Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective.

On Thursday, crude oil lost 1.39% as OPEC cut a demand forecast for its crude. Additionally, a stronger green back and news from Libya weighed on the price. In a response, the commodity hit an intraday low of $77.12, erasing over 75% of Wednesday’s rally. Will light crude hit a fresh low?

Yesterday, the Organization of the Petroleum Exporting Countries reduced the demand forecast for its oil in its annual world outlook, predicting consumption would fall to 28.2 million barrels by 2017, down 6.9% from 2013. Additionally, Libyan oil officials said that they intend to restart the 300,000 barrel-a-day Sharara field soon, which watered down the price of the commodity.

On top of that, the Labor Department showed that the initial claims for unemployment benefits decreased by 10,000 in the week ended Nov. 1, beating analysts’ expectations for a 3,000 drop. This second lowest level for claims this year supported the greenback, making crude oil a less attractive commodity among investors holding other currencies. In these circumstances, light crude extended losses and closed the day below $78, but did this move change anything? (charts courtesy of http://stockcharts.com).

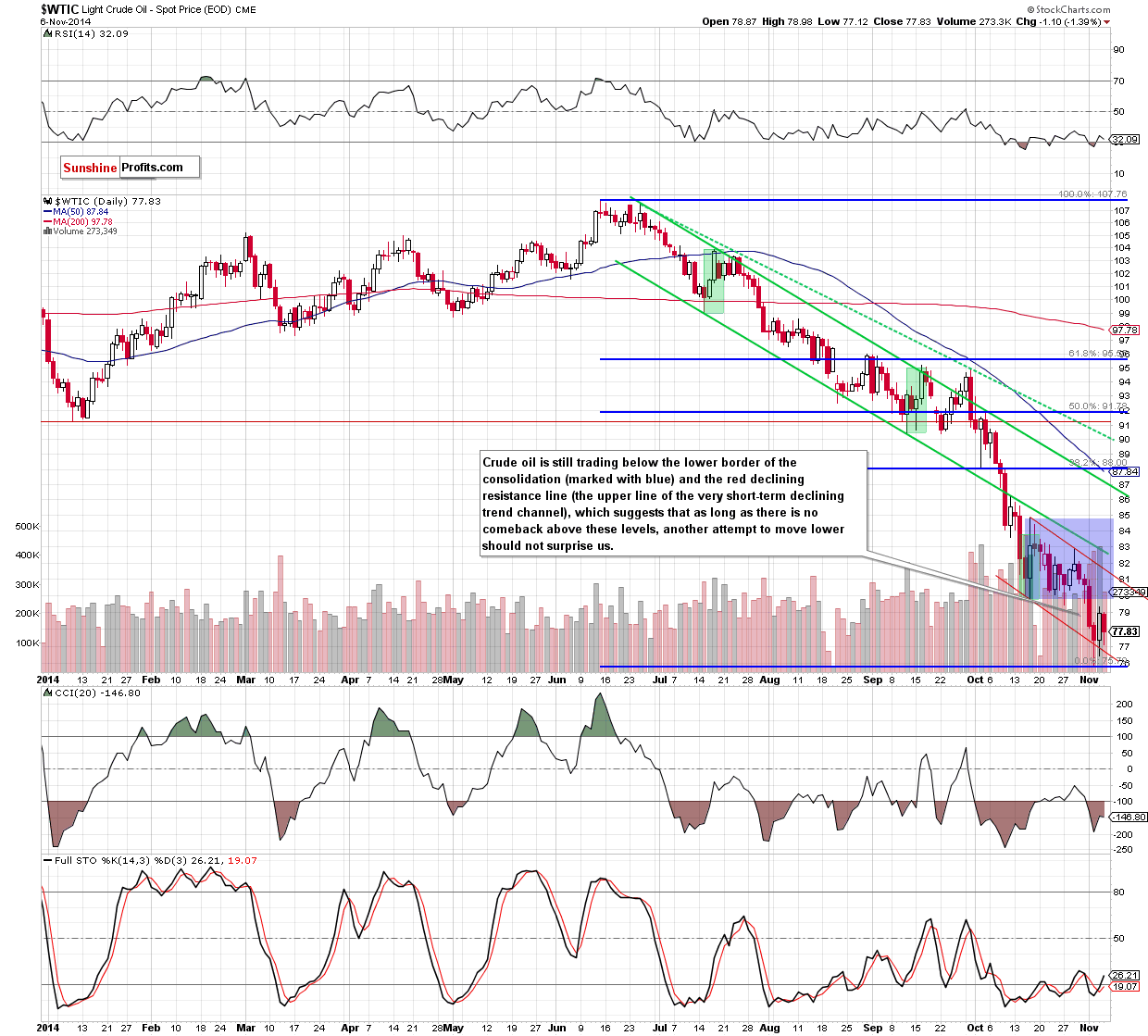

The situation in the medium term hasn’t changed much as crude is still trading in a narrow range between the support zone created by the Aug and Oct 2011 and Jun 2012 lows and the resistance area based on the barrier of $80, the previous lows and the long-term blue resistance line. In our opinion, as long as there is no breakout/breakdown, another sizable upward/downward move is not likely to be seen.

How yesterday’s move affected the very short-term chart? Let’s take a look.

From this perspective, we see that crude oil reversed once again and slipped below $78, erasing over 75% of Wednesday’s rally. As you see, the commodity remains below the lower border of the consolidation, but is still trading in the very short-term declining trend channel. Although the lower line of the formation could trigger some improvement in the coming day, we think that as long as light crude doesn’t invalidate a breakdown under the previous lows, the barrier of $80 and the long-term blue resistance line, another attempt to move lower should not surprise us. Taking all the above into account, we believe that our last commentary is still valid:

(…) If (…) light crude declines once again, we’ll see a test of the strength of Tuesday’s low in the coming days. (…) if it doesn’t withstand the selling pressure (…) it seems that crude could drop even to around $75 (…) At this point, it’s worth noting that below this level there is also the 50% Fibonacci retracement based on the entire 2009-2011 rally (at $74.19), which together create a solid support zone.

Summing up, although crude oil moved lower once again, the overall situation in the commodity hasn’t changed much as it is still trading in a narrow range between the solid resistance zone, which could trigger another downswing in the coming days. Nevertheless, taking into account the fact that the space for further declines seems limited, we suggest opening long positions when crude oil drops to $75.82 with a stop-loss order at $73.47.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): In our opinion, long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts