Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil moved lower after yesterday’s market’s open, oil bulls didn’t give up and pushed the black gold higher in the following hours. Thanks to their action, light crude gained 1.20% and approached the barrier of $50. Will we see a breakout above this important resistance in the coming days?

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com)

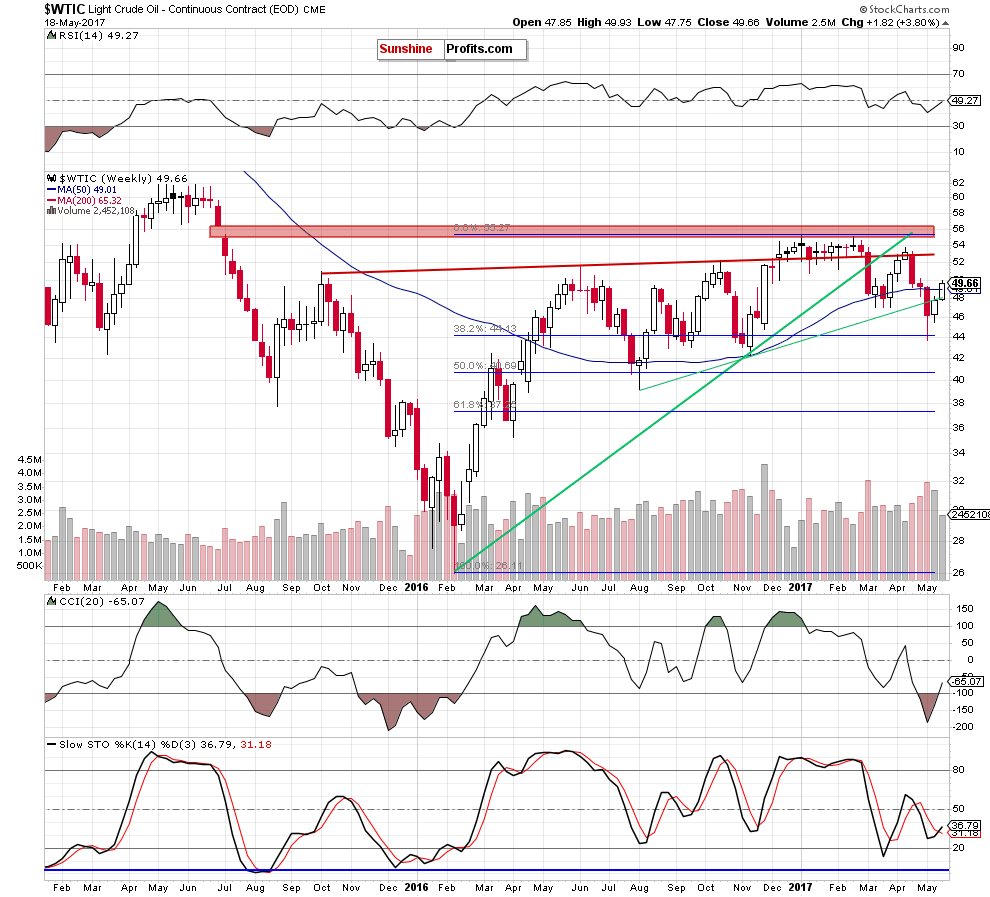

The first thing that catches the eye on the weekly chart is a comeback above the previously-broken 50-week moving average. Thanks to this increase crude oil invalidated the earlier breakdown, which together with the buy signals generated by the indicators suggests further improvement.

How high could the black gold go in the coming days? Let’s examine the very short-term picture of the commodity and find out.

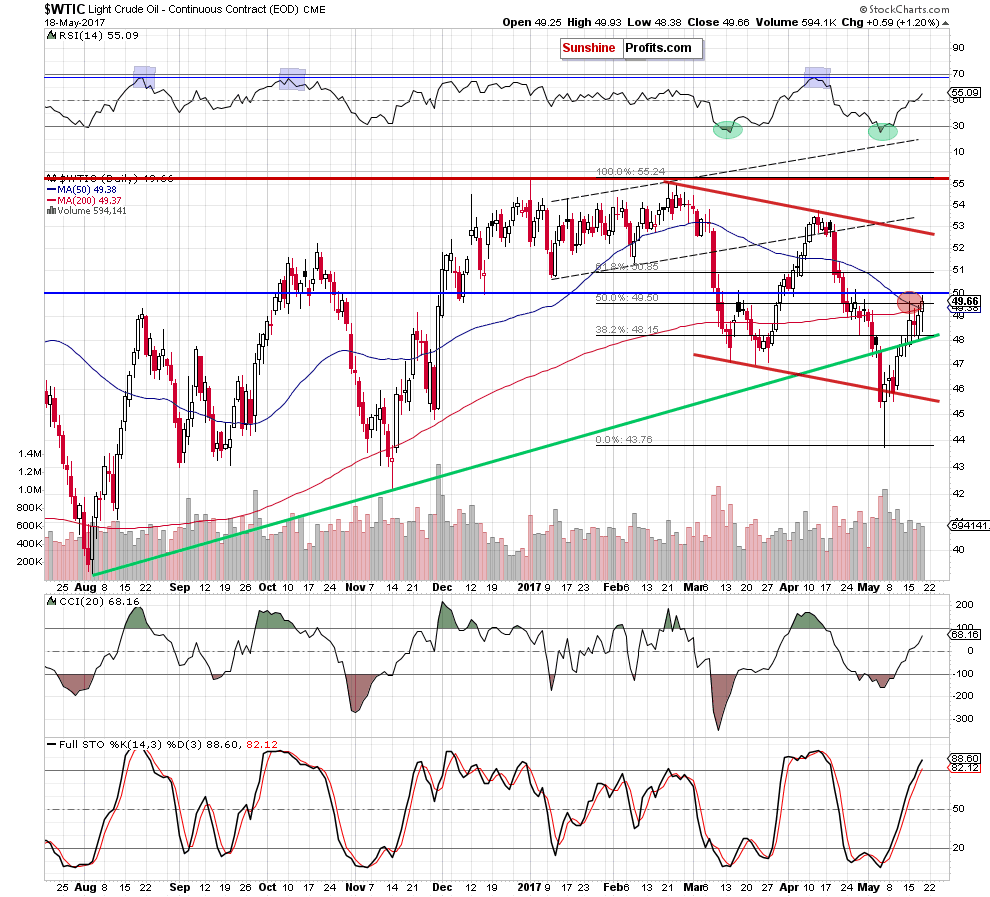

Looking at the daily chart, we see that although crude oil declined after the market’s open the proximity to the long-term green support line and the buy signals generated by the indicators encouraged oil bulls to act.

As a result, the commodity extended gains and came back to the red resistance zone. However, this time the black god closed the day above the 50- and 200-day moving averages, which together with the breakout above the 50% Fibonacci retracement suggests a test of the barrier of $50 later in the day.

If this resistance is broken, the next upside target for oil bulls will be around $50.85, where the 61.8% Fibonacci retracement based on the entire February-May downward move is.

Summing up, crude oil extended gains and broke above two important moving averages and the 50% Fibonacci retracement, which suggests (at least) a test of the barrier of $50 later in the day.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts