Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil extended gains and hit a fresh 2016 high as bigger-than-expected drop in crude oil inventories and another decline in domestic production supported the price of the commodity. In this environment, light crude gained 2.60% and closed the day above the May high. Will we see black gold above $50?

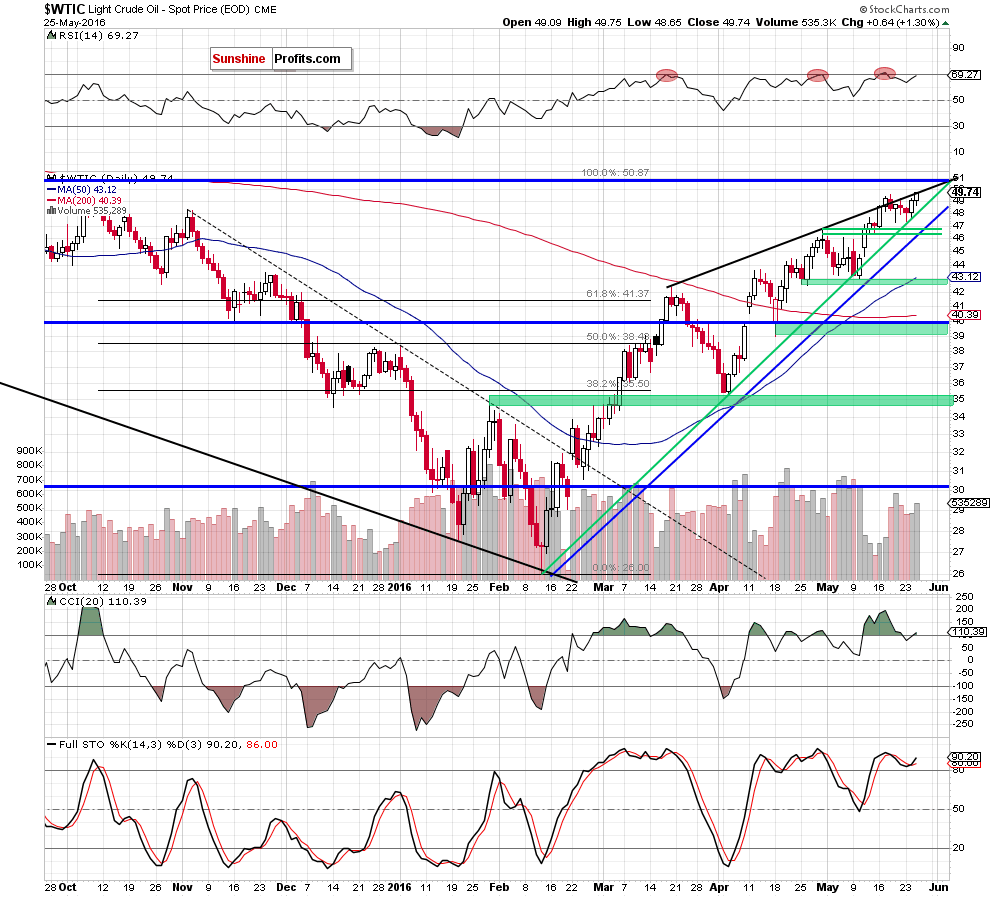

Although the U.S. Energy Information Administration reported that gasoline stockpiles rose by 2.04 million barrels in the week ending on May 20, the report also showed that crude oil inventories dropped by 4.2 million barrels and distillate fuel inventories decreased by 1.28 million barrels. Additionally, stockpiles in Oklahoma dropped by 649,000 on the week, beating expectations for a draw of 400,000. On top of that, production declined by 24,000 barrels per day to 8.791 million bpd, reaching lows from September, 2014. Thanks to these circumstances, light crude extended gains and closed the day above the May high. Will we see black gold above $50? Let’s examine the daily chart and find out what can we infer from it (charts courtesy of http://stockcharts.com).

On the daily chart, we see that although crude oil declined after the market’s open, the commodity reversed and rebounded in the following hours. With this upward move, light crude broke above the May 18 peak, hitting a fresh high and reaching the black resistance line (based on the Mar and Apr highs) once again. What’s next? Taking into account the fact that the commodity closed the day slightly below in intraday high and above the May peak, bigger volume than day before and invalidation of sell signals generated by the CCI and Stochastic Oscillator, it seems that black gold will test the barrier of $50 and the Oct high in the coming day(s).

Summing up, crude oil reversed and rebounded once again, reaching the black resistance line (based on the Mar and Apr highs) and breaking above the May peak, which suggests that we may see a test of the barrier of $50 and the Oct high in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts