Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil gained 4.14% as Friday’s Baker Hughes’ report continued to weigh. Weaker U.S. dollar supported the commodity as well. As a result, light crude climbed to $50 per barrel for the first time since Jan 15. Is the final bottom in?

Yesterday, crude oil extended gains and increased to an intraday high of $50.56 as Baker Hughes report released on Friday continued to weigh on investors‘ sentiment. As a reminder, the company showed that the number of oil rigs has declined in 13 of the last 16 weeks, which triggered a rally in crude oil prices.

Also yesterday, the Commerce Department showed that personal spending fell 0.3% in December (missing expectations for a decline of 0.2%), while the Institute for Supply Management showed that its index of purchasing managers dropped to 53.5 in January from a reading of 55.5 in December. These disappointing numbers pushed the U.S. dollar lower, making crude oil more attractive for buyers holding other currencies. In this environment, light crude approached its key resistance zone. Will we see a breakout and sizable upward move? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

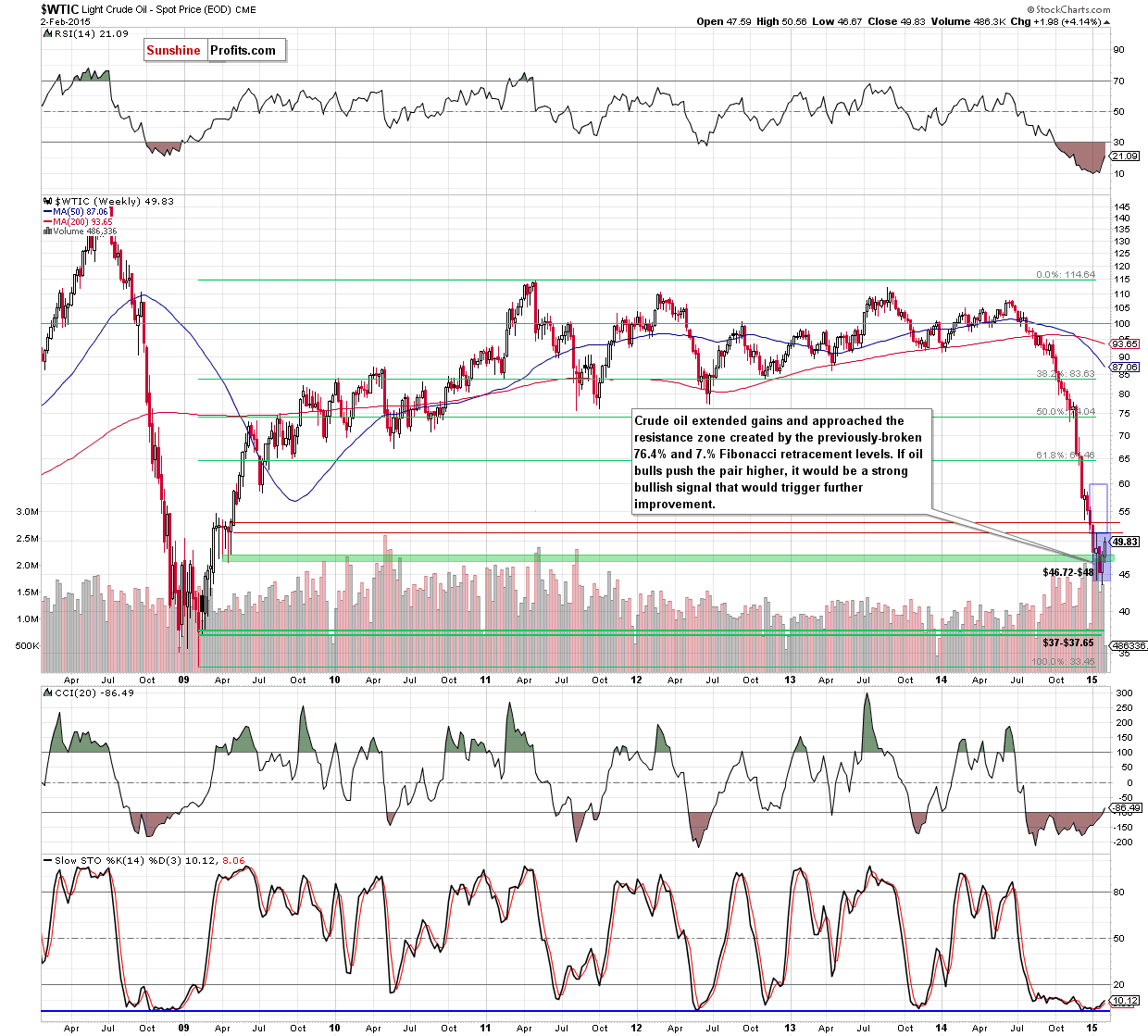

(…) crude oil bounced off the recent low and increased sharply, invalidating not only the breakdown below the previous low, but also under the Apr 2009 lows. (…) Friday’s rally invalidated the breakdown below the lower border of the consolidation (…), which is another bullish signal. On top of that, the CCI and Stochastic Oscillator generated buy signal, while the size of volume that accompanied this increase was significantly, which suggests that oil bulls are getting stronger. Without a doubt, these are positive circumstances favoring further growth and an increase to the 38.2% or even 50% Fibonacci retracement (based on the Dec-Jan decline).

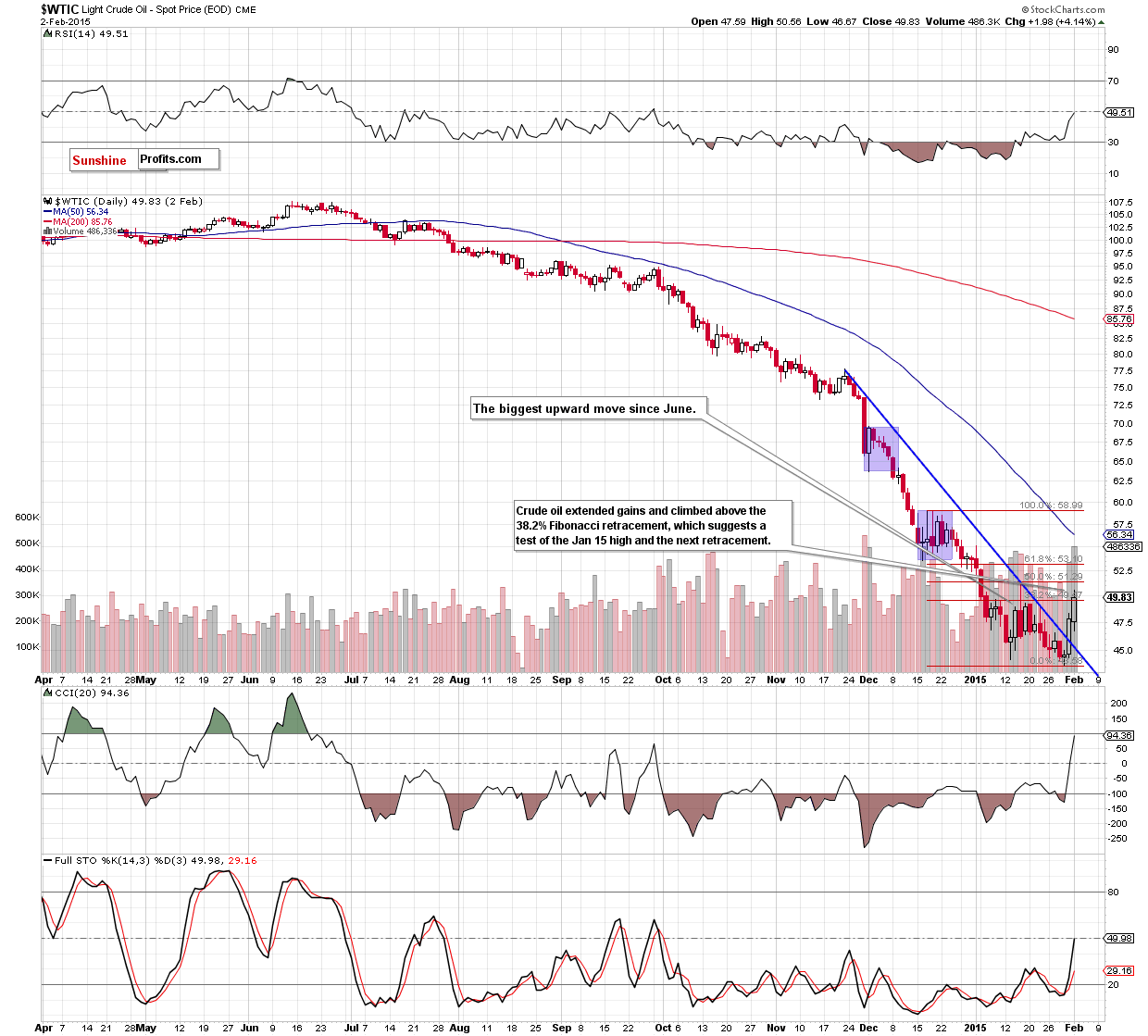

As you see on the charts, the situation developed in line with the above-mentioned scenario and crude oil reached our first upside target - the 38.2% Fibonacci retracement (based on the Dec-Jan decline). When we take a closer look at the daily chart, we see that yesterday’s move materialized on huge volume, which confirms the growing strength of oil bulls. Therefore, we believe that crude oil will climb to its key resistance zone. What’s next? We think that the best answer to this question will be our yesterday’s commentary:

(…) we believe that a reliable trend reversal and a sizable upward move to (at least) Dec highs around $60 will be likely only if we see a breakout above the solid resistance zone (created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels marked with green on the weekly chart, the 50% Fibonacci retracement based on the mid-Dec-Jan decline and the Jan 15 high), which won’t be followed by a fresh low. Until this time, another attempt to move lower can’t be ruled out (even if crude oil shows further strength later today or in the coming days).

Summing up,crude oil extended gains and climbed above the 38.2% Fibonacci retracement, approaching its key resistance zone. Despite this improvement, we think that as long as there is no comeback above the Jan 15 high, a trend reversal is questionable.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if we see a successful breakout above the Jan 15 high of $51.27, we’ll consider opening long positions. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts