Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Monday, crude oil reversed and lost 1.64% expectations that the OPEC will not cut output overshadowed news that six world powers failed to reach a nuclear deal with Iran. Thanks to these circumstances, light crude invalidated earlier breakout and slipped below $76. Is the recent rally over?

Yesterday, the price of crude oil moved higher after the market’s open on news that six world powers failed to reach a nuclear deal with Iran (as a reminder, a deal would lift sanctions and allow for more oil on the global market). Both sides agreed to extend Monday's deadline to July to give Tehran more time to comply. Thanks to this move Iranian exports will remain lower, which supported the commodity and pushed it to an intraday high of $77.02.

Despite this improvement, expectations that the coming meeting of the OPEC would fail to stem a monthslong plunge in oil prices watered down earlier gains and light crude slipped to $75.45. Will we see a test of the recent lows? (charts courtesy of http://stockcharts.com).

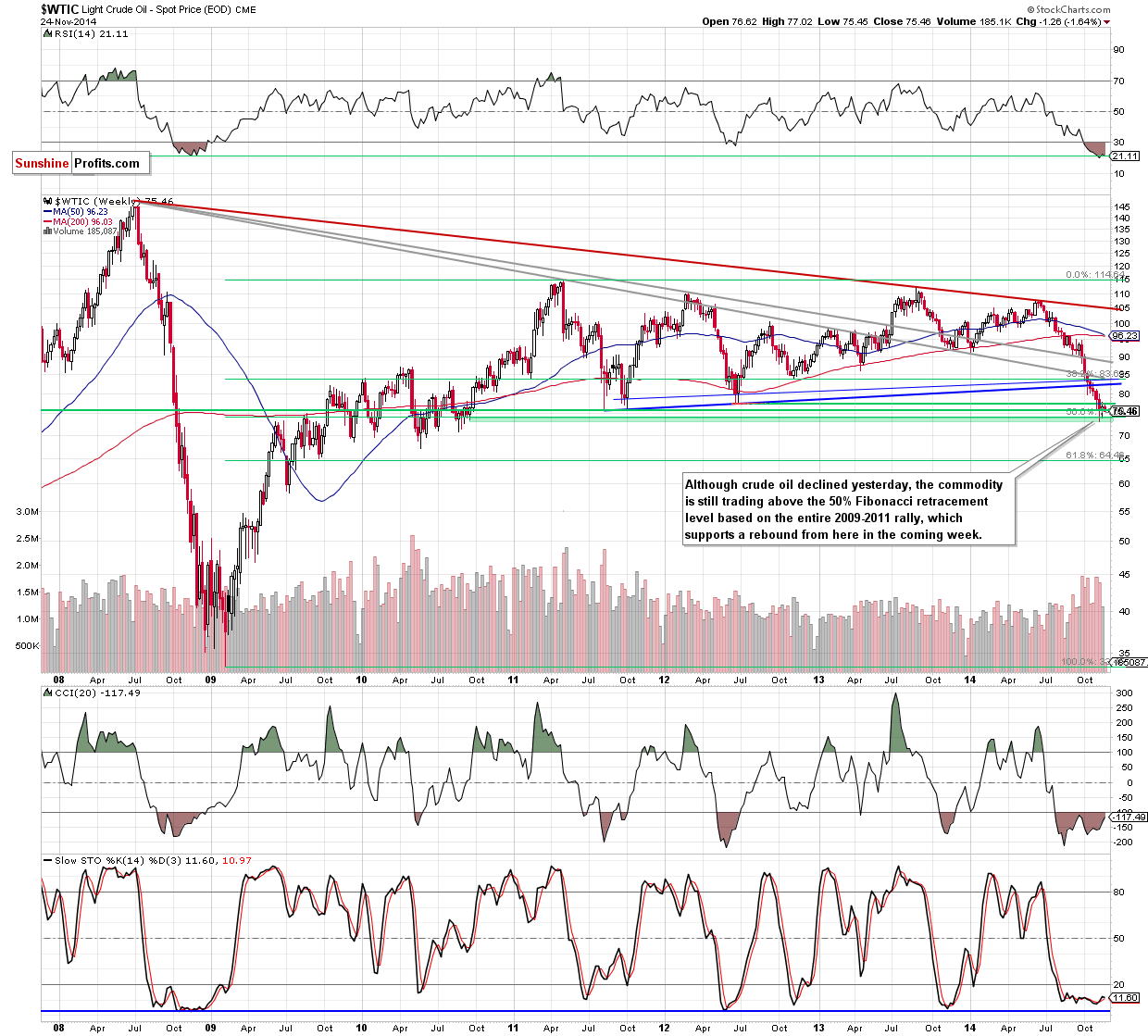

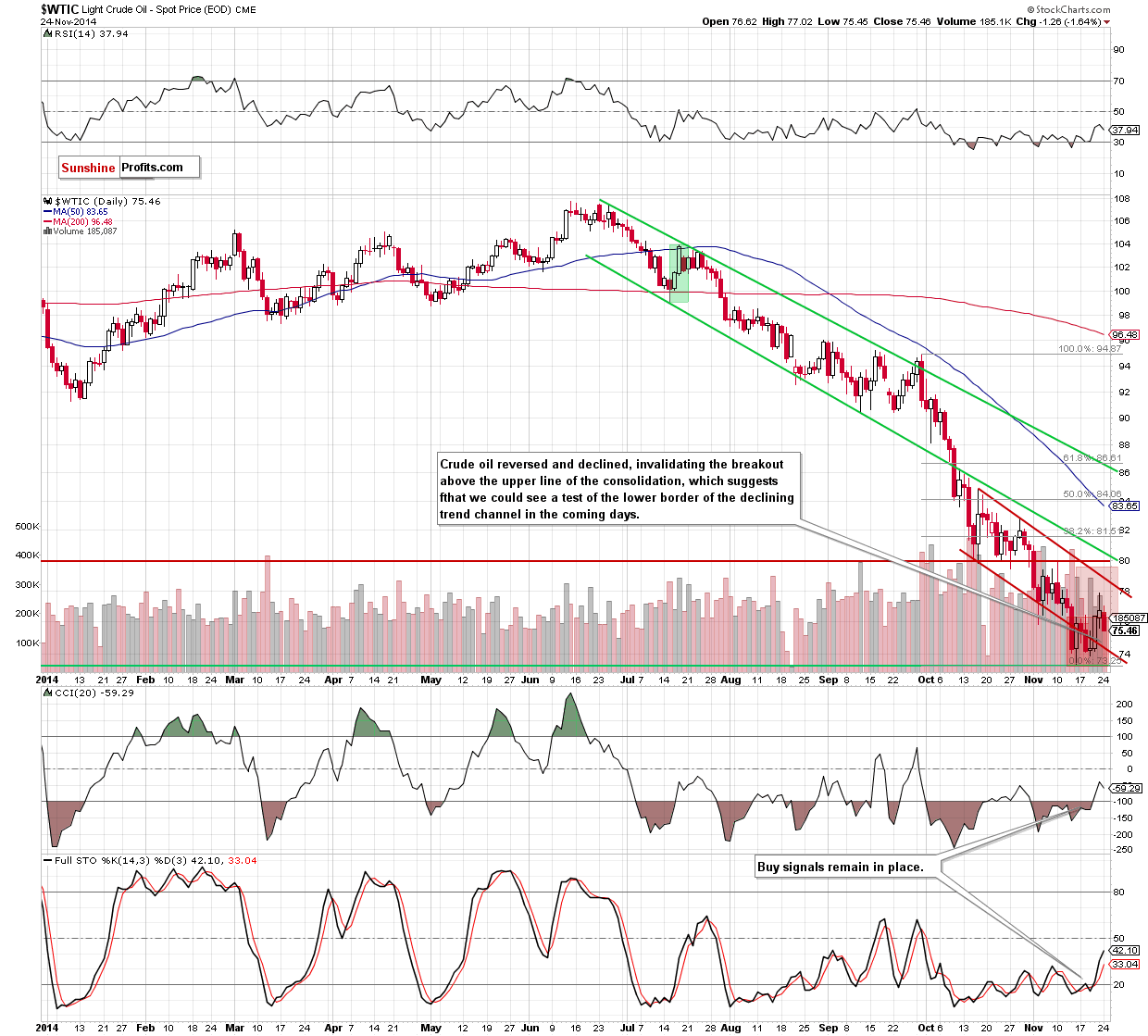

Looking at the daily chart, we see that the situation in the very short-term has deteriorated slightly as crude oil reversed and came back to the consolidation range. Although the commodity invalidated earlier breakout above the upper line of the formation, light crude is still trading well above the lower line of the declining trend channel. In our opinion, as long as there is no breakdown below this support, further improvement is likely – especially when we factor in the fact that buy signals generated by the indicators remain in place, supporting the bullish case. Therefore, even if we see another drop in the coming days, we believe that the support zone created by the lower border of the trend channel, the recent lows and the 50% Fibonacci retracement (marked on the weekly chart) will be strong enough to stop futher deterioration.

Summing up, we believe that keeping long positions (which are profitable) is still justified from the risk/reward perspective as crude oil is still trading well above the support zone created by the lower border of the trend channel, the recent lows and the 50% Fibonacci retracement. Additionally, buy signals generated by the indicators remain in place, supporting further improvement.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, the markets in the U.S. will be closed on Thursday and we expect the trading activities to be limited on Friday as well. Consequently, we there will be no Oil Trading Alerts on Thursday and Friday. The alerts will be posted until Wednesday and will then be posted normally beginning on Monday, Dec 1.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts