Trading position (short-term; our opinion): No positions.

On Wednesday, crude oil lost 1.43% as the combination of the speculations the OPEC will not cut output to support the market and disappointing U.S. data weighed on investors’ sentiment. In this environment, light crude hit a fresh multi-year low and dropped to the barrier of $80 per barrel. Where are oil bulls?

Yesterday, the Census Bureau showed that U.S. retail sales fell 0.3% last month, while core retail sales (without motor vehicles and parts) dropped 0.2% in September. Additionally, U.S. producer price inflation slipped 0.1% in September, missing expectations for a 0.1% rise. On top of that, the Federal Reserve of New York reported that its manufacturing index dropped to a six-month low of 6.2 in October from 27.5 in September. Although these bearish numbers pushed the greenback lower, making crude oil more attractive among investors holding other currencies, they also raised concerns over the U.S. economic outlook and the impact on future oil demand prospects.

Additionally, Kuwait cut official selling prices to Asian buyers in an effort to retain its market share, following similar moves from core OPEC members Saudi Arabia, Iraq and Iran, which fuelled speculations the OPEC will not cut output to support the market as it has in the past and pushed the price lower as well. How low could the commodity go? (charts courtesy of http://stockcharts.com).

Quoting our yesterday’s Oil Trading Alert:

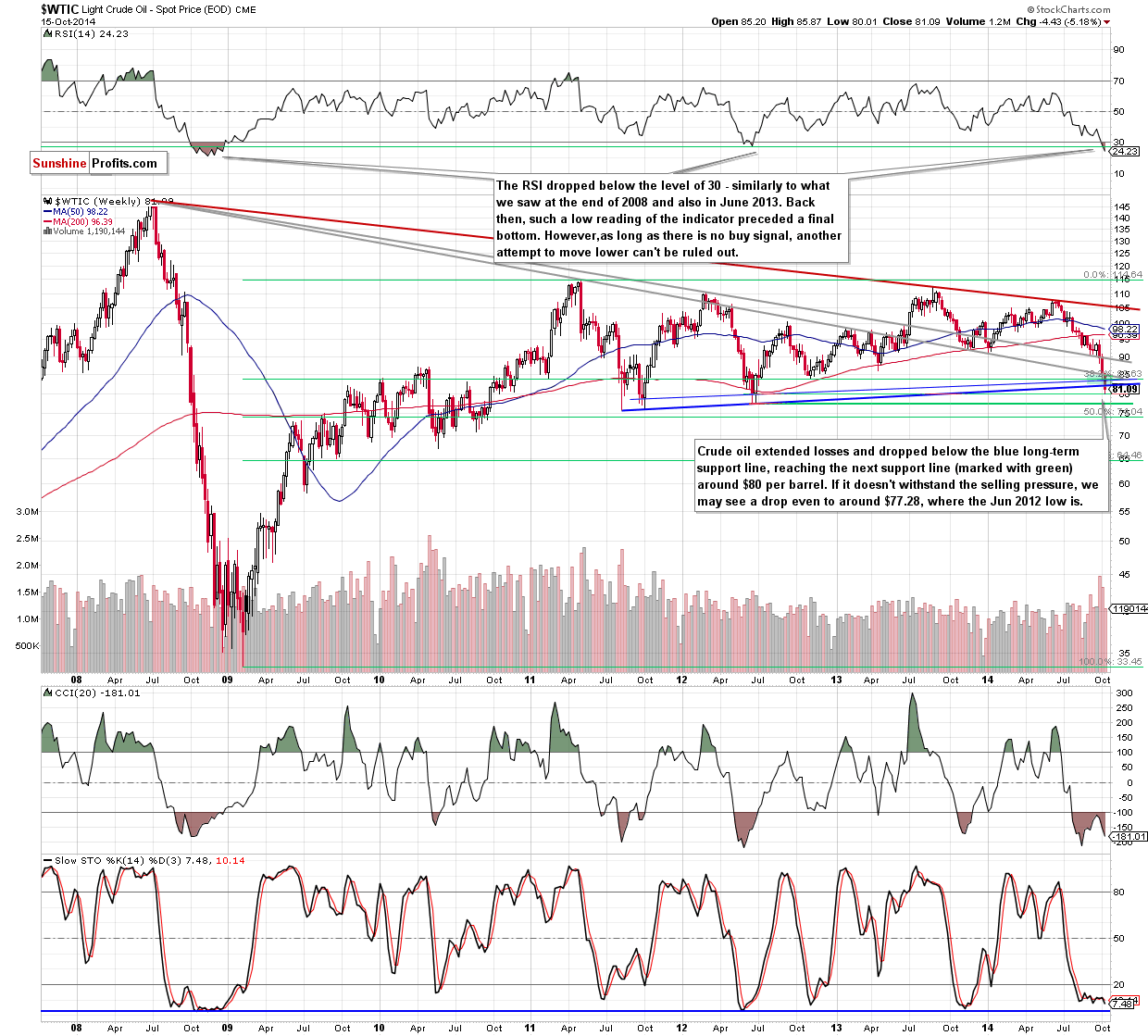

(…) we should take into account the possibility of further declines. How low could the commodity go? As you see on the above chart, the initial target for oil bears would be around $80 per barrel, where the next support line is.

Looking at the weekly chat, we see that oil bears realized the above-mentioned scenario as crude oil hit a multi-year low of $80.01 yesterday. As you see, the commodity rebounded slightly from here, but similarly to what we wrote in our last commentary, this move is too small to conclude that the situation has improved in any way (even in the very short term). Therefore, we should consider two scenarios. On one hand, if this support line encourages oil bulls to act, we could see a bigger corrective upswing from here. In this case, initial upside target would be around $84, where the previously-broken lower long-term grey line is. On the other hand, if the commodity moves lower, we could see a drop even to $77.28, where the Jun 2012 low is. Which scenario is more likely? Although from the technical point of view both sides of the market (bulls and bears) have more or less equal chances, it seems to us that the key driver of today’s changes will be the EIA weekly report. If it shows a decline in crude oil inventories (or at least a smaller increase than forecasts), we’ll likely see an attempt to realize the bullish scenario. However, if it disappoints market participants, the commodity could drop below the barrier of $80.

Summing up, the most important event of yesterday’s session was another breakdown below the long-term support line and a drop to the barrier of $80, which is a bearish signal. Therefore, another move lower can’t be ruled out. However, taking into account the proximity to the next support lines, the space for further declines seems limited. Nevertheless, as long as there are no signs (such as buy signals or invalidation of the key resistance zone) that the declines could be over, we think that staying on the sidelines and waiting for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts