On Friday, crude oil was trading in a narrow range as investors remained confused. On one hand, a U.S. inventories report pushed the price lower, but on the other hand, Janet Yellen’s comments gave oil a boost. Finally, light crude lost 0.19% and closed the day slightly below $94 once again.

As we wrote in our previous Oil Trading Alert, there were two major factors which had an impact on light crude on Thursday. First of them was a bearish U.S. Energy Information Administration (EIA) weekly report, which showed a much-larger-than-expected rise in U.S. crude inventories and pushed light crude to its new monthly low. The second one was a bullish comment by Janet Yellen, who put to rest expectations that the Fed may announce plans to scale back stimulus tools at its December meeting. As a reminder, this commentary resulted in a sharp pullback in light crude and pushed the price above $94.

Looking at Friday's price action, we can assume that these factors also had an impact on crude oil during the last session of the week. It seems that oil investors remained confused and tried to puzzle out the impact of these two conflicting factors on future light crude’s moves.

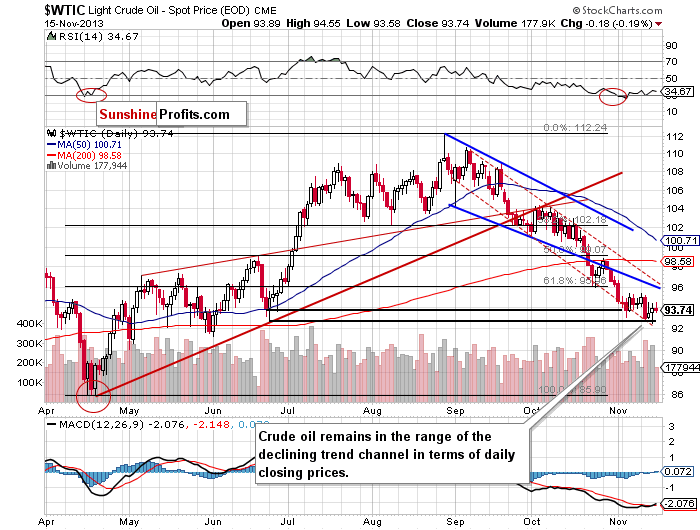

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

As you can see on the above chart, the situation hasn’t changed much. On Friday, after the market open crude oil moved higher and reached its daily high of $94.55. However, this improvement was only temporary and light crude declined in the following hours to its daily low of $93.58. Despite this drop, crude oil remains in the range of the declining trend channel in terms of daily closing prices (marked with the red dashed line).

The nearest support is the November low – slightly below the bottom of the corrective move that we saw in June (in terms of intraday lows). The next one is the lower border of the declining trend channel (currently around $92).

The first resistance level is the Nov. 11 high, which is slightly below the lower border of the declining trend channel in terms of intraday lows (marked with the blue bold line).

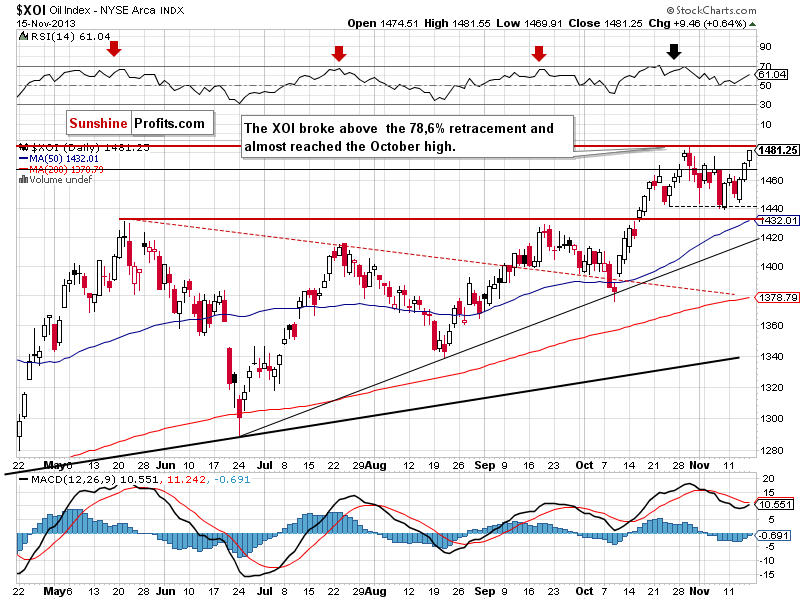

Once we know the current situation in crude oil, let’s move on to the XOI daily chart.

Quoting our previous Oil Trading Alert:

(...) the oil stock index broke above the 78.6% Fibonacci retracement level once again. If the breakout is not invalidated, we will likely see a continuation of the recent upswing. Please note that the nearest resistance level is the Nov. 6 high at 1,476 and the next one is the 2013 high.

As you can see on the above chart, on Friday after the market open the XOI pulled back and hit its daily low at 1,469. In spite of this drop, buyers didn’t give up and pushed the oil stock index higher in the following hours once again. In this way, the XOI almost reached the 2013 high and closed the day slightly below this level.

Looking at the above chart, we can mark a candlestick pattern, which is quite similar to a bearish advanced block. Although Friday’s candlestick didn’t open within the previous body, we have three consecutive white days with higher closes and smaller bodies each day, which is not as bullish as it might seem at first glance. Taking the above into account, we may see a double top. On the other hand, if the buyers manage to break above the 2013 high, we will likely see further growth to 1,495, where the upper line of the rising wedge is.

Keep in mind that the nearest support zone is created by Wednesday’s low and the bottom of the recent corrective move (between 1,439 and 1,444).

Summing up, the situation hasn’t changed much and crude oil still remains in the declining trend channel in terms of daily closing prices and the long-, medium- and short-term support levels are still in play.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the medium- and short-term picture, we do not suggest opening any positions.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts