Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil moved higher after the market’s open as a combination of further supply disruptions in Nigeria and growing Asian demand for Saudi Arabian oil affected positively investors’ sentiment. As a result, black gold climbed above the barrier of $50, but then reversed and pulled back. Will we see further deterioration in the coming days?

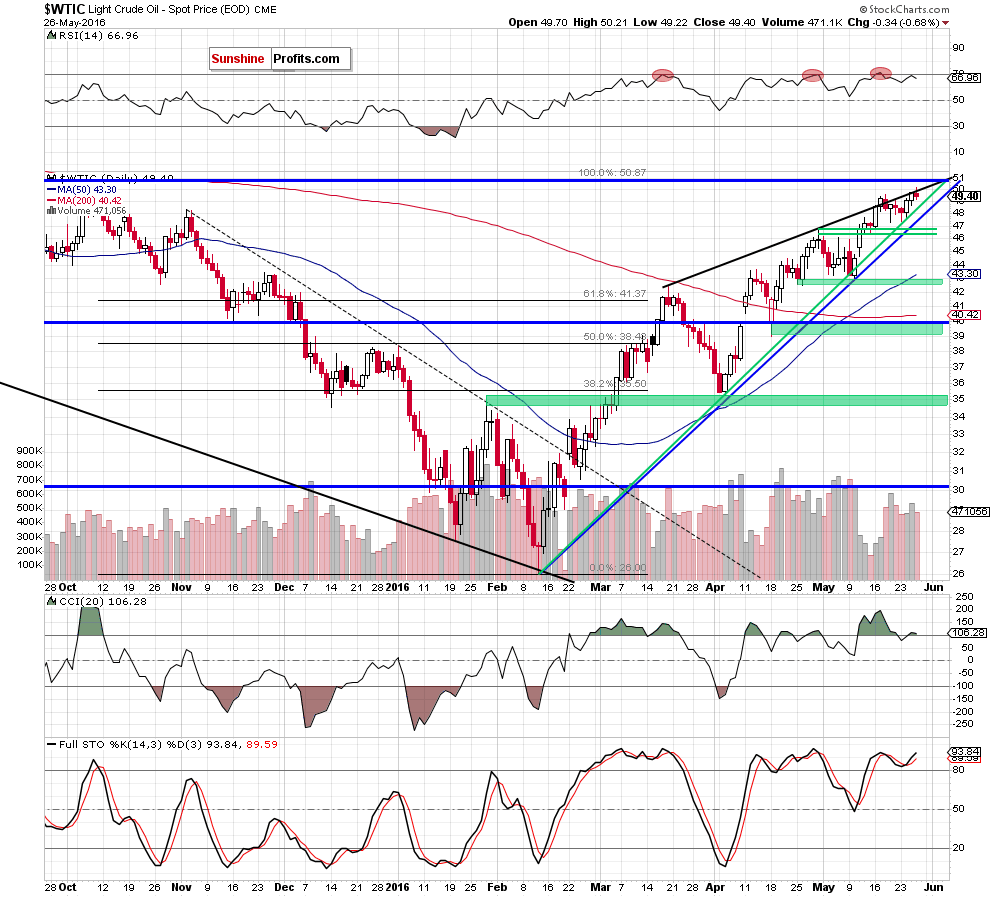

Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) light crude broke above the May 18 peak, hitting a fresh high and reaching the black resistance line (based on the Mar and Apr highs) once again. What’s next? Taking into account the fact that the commodity closed the day slightly below in intraday high and above the May peak, bigger volume than day before and invalidation of sell signals generated by the CCI and Stochastic Oscillator, it seems that black gold will test the barrier of $50 and the Oct high in the coming day(s).

From today’s point of view, we see that oil bulls pushed the commodity slightly above the barrier of $50 yesterday, but despite this improvement, they didn’t manage hold gained levels. As a result, light crude reversed and declined, closing the day under this psychologically important level and invalidating earlier small breakout. With this drop, crude oil also declined under the black resistance line based on the Mar and Apr highs, invalidating the breakout. Taking these two negative events into account, we think that further deterioration is just around the corner. If this is the case, and light crude extends declines from here, the initial downside target would be around $48.90, where the medium-term green rising support line currently is.

Summing up, crude oil climbed above the barrier of $50 and the black resistance line, but as it turned out, this improvement was only temporary and the commodity reversed and declined in the following hours. Thanks to this drop, light crude invalidated earlier small breakouts, which is a negative signal that suggests further deterioration and a test of the medium-term green rising support line in the coming day.

Very short-term outlook: mixed with berish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts