Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Thursday, crude oil lost 2.73% as a stronger greenback and ongoing speculations over OPEC meeting pushed the commodity lower. In this environment, light crude slipped to the support line, but will it withstand the selling pressure in the coming days?

Yesterday, the U.S. Department of Labor reported that the number of initial jobless claims in the week ending May 30 declined by 8,000 to 276,000, beating analysts’ expectations for a 5,000 drop. Thanks to these positive numbers, the USD Index bounced off the session’s lows, supporting the greenback and making crude oil less attractive for buyers holding other currencies. As a result, light crude slipped to the support line, but will it withstand the selling pressure in the coming days? (charts courtesy of http://stockcharts.com).

Quoting our last Oil Trading Alert:

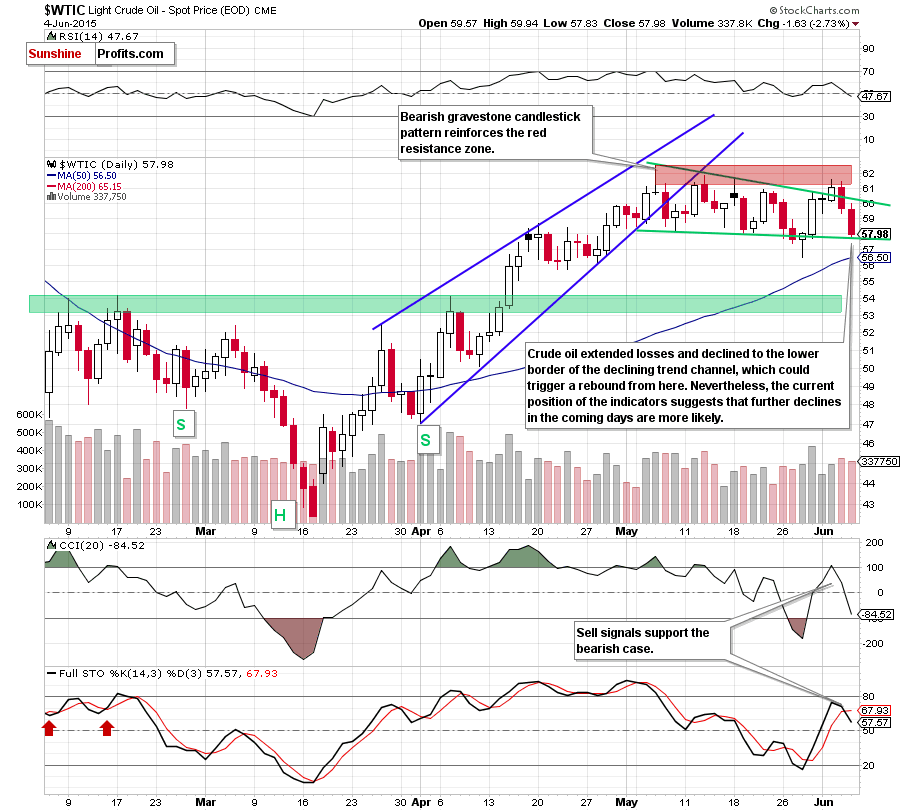

(…) light crude declined below the upper border of the green declining trend channel, invalidating earlier breakout, which is a bearish signal. Additionally, yesterday’s downswing materialized on higher volume than previous increases, which suggests that oil bears are getting stronger. On top of that, (…) the CCI generated a sell signal, while the Stochastic Oscillator is overbought, which could translate to a sell signal in the coming day(s).

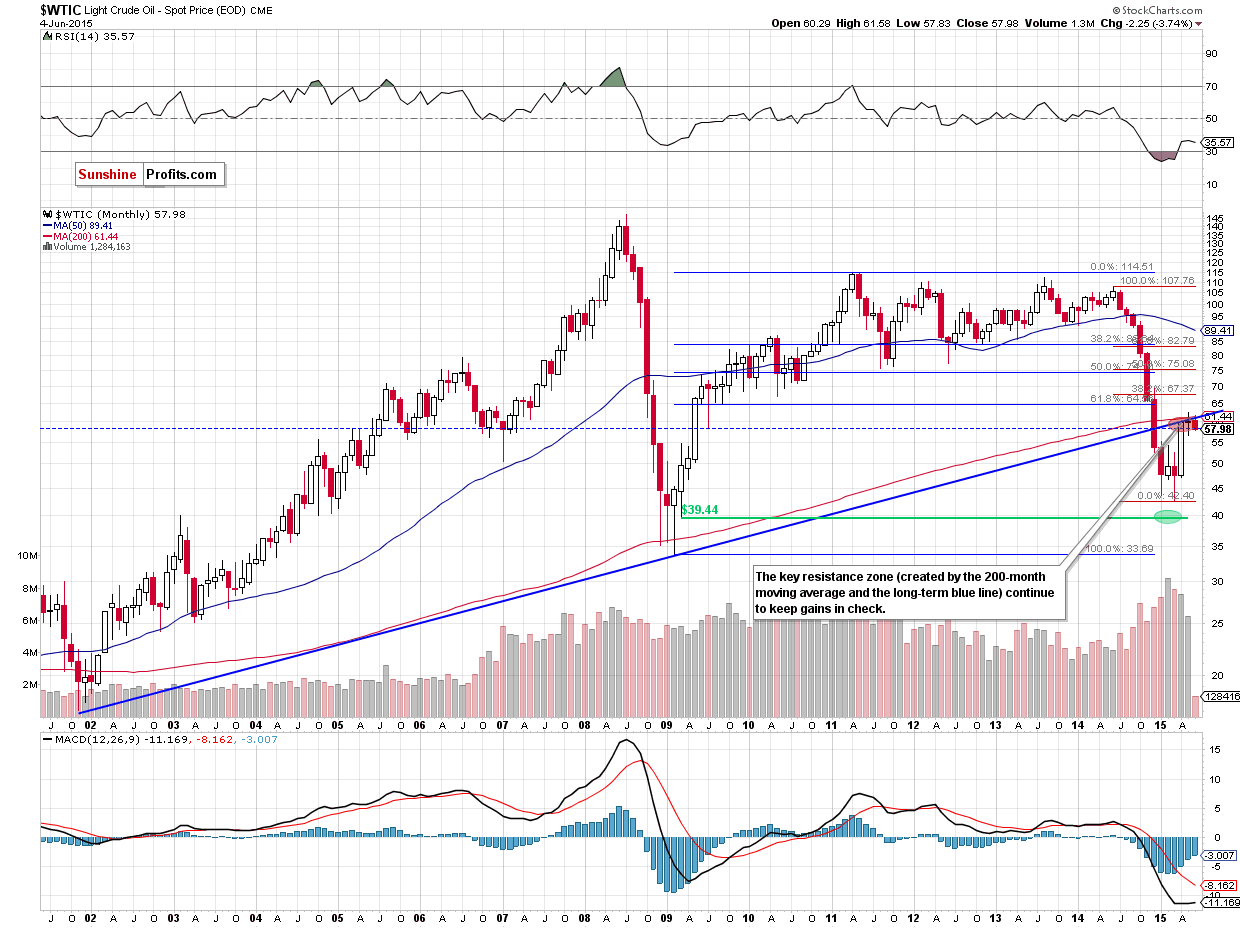

Taking all the above into account, and combining with the long-term picture, we believe that the next move will be to the downside. If this is the case, and crude oil moves lower from here, the initial downside target would be around $58, where the lower border of the green declining trend channel is.

Looking at the daily chart we see that the situation developed in line with the above scenario and crude oil reached our downside target. Although the commodity could rebound from here, we think that sell signals generated by the indicators in combination with the long-term picture will encourage oil bears to act. If this is the case, and the green support line is broken, we’ll see a test of the recent low of $56.51 (which is only slightly above the 50-day moving average at the moment) or even a drop to the green support zone (created by the Feb highs) in the coming day(s).

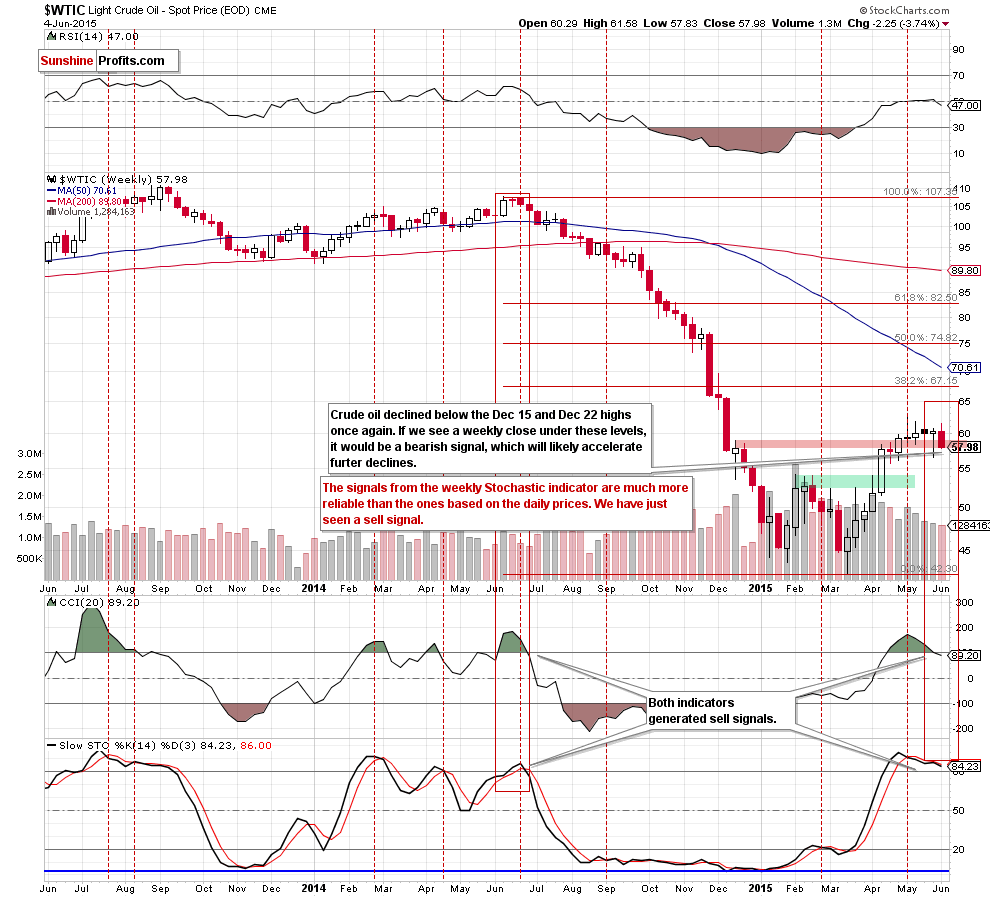

Finishing today’s Oil Trading Alert, let’s check what impact yesterday’s drop had on the medium-term picture.

From this perspective, we see that yesterday’s downswing took crude oil below the Dec 15 and Dec 22 highs, invalidating the breakout once again. Although we saw similar price action in the previous weeks, it seems that this time sell signals generated by the indicator will encourage oil bears to push the pair lower. If we see such price action and light crude closes the week below these levels, it would be a negative signal, which will likely accelerate further deterioration.

Summing up, crude oil extended losses and dropped to the lower border of the declining trend channel. Although the commodity could rebound from here, we think that the long- and medium-term picture in combination with sell signals generated by the indicators (daily and weekly) will trigger further deterioration in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts