Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil extended losses and hit a fresh 2015 low weakened by the Wednesday’s bearish EIA weekly report on domestic inventories. Despite this drop, the commodity rebounded later in the day, gaining 0.47% as upbeat jobless claims report supported the price. Did this increase change anything in the short-term picture?

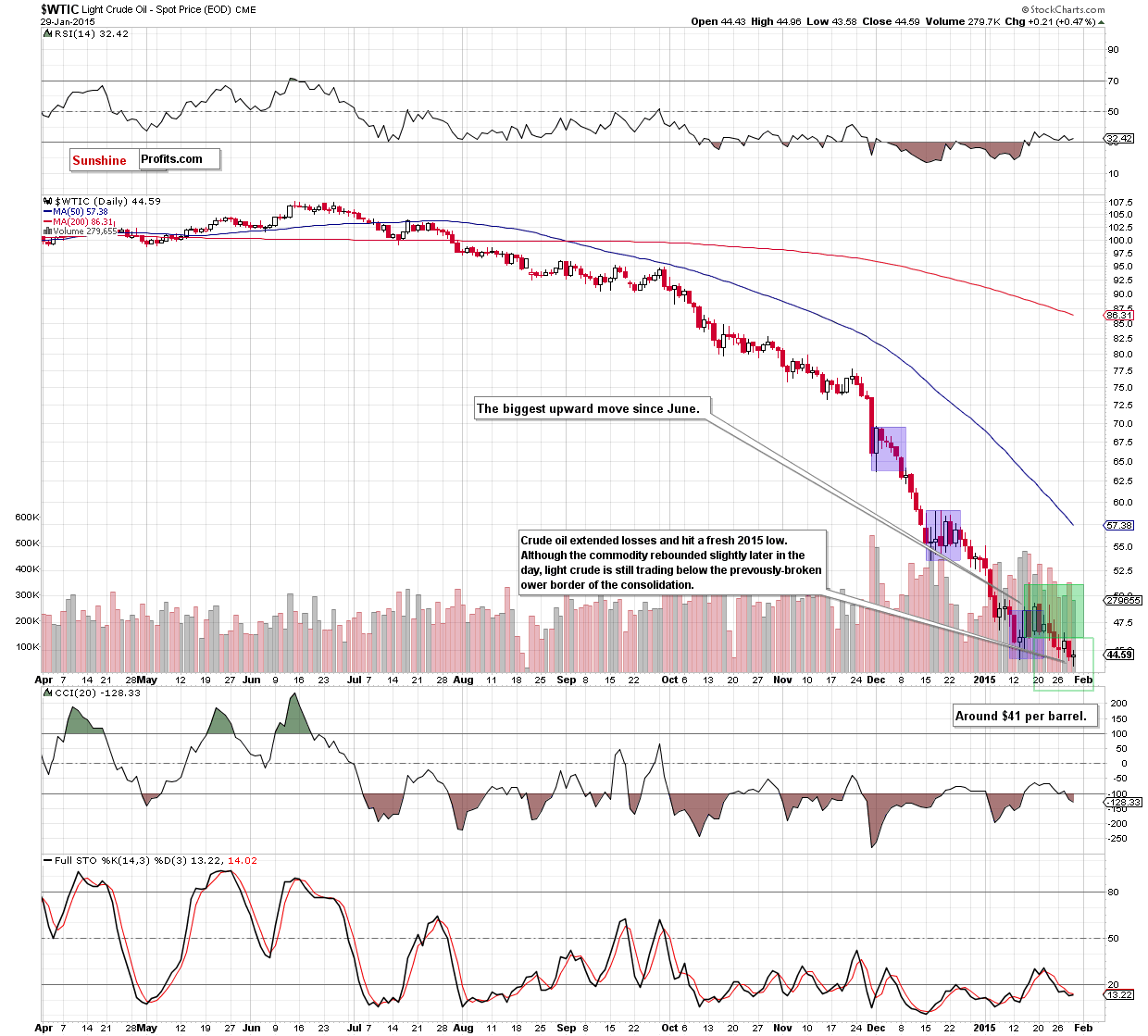

Yesterday, crude oil extended losses and declined under $44 per barrel for the first time since April 2009 as another increase in crude oil inventories continued to weight (as a reminder, last week's build took stockpiles to nearly 407 million - the highest level since 1982). Despite this drop, the commodity rebounded, supported by upbeat jobless claims report. The U.S. Department of Labor reported that the number of individuals filing for initial jobless benefits decreased by 43,000 to 265,000, which is the lowest level since 2000. These bullish numbers fueled optimism over the strength of the economy and pushed light crude to an intraday high of $44.96. Whether yesterday’s move was another one-day rally or the beginning of the reversal? (charts courtesy of http://stockcharts.com).

The first thing that catches the eye on the above charts is a fresh 2015 low of $43.58. Despite this deterioration, the commodity reversed and moved slightly higher, invalidating earlier breakdown below the previous lows. Although this is a bullish signal, we should keep in mind that yesterday’s upswing materialized on smaller volume than Wednesday’s decline, which suggests that oil bulls might not be as strong as it seems on the first sight. Taking the above into account, and combining it with the fact that light crude still remains below the previously-broken lower border of the consolidation (marked with green) and the Apr 2009 lows, we think that our last commentary is up-to-date:

(…) we think that lower values of light crude are still ahead us. This scenario is also reinforced by the size of volume, which accompanied yesterday’s move – it was much bigger than a day before, which confirms the strength of oil bears. How low could the commodity go? As you see on the daily chart, the initial downside target for oil bears will be around $41 per barrel, where the size of the downward move will correspond to the height of the formation.

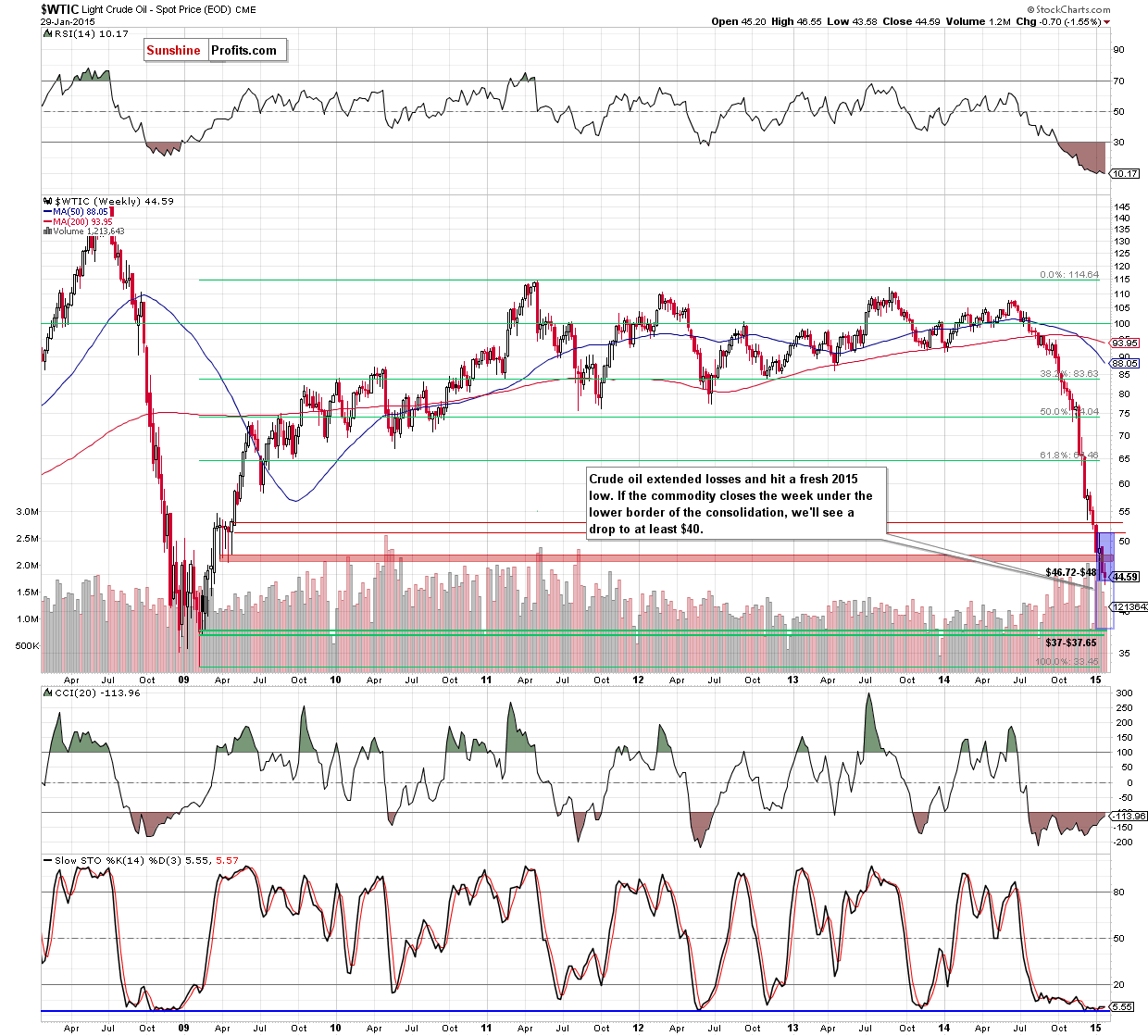

(…) When can we expect a reliable trend reversal? (…) In our opinion, a trend reversal (and an upward move to the Dec highs around $60) will be likely only if we see a breakout above the solid resistance zone (created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels marked with green on the weekly chart and the 50% Fibonacci retracement based on the mid-Dec-Jan decline), which won’t be followed by a fresh low. Until this time, the above-mentioned bearish scenario is still in play.

Summing up, crude oil extended losses and ht a fresh 2015 low. Although the commodity rebounded slightly, invalidating the breakdown below the previous low, we think that lower values of light crude are still ahead us. If this is the case, the initial downside target for oil bears will be around $40-$41 per barrel. However, if this area is broken, we could see a decline even to $37-$37.65 in the coming week(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts