Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil gained 5.03% as weaker U.S. dollar and expectations that U.S. shale producers will cease production supported the price. As a result, light crude invalidated the breakdown below the support area and erased almost 40% of the recent declines. Is it enough to trigger a trend reversal?

Yesterday, the data showed that U.S. manufacturing PMI moved lower to 54.8 in November from 55.9 in October. Additionally, the Institute of Supply Management reported that its manufacturing PMI dipped to 58.7 from 59.0 in October, which weakened the U.S. dollar, making crude oil more attractive in dollar-denominated exchanges, especially among investors holding other currencies. In this environment, light crude bounced off a fresh multi-year low of $63.82 and posted the biggest increase since mid-June. Is the trend reversal approaching? (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

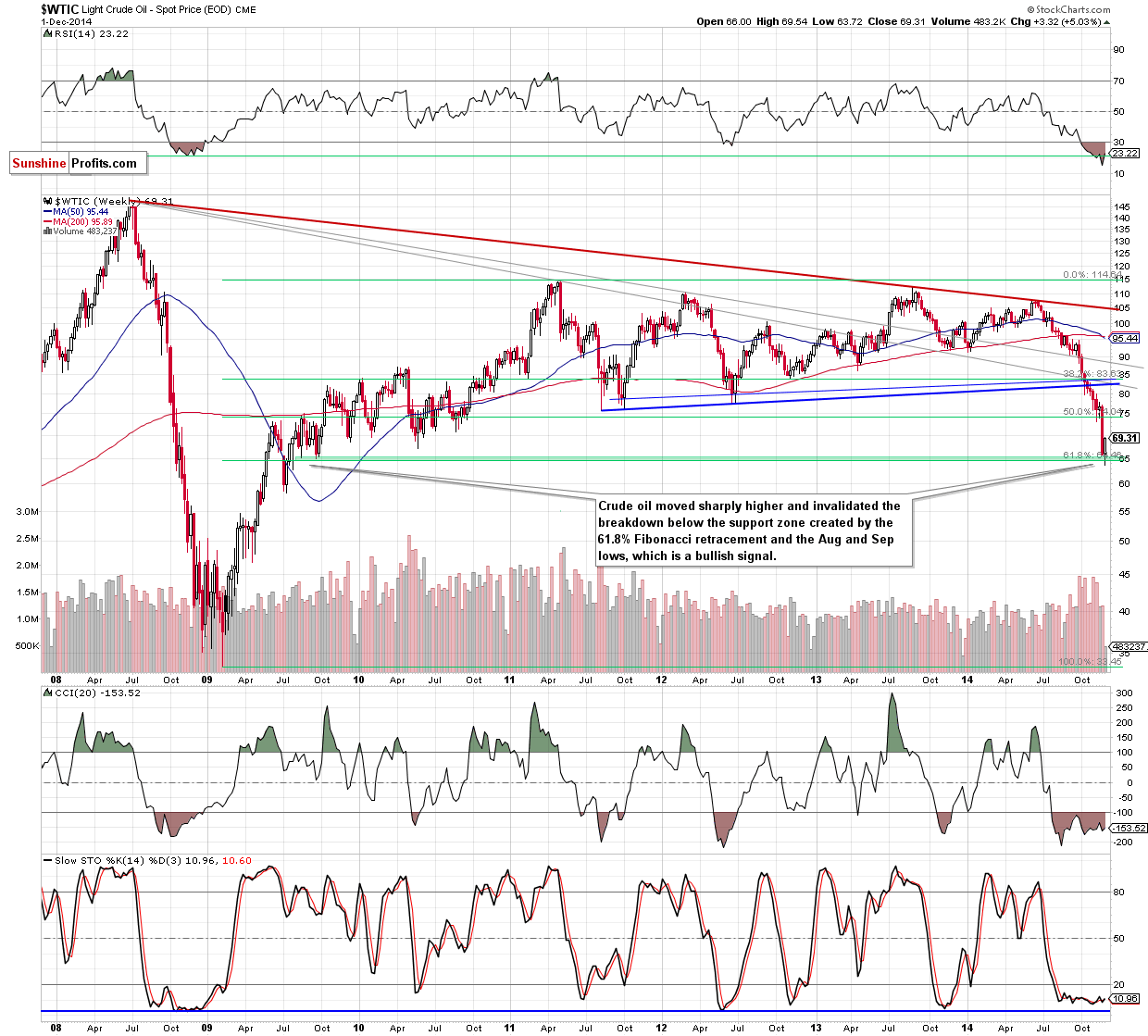

(…) crude oil approached the next support zone created by the 61.8% Fibonacci retracement and the Aug and Sep 2009 lows. Although light crude still has some room for declines, it seems that the space is limited, which suggests that a pause (or bigger corrective upswing) is just around the corner.

Looking at the above charts, we see that although crude oil moved lower after the market’s open (hitting a fresh multi-year low of $63.72), the above-mentioned support zone encouraged currency bulls to act as we expected. As a result, the commodity rebounded sharply and invalidated the small breakdown below these levels (the first positive signal), climbing to an intraday high of $69.54. At this point, we would like to draw your attention to the quote from yesterday’s Oil Trading Alert:

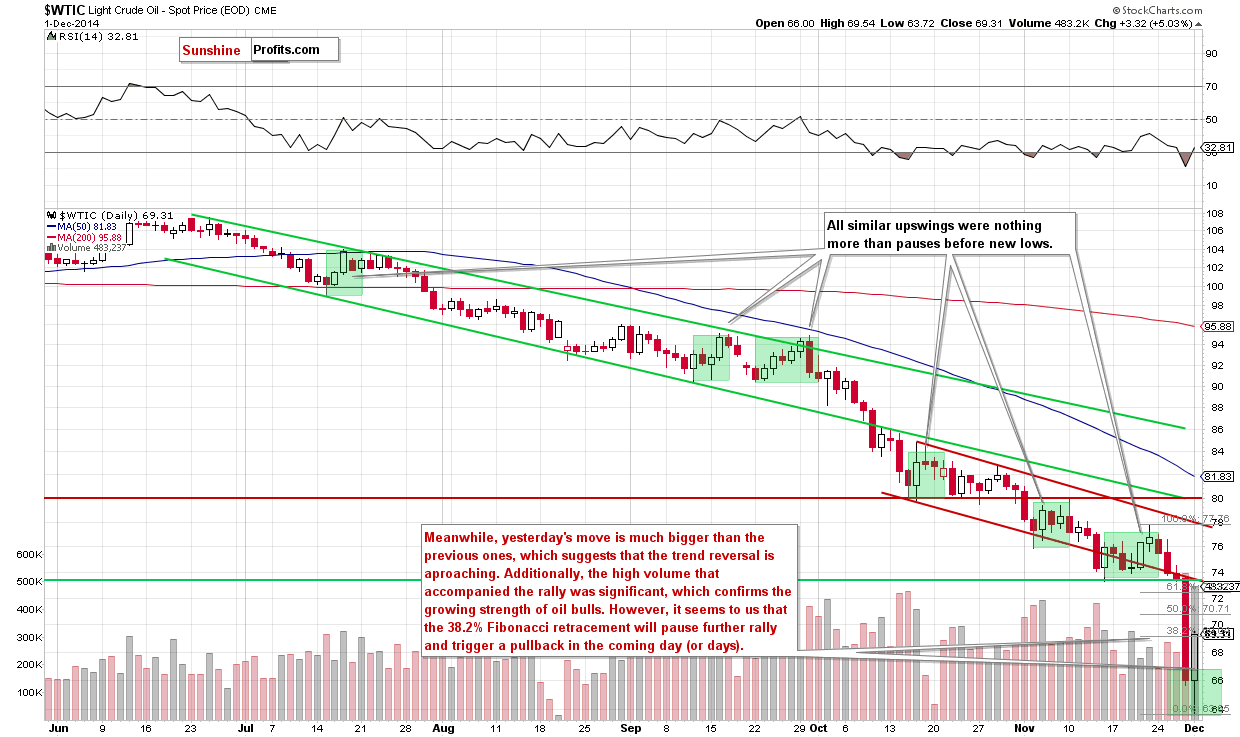

(…) Nevertheless, as long as there is no increase of (at least) $5.5 dollar, which won’t be followed by a fresh multi-year low, we do not recommend opening long positions. Why just such an increase is so important? Because since mid-Jul all smaller corrective upswings were nothing more than stops before new lows. Therefore, until we see stronger bulls, long positions are not justified from the risk/reward perspective.

As you see on the daily chart, yesterday’s upswing was much bigger ($5.82) than the previous ones, which is the second positive step toward the trend reversal. Additionally, the volume that accompanied the rally was significant, which confirms the growing strength of oil bulls. Nevertheless, we should keep in mind that the commodity reached the 38.2% Fibonacci retracement based on the recent decline (launched on Nov 21), which will likely trigger a pullback later in the day (or even in the coming days).

Summing up, although yesterday’s rally was the largest upswing since mid-Jun and crude oil invalidated the small breakdown below the 61.8% Fibonacci retracement, it seems to us that the situation is still unclear to open long positions. Additionally, as we have pointed out before, the commodity reached the 38.2% Fibonacci retracement, which will likely trigger a pullback later in the day (or even in the coming days). Although such price action won’t be positive for the commodity, it could help us to identify whether the final bottom is already in or not.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts