Trading position (short-term; our opinion): Short positions are justified from the risk/reward perspective.

Although crude oil hit a fresh 2015 low after EIA weekly report, the commodity reversed and rebounded sharply as weaker greenback supported the price. As a result, light crude gained 5.33% and invalidated the breakdown under the Jan low. Is this as bullish signal as it seems at the first sight?

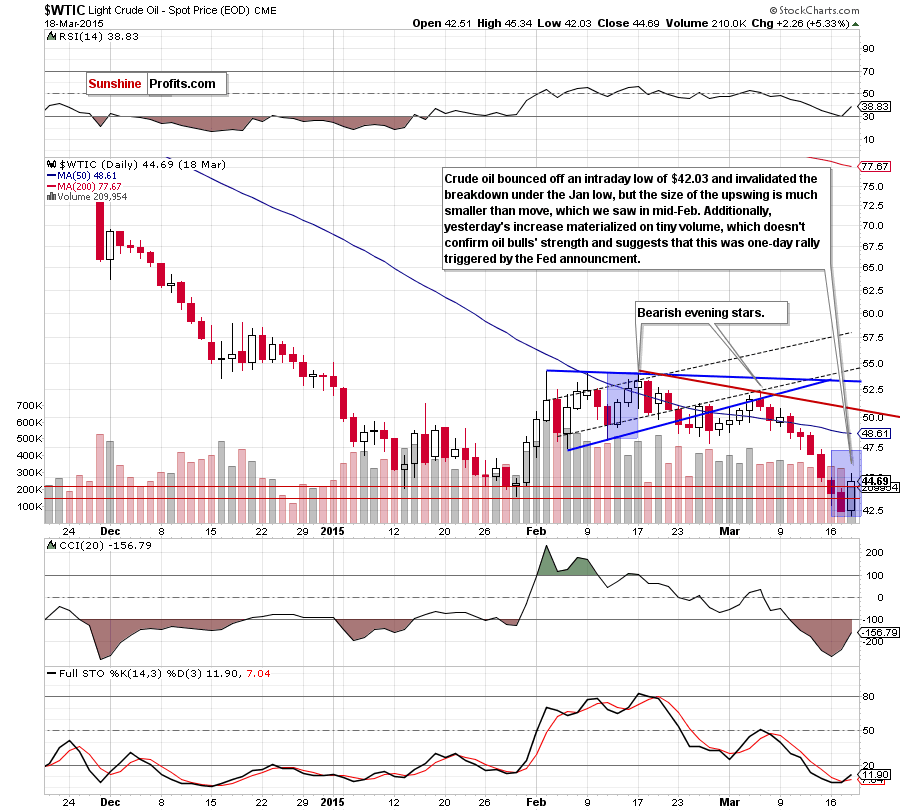

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories rose by 9.6 million barrels in the week ended March 13, compared to expectations for an increase of 3.8 million barrels. The report also showed that gasoline inventories decreased by 4.5 million barrels, while distillate stockpiles increased by 0.4 million barrels. Thanks to these bearish numbers, crude oil extended losses and dropped to a fresh 2015 low of $42.03. Despite this drop, light crude reversed and rebounded after the USD Index declined sharply below the barrier of 100 and reached an intraday low of 94.77, making crude oil more attractive for buyers holding other currencies. In these circumstances, crude oil shoot up, climbing to an intraday high of $45.34. Did this rally is as bullish as it seems at the first sight? (charts courtesy of http://stockcharts.com).

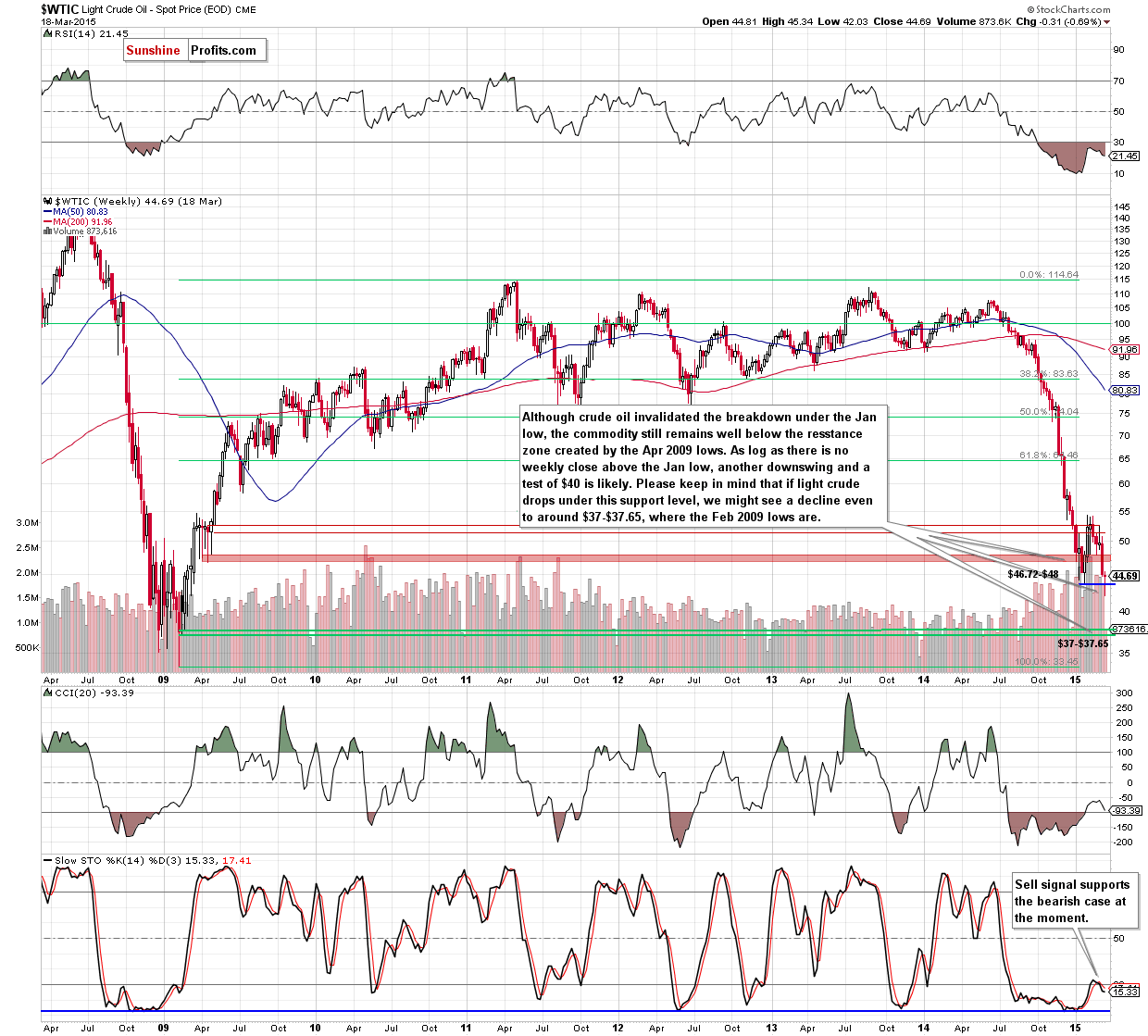

Looking at the above chart, we see that crude oil rebounded and invalidated the breakdown under the Jan low, which is a positive signal. Nevertheless, we should keep in mind that the commodity is still trading well below the resistance zone created by the Apr 2009 lows. Therefore, we believe that as long as there is no weekly close above the Jan low another downswing and a test of $40 is likely.

Are there any short-term factors that could support or hinder the realization of this scenario? Let’s examine the daily chart and find out.

From this perspective, we see that crude oil bounced off an intraday low of $42.03 and invalidated the breakdown under the Jan low. However, the size of the upswing is much smaller than the move, which we saw in mid-Feb (both moves marked with blue). Additionally, yesterday’s increase materialized on tiny volume, which doesn’t confirm oil bulls’ strength and suggests that this was only one-day rally triggered by the Fed announcement.

Taking the above into account, and combining it with the medium-term picture, we think that lower values of the commodity are still ahead us (especially when we factor in fundamental factors , which continue to weigh). If this is the case, the initial target for oil bears will be yesterday’s low and then the barrier of $40.

Summing up, short positions are still justified from the risk/reward perspective as the commodity is still trading well below the Apr 2009 lows (not to mention the major resistance zone around $54-$54.50). Although crude oil rebounded and invalidated the breakdown under the Jan low, the size of the volume doesn’t confirm oil bulls’ strength, suggesting another pullback and lower values of light crude in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Short positions with a stop loss order at $46.10 (and price target at $37.70) are justified from the risk/reward perspective. We will keep you informed should anything change.

On an administrative note, please note that there will be no Oil Trading Alerts next week. Nevertheless, tomorrow, we’ll include scenarios of what could happen in the coming days because we want you to be better prepared for upcoming price moves. The alerts will be posted normally the week after (beginning Monday, March 30). Thank you for your understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts