Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Thursday, crude oil gained 1.24% as a weaker greenback supported the price. With this upswing light crude climbed to major resistance zone once again, but then reversed. Will we see another pullback from here?

On Wednesday, Fed Chair Janet Yellen said the economy has “expanded moderately” after a weak first quarter, but despite this commentary Fed officials lowered expectations for GDP growth in 2015 (the second time since December) and its interest-rate projections. As a result, the USD Index moved sharply lower, declining below 94 and hitting a monthly low against the basket of major currencies. As a result, a weaker greenback supported the price, making crude oil more attractive for buyers holding other currencies. Thanks to these circumstances, light crude climbed above $60 once again, but does it change anything? (charts courtesy of http://stockcharts.com).

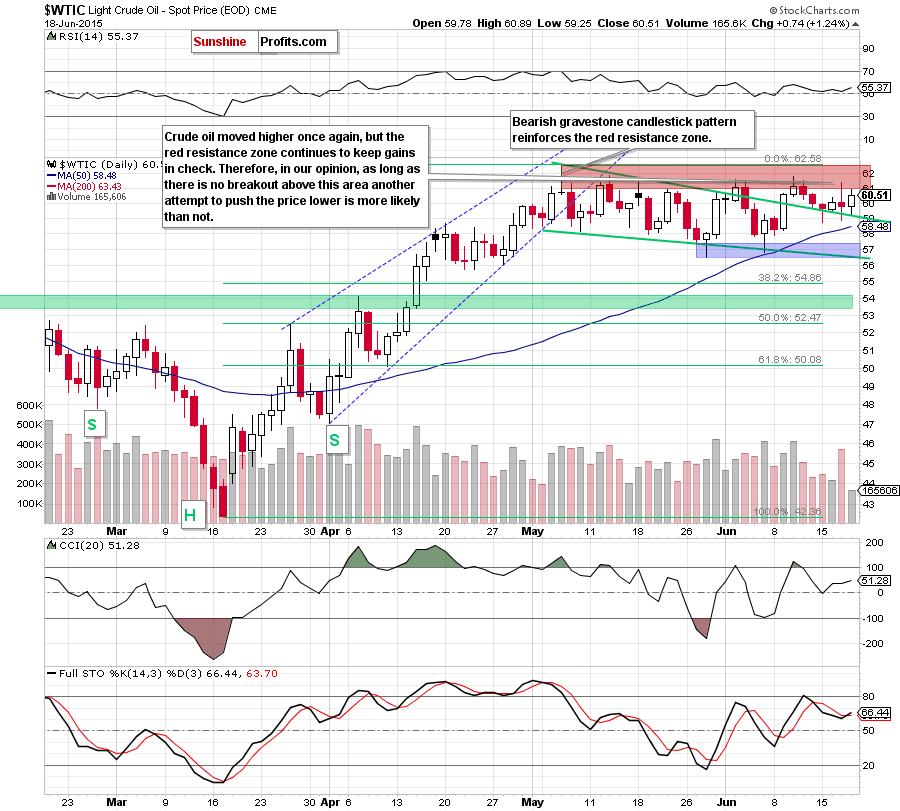

Looking at the daily chart, we can summarize the current price action in one simple sentence: more of the same. Yesterday, crude oil bounced off the green support line and climbed to the red resistance zone – similarly to what we saw in the previous weeks. This suggests that we’ll likely see another pullback from here and a comeback to the upper border of the declining wedge – especially when we factor in the size of volume. As you see on the above chart, yesterday’s move materialized on tiny volume, which doesn’t confirm oil bulls’ strength and increases the probability of another downswing.

In our opinion, as long as there is no successful breakout above the red resistance zone or a daily close below the green support line another bigger upward/downward move is not likely to be seen. Instead, we’ll likely see short-lived moves in both directions.

Please keep in mind that if crude oil closes the day below the green support line and the 50-day moving average (currently under $58.48), the next target (and the last stop before the Feb highs) would be the blue support zone ($56.50-$57.60).

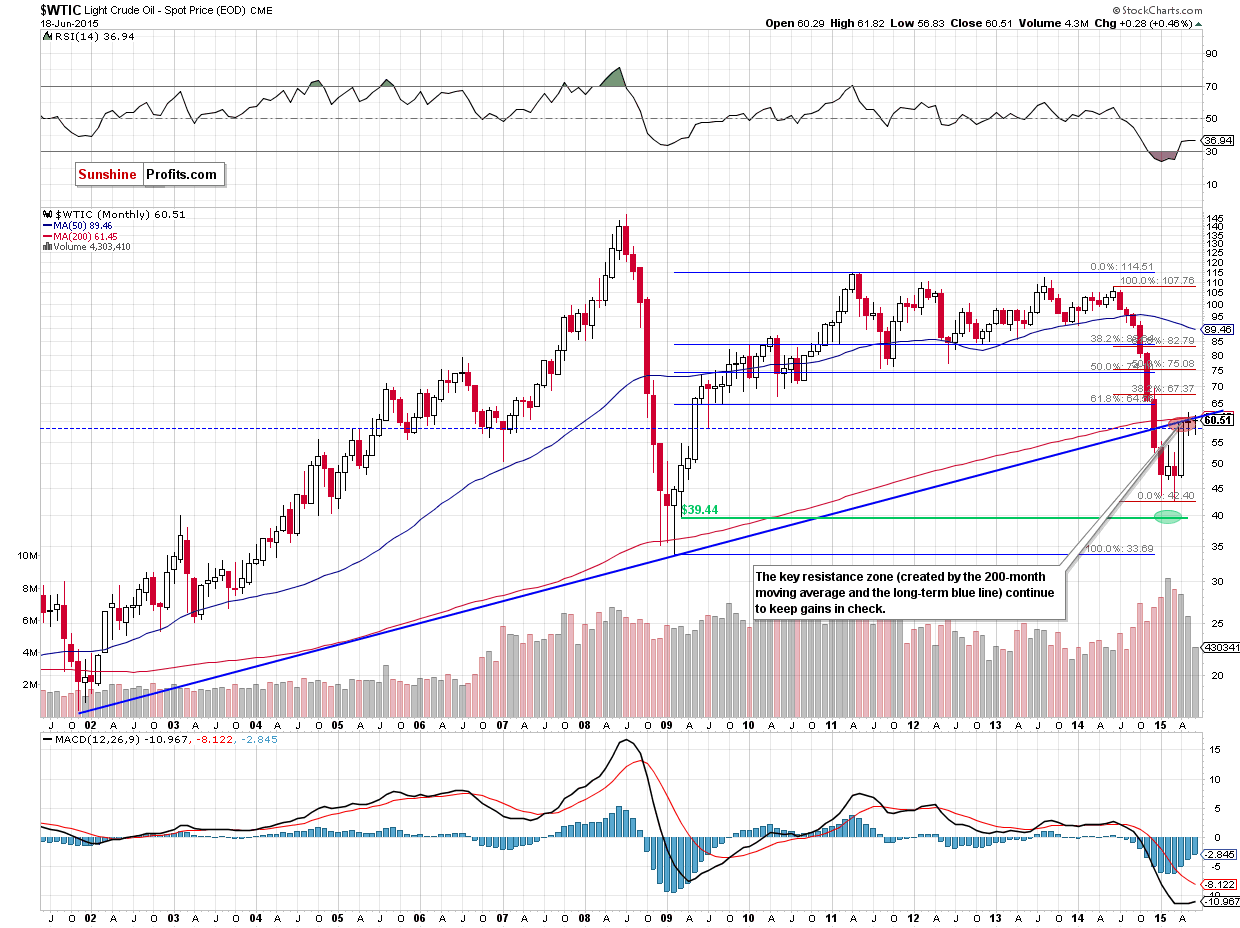

Summing up, crude oil re-tested the red zone once again, but this solid resistance withstood the buying pressure and pushed the commodity lower – similarly to what we saw in previous weeks. This means that as long as this zone (reinforced by the 200-month moving average and the long-term blue line) keeps gains in check further rally is not likely to be seen and another downswing should not surprise us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts