Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Tuesday, crude oil bounced off the recent lows and came back above $48, but did this increase change the short-term picture of the black gold?

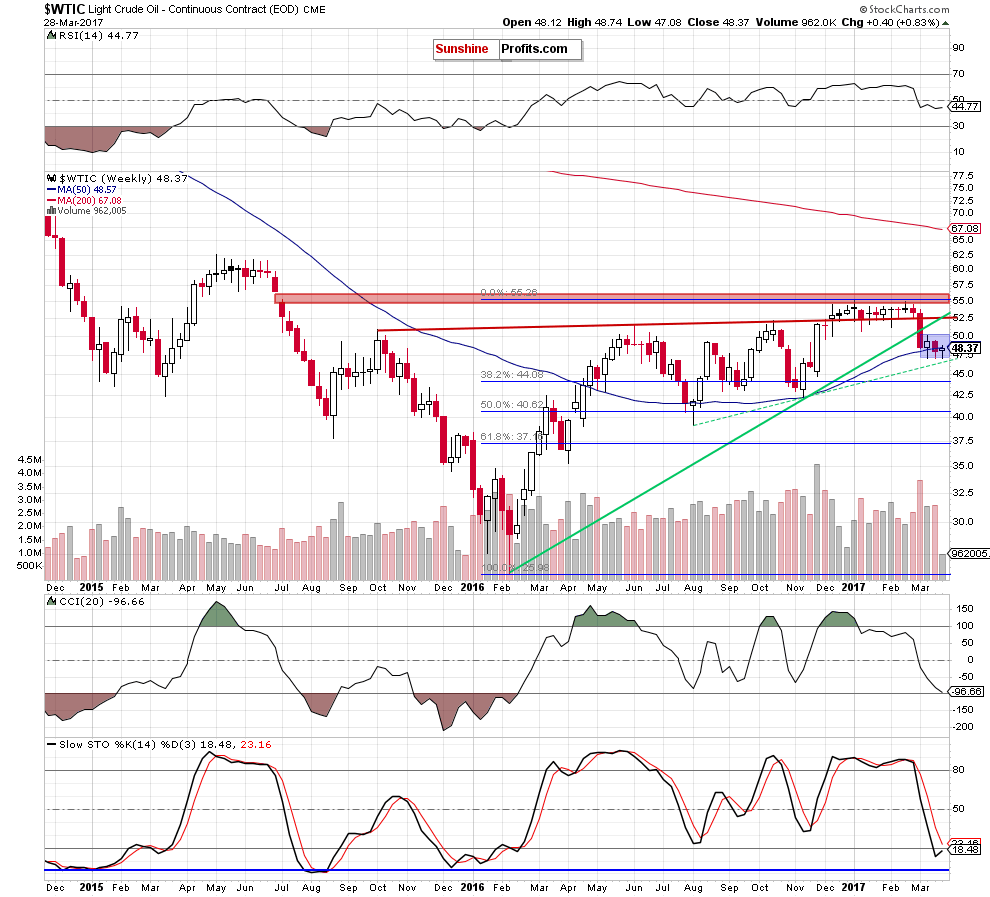

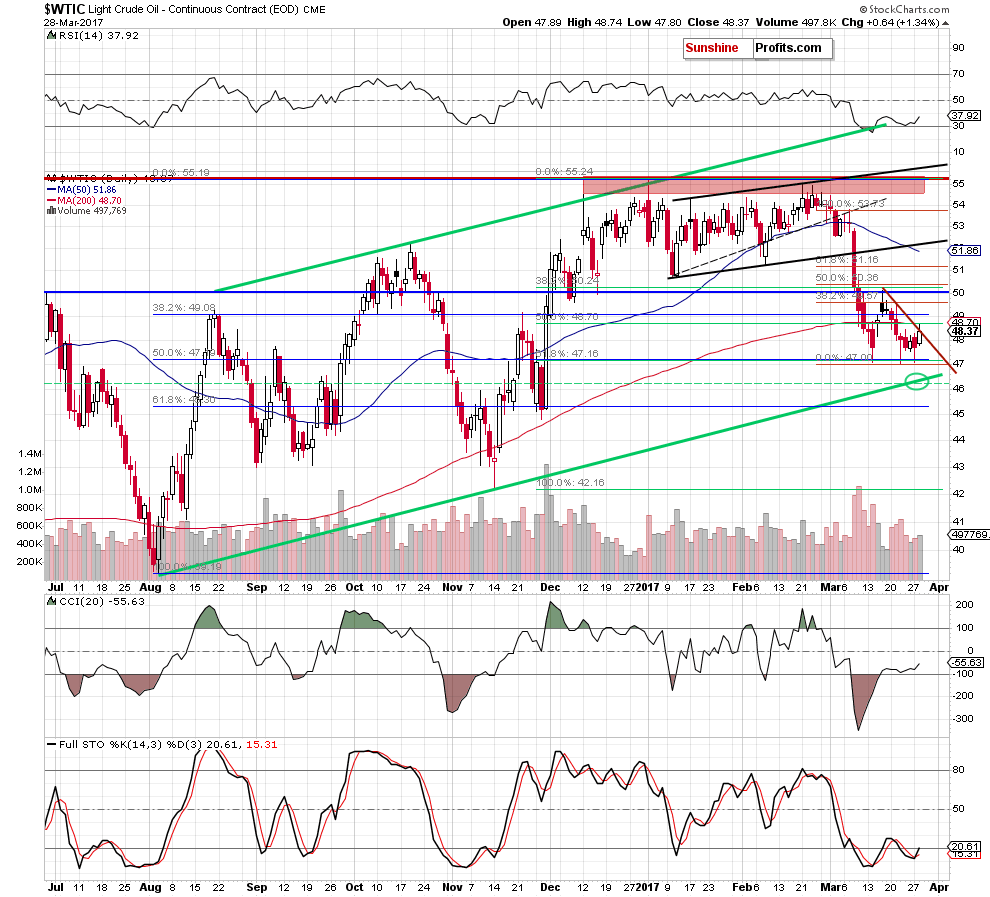

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Today’s alert is going to be quite short, because crude oil didn’t do anything that would change the outlook on Tuesday. The only thing that crude oil did is that it moved initially higher and broke above the very short-term red declining resistance line based on the previous highs.

Despite this increase, oil bulls didn’t manage to hold gained levels, which resulted in a pullback and a daily closure below this line. In this way, light crude invalidated the earlier small breakout, which is a negative event. Additionally, the key resistance levels continue to keep gains in check, which suggests that another attempt to move lower and a test of the medium-term green support line based on the August and November may be just around the corner.

Summing up, short (profitable) positions continue to be justified as crude oil invalidated the tiny breakout above the red declining resistance line based on the previous highs, which suggests another attempt to move lower.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts