Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil lost 0.78% as speculation that weekly supply data will show another build in U.S. crude inventories weighed on the price. Thanks to these circumstances, light crude slipped to its lowest level since Aug 31 and closed the day under important support zone. What’s next for the commodity?

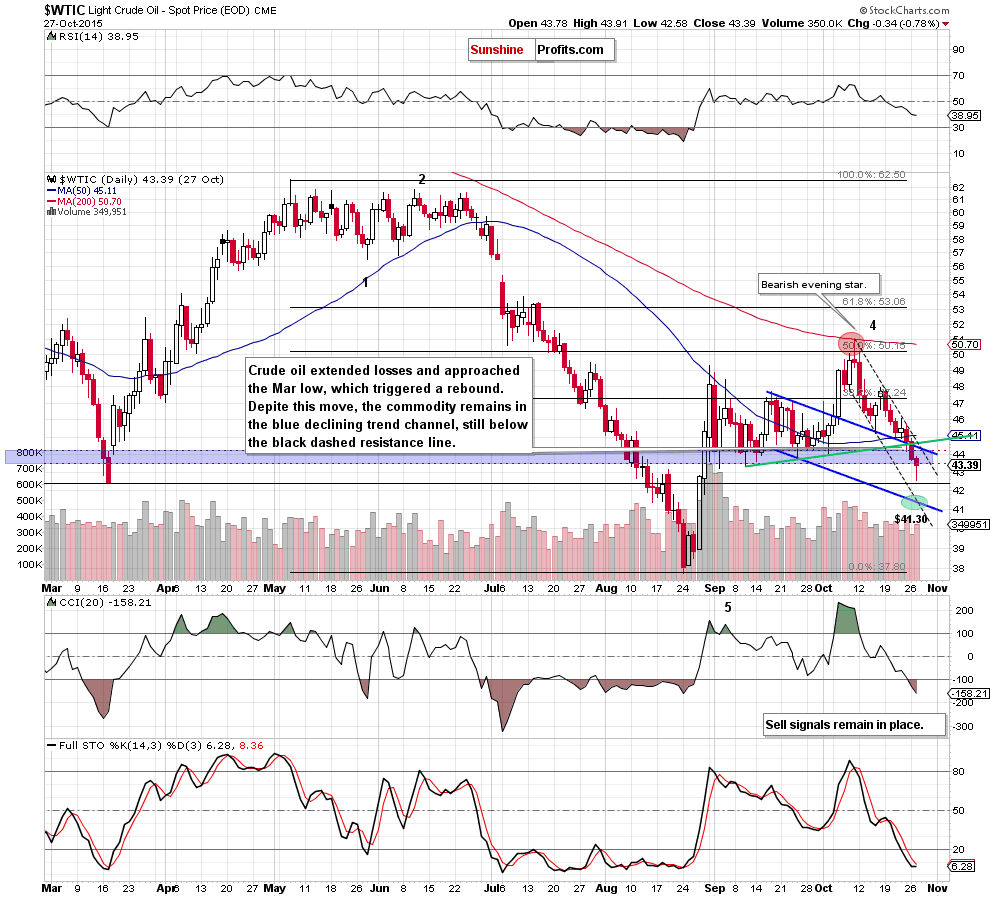

Yesterday, crude oil moved lower as speculation that weekly supply data will show another build in U.S. crude inventories weighed on the price. In this way, the commodity hit an intraday low of $42.58 and approached the Mar low. In the following hours light crude rebounded, but did this increase change anything in the technical picture of the commodity? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

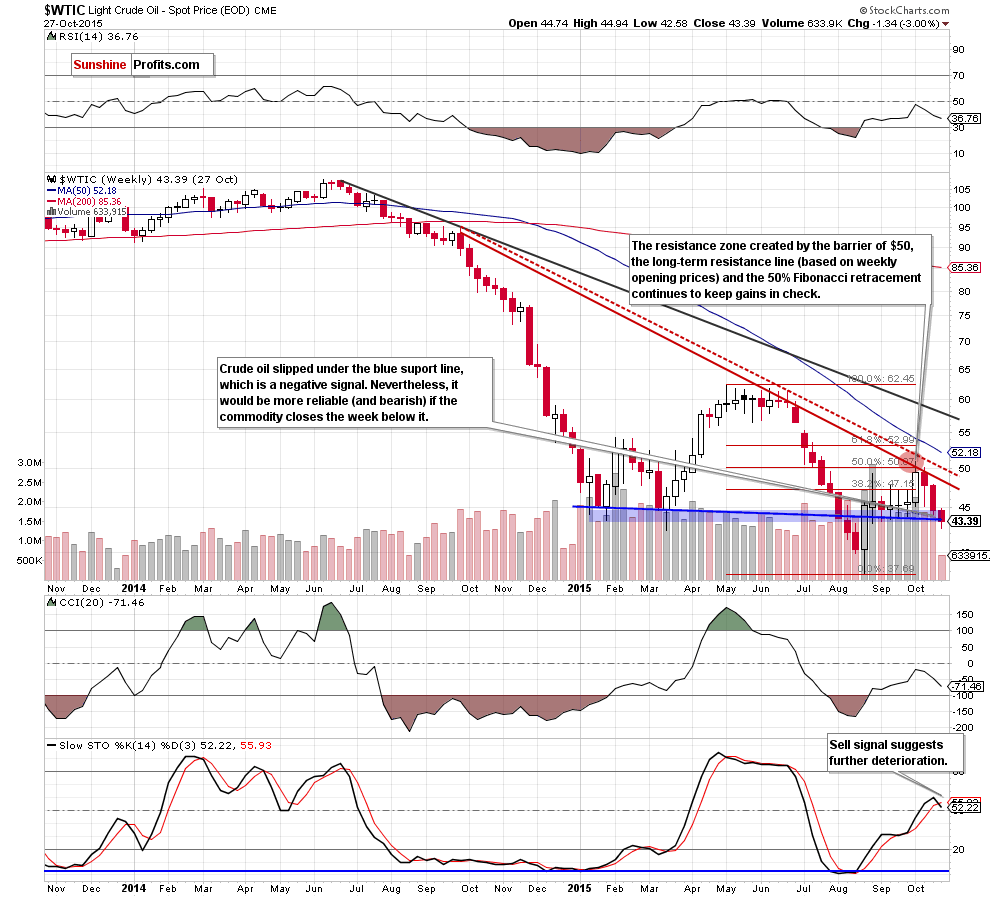

Looking at the weekly chart we see that the commodity dropped under the blue support line, which is a negative signal that suggests further declines. Nevertheless, it would be more reliable (and bearish) if crude oil closes the week below it (at this point, it is worth noting that sell signal generated by the Stochastic Oscillator remains in place, suggestig that further deterioration is more likely than not).

Having said that let’s focus on the very short-term changes.

Quoting our previous alert:

(…) light crude verified the breakdown under the 50-day moving average, which triggered further deterioration. With this downswing, the commodity dropped under the green and blue support lines, which is a strong negative signal that suggests lower values of crude oil.

From today’s point of view, we see that oil bears pushed the commodity lower as we had expected. With this downswing, light crude slipped to the Mar low, which triggered a small rebound. Despite this move, crude oil closed the day slightly below the blue support zone, which suggests further deterioration in the coming days (even if we see an increase to the previously-broken upper border of the blue declining trend channel). Additionally, this scenario is reinforced by sell signals generated by the indicators and the size of volume that accompanied yesterday’s decline.

How low could the commodity go in the coming days? If crude oil extends declines from here, we think that the initial target for oil bears would be around $41.30, where the lower line of the declining trend channel currently is.

Summing up, crude oil extended losses and slipped under the blue support zone and the blue support line, which in combination with sell signals generated by the indicators suggests lower prices of the commodity in the coming days. Therefore, we believe that further deterioration is more likely than not and short positions (which are already profitable as we entered them when crude oil was at about $46.68) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts