Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective.

On Wednesday, crude oil gained 2.06% after bullish the EIA weekly report on domestic inventories. As a result, the commodity invalidated the breakdown below two support/resistance levels and approached the previous lows. Will it be enough to change oil investors’ attitude and trigger a rally?

Yesterday, the U.S. Energy Information Administration reported that U.S. crude oil inventories rose by 0.5 million barrels in the week ended October 31, beating expectations for a gain of 1.9 million barrels. Additionally, gasoline inventories decreased by 1.4 million barrels (below forecasts for a decline of 1.0 million barrels), while distillate stockpiles fell by 0.7 million barrels. These bullish numbers fueled expectations for higher demand for fuel and energy and pushed the commodity to an intraday high of $79.35.

On top of that, reports of a fire on a Saudi Arabian pipeline sparked concerns over supply disruptions and supported the price as well. Did these factors change the overall picture of crude oil? (charts courtesy of http://stockcharts.com).

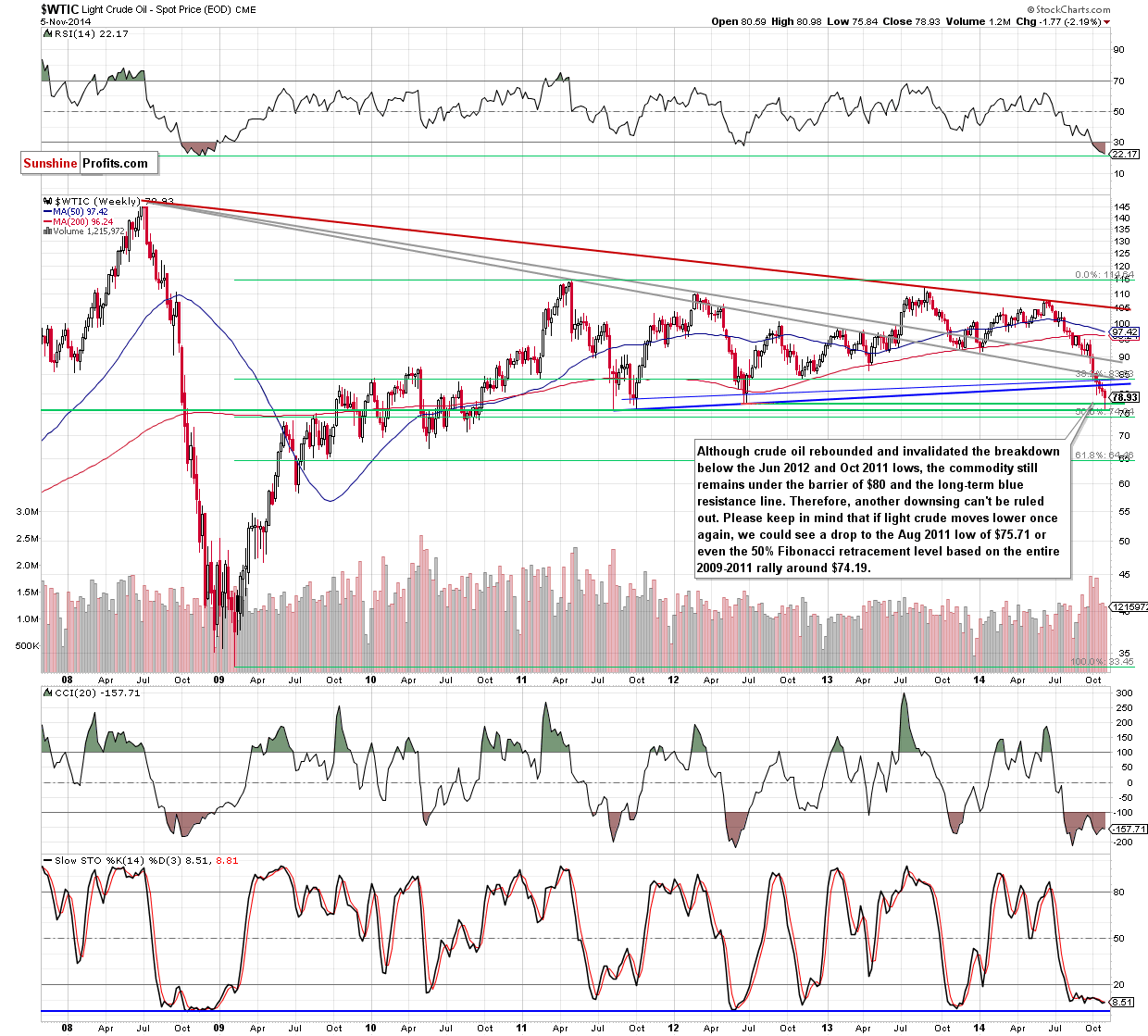

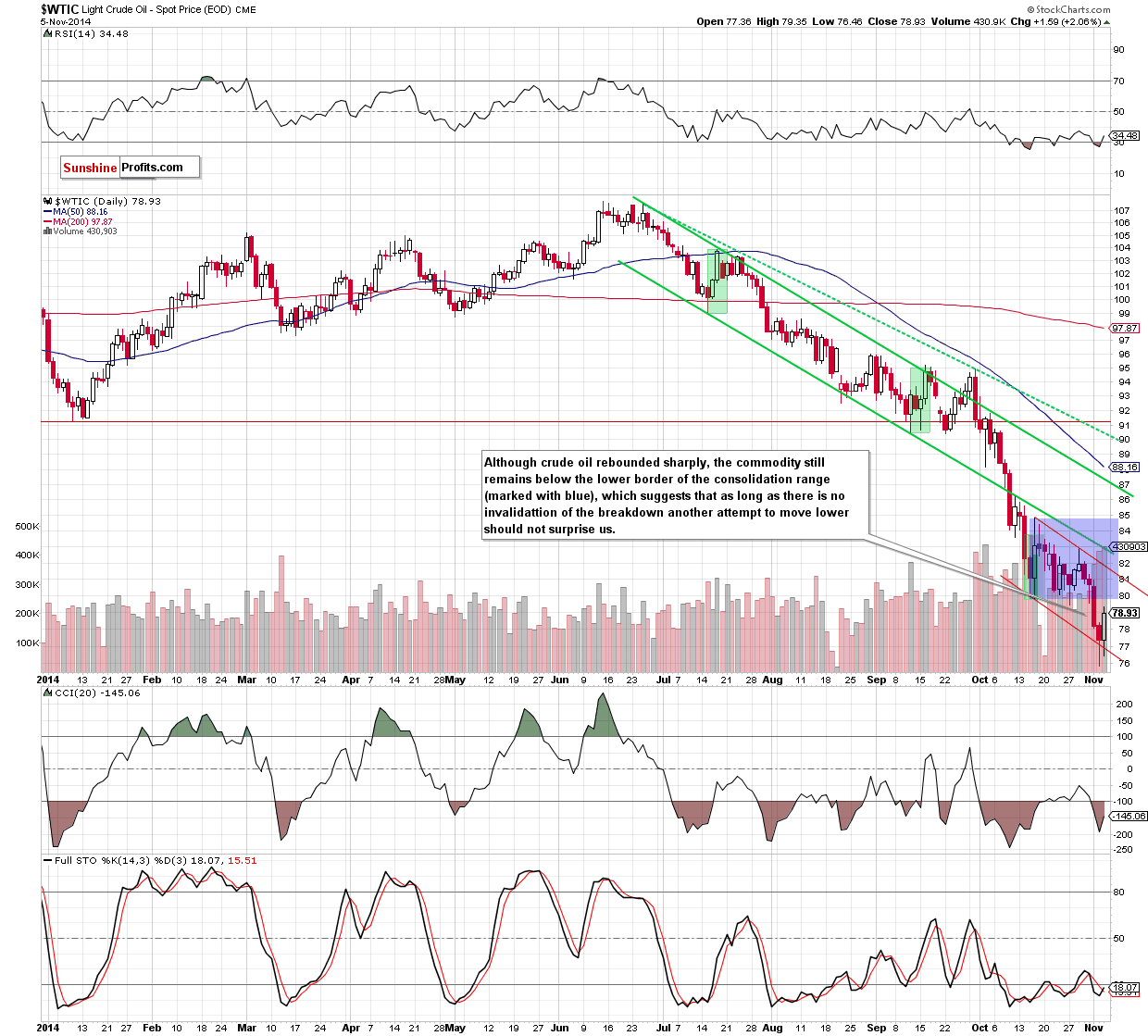

Looking at the above charts, we see that crude oil rebounded sharply and invalidated the breakdown below the Oct 2011 and Jun 2012 lows. Although this is a positive sign, the commodity still remains under the previous lows, the barrier of $80 and the long-term blue resistance line. Therefore, as long as there is no invalidation of the breakdown below these levels, another attempt to move lower should not surprise us. If this is the case, and light crude declines once again, we’ll see a test of the strength of Tuesday’s low in the coming days. What could happen if it doesn’t withstand the selling pressure? We think that the best answer to this question will be our last commentary:

(…) taking into account the (…) breakdown below the lower border of the consolidation, it seems that crude could drop even to around $75, where the size of the downward move will correspond to the height of the formation. At this point, it’s worth noting that below this level there is also the 50% Fibonacci retracement based on the entire 2009-2011 rally (at $74.19), which together create a solid support zone.

Summing up, although crude oil rebounded sharply, the commodity still remains below the solid resistance zone, which could trigger another downswing in the coming days. Nevertheless, taking into account the fact that the space for further declines seems limited, we suggest opening long positions when crude oil drops to $75.82 with a stop-loss order at $73.47.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts