Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Wednesday, crude oil gained 1.25% as better-than-expected U.S. new home sales data and the EIA bullish report, which showed that domestic oil supplies unexpectedly fell last week, supported the price. Thanks to these circumstances, light crude extended rally and reached its key-resistance line. What’s next?

Yesterday, official data showed that U.S. new home sales data rose 18.0% in August to 504,000 units, beating expectations for a 4.4% gain (it’s worth noting that it was the highest level since May 2008. Additionally, later in the day, the U.S. Energy Information Administration showed in its report that crude oil inventories plunged by 4.3 million barrels last week, beating market’s expectations for a build of 386,000. Thanks to these bullish numbers, crude oil rallied above $93 per barrel for the first time since Sep 18. Will we see further improvement? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

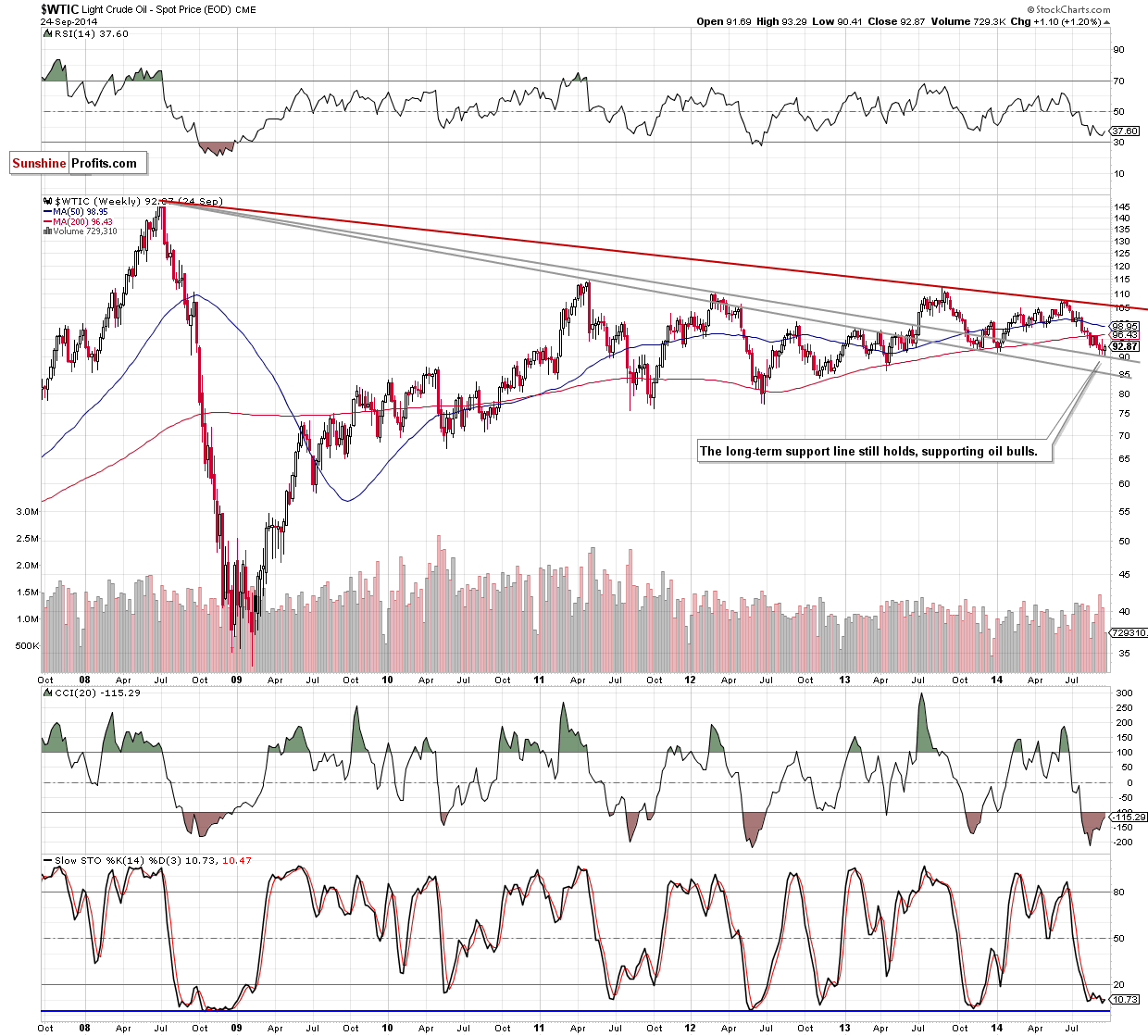

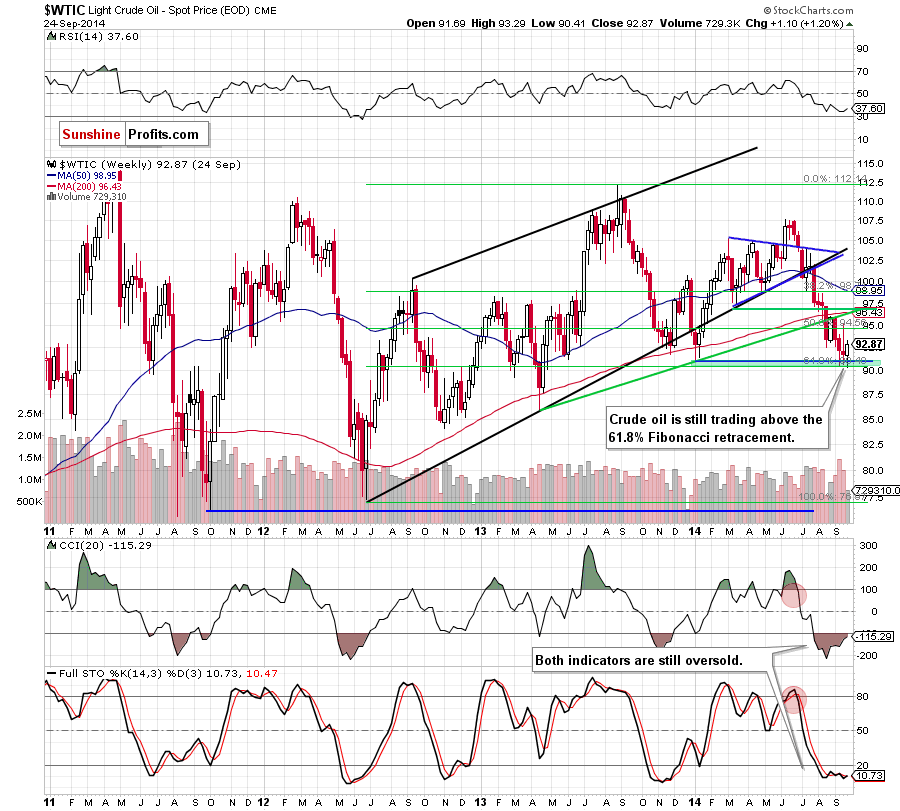

Looking at the above charts we see that the situation in the medium term improved as crude oil bounced off the strong support zone created by the long-term declining support line and the 61.8% Fibonacci retracement. What impact did this increase have on the very short-term picture? Let’s check.

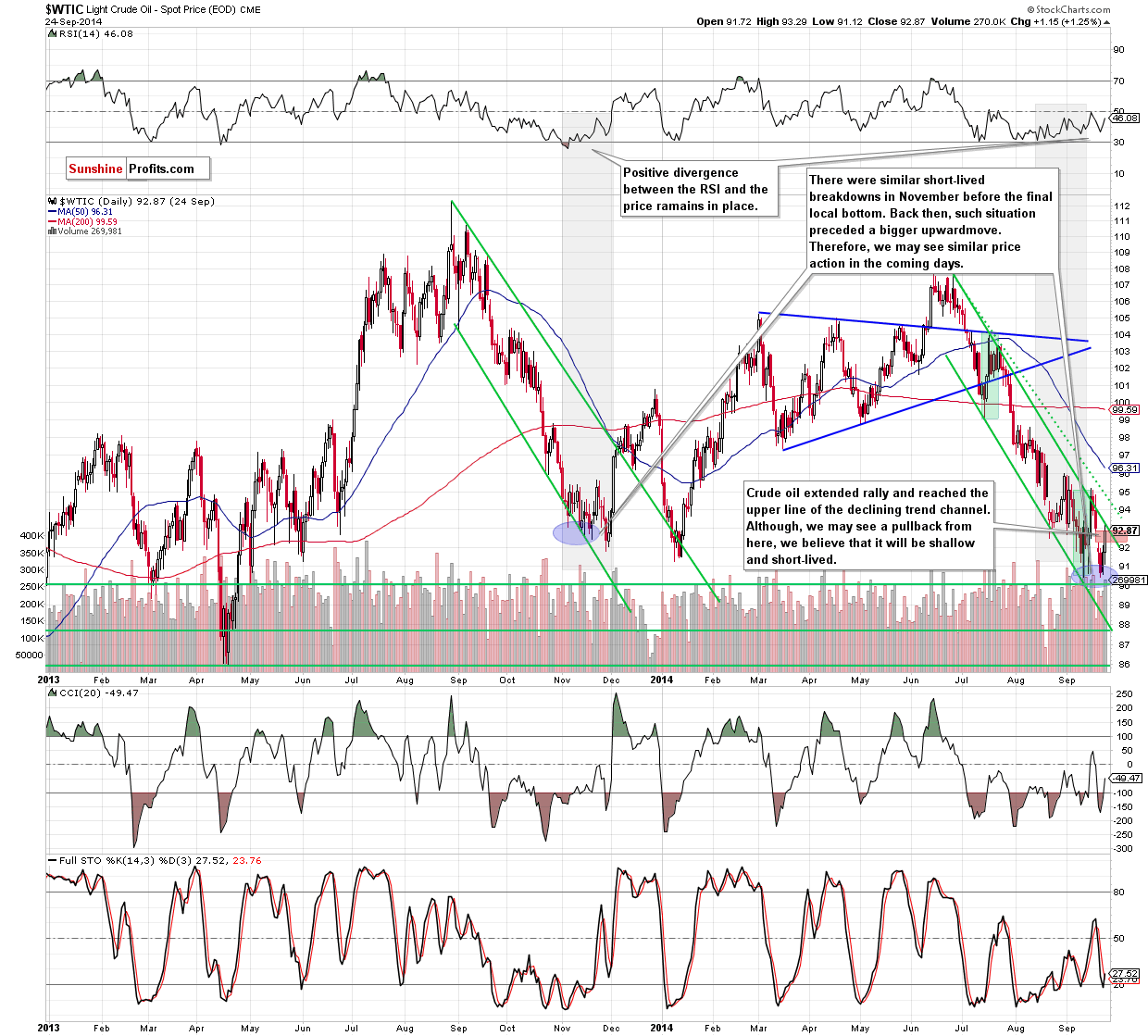

The above chart clearly shows that the very short-term picture has improved as crude oil extended rally (as we expected) and closed a bearish gap (marked with red). Additionally, yesterday’s move materialized on huge volume (especially when we compare it with the volume that we saw in the recent days), which confirms the real direction in which the commodity is heading. On top of that, the CCI and Stochastic Oscillator generated buy signals, supporting the bullish case. All the above provides us with bullish implication and suggests further improvement. Nevertheless, we should keep in mind that yesterday’s upswing took light crude to the upper line of the declining trend channel, which serves as the key resistance line. Therefore, a shallow and short-lived pullback from here should not surprise us. Please note that, if the commodity breaks above the nearest resistance line (which is, in our opinion, more likely than not), the initial upside target will be the last week’s high of $95.19.

Summing up, we are convinced that keeping long positions is still justified from the risk/reward perspective as a bearish gap between Sep 18 and Sep 19 was closed. Taking this positive fact into account and combining it with buy signals generated by the indicators, we still believe that the next bigger move will be to the upside. In our opinion, the rally will accelerate, if the commodity breaks above the key resistance line in the coming day (or days).

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts