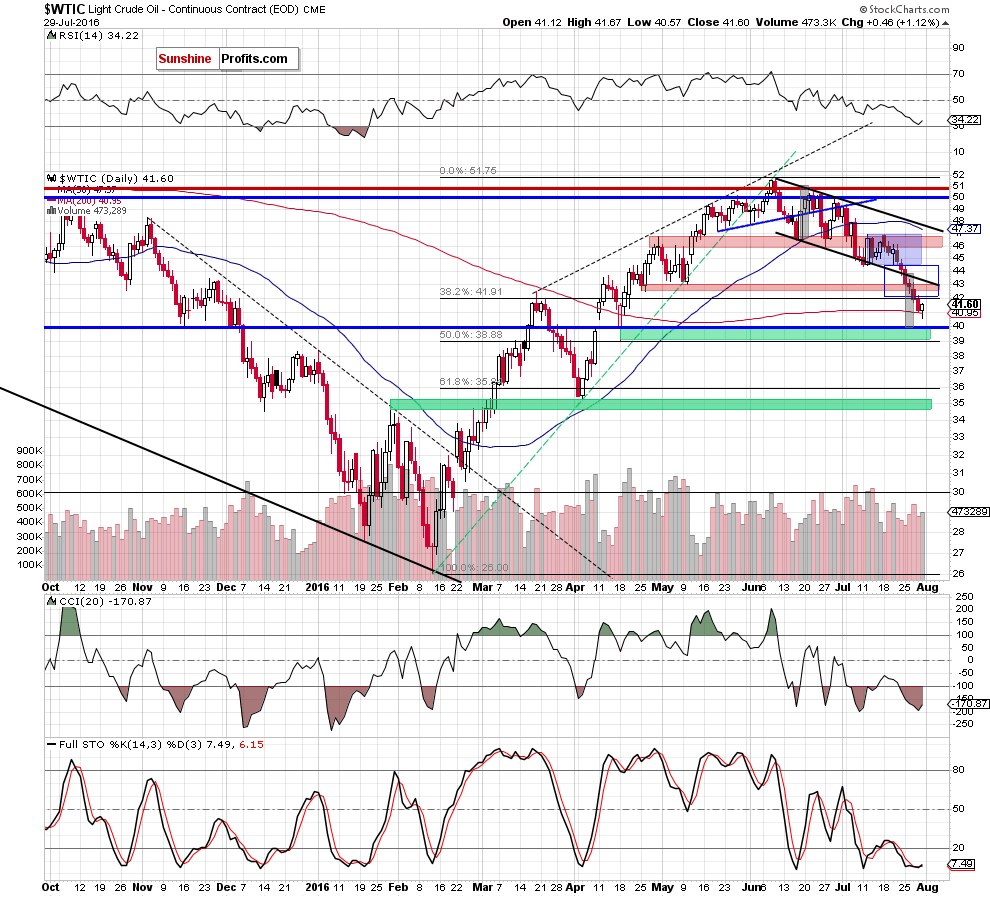

On the daily chart, we see that oil bears pushed the commodity lower as we had expected. With this drop, light crude slipped the 200-day moving average and approached the barrier of $40, hitting an intraday low of $40.57. As you see, the proximity to the green support zone encouraged oil bulls to act, which resulted in a rebound on Friday. Thanks to this increase, light crude came back above $41 and closed the day above the 200-day moving average, invalidating earlier small breakdown. When we take a closer look at the chart, we see that there was a similar price action on Apr 18. Back then, invalidation of the breakdown under the above-mentioned moving average triggered further increases, which took the commodity to the barrier of $50. Taking this fact into account and combining it with a decline to the long-term back support line seen on the weekly chart, it seems that crude oil may rebound and verified earlier breakdown under the lower border of the black declining trend channel (currently around $43.30) in the coming days. Therefore, in our opinion, closing short positions and taking profits off the table (as a reminder, we opened them when crude oil was around $47) is justified from the risk/reward perspective.

Summing up, crude oil declined to the long-term support line (marked on the weekly chart) and rebounded, invalidating earlier breakdown under the 200-day moving average. Taking this fact into account, we think that the commodity could rebound and increase even to the previously-broken lower border of the black declining trend channel (currently around $43.30) in the coming days. Therefore, closing short positions and taking profits off the table is justified from the risk/reward perspective. Nevertheless, if we see reliable bearish factors, which could trigger further deterioration, we’ll re-open short positions (very likely at higher levels).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts