Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Wednesday, crude oil lost 0.53% after the EIA showed in its weekly report that oil inventories fell less than expected in the week ended June 13. As a result, light crude extended its decline below the medium-term support line. Where the commodity head next?

Yesterday, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories decreased by 579,000 barrels in the week ended June 13, less than expectations for a decline of 650,000 barrels. Total U.S. crude oil inventories stood at 386.3 million barrels as of last week. The report also showed that gasoline supplies increased by 785,000 barrels, disappointing forecasts for a decline of 113,000 barrels, while distillate stockpiles rose by 436,000 barrels, above expectations for an increase of 250,000 barrels.

As we mentioned earlier, these disappointing numbers pushed light crude lower and the commodity finished the day slightly above $106. Where the commodity head next? Let’s check the technical picture of crude oil (charts courtesy of http://stockcharts.com).

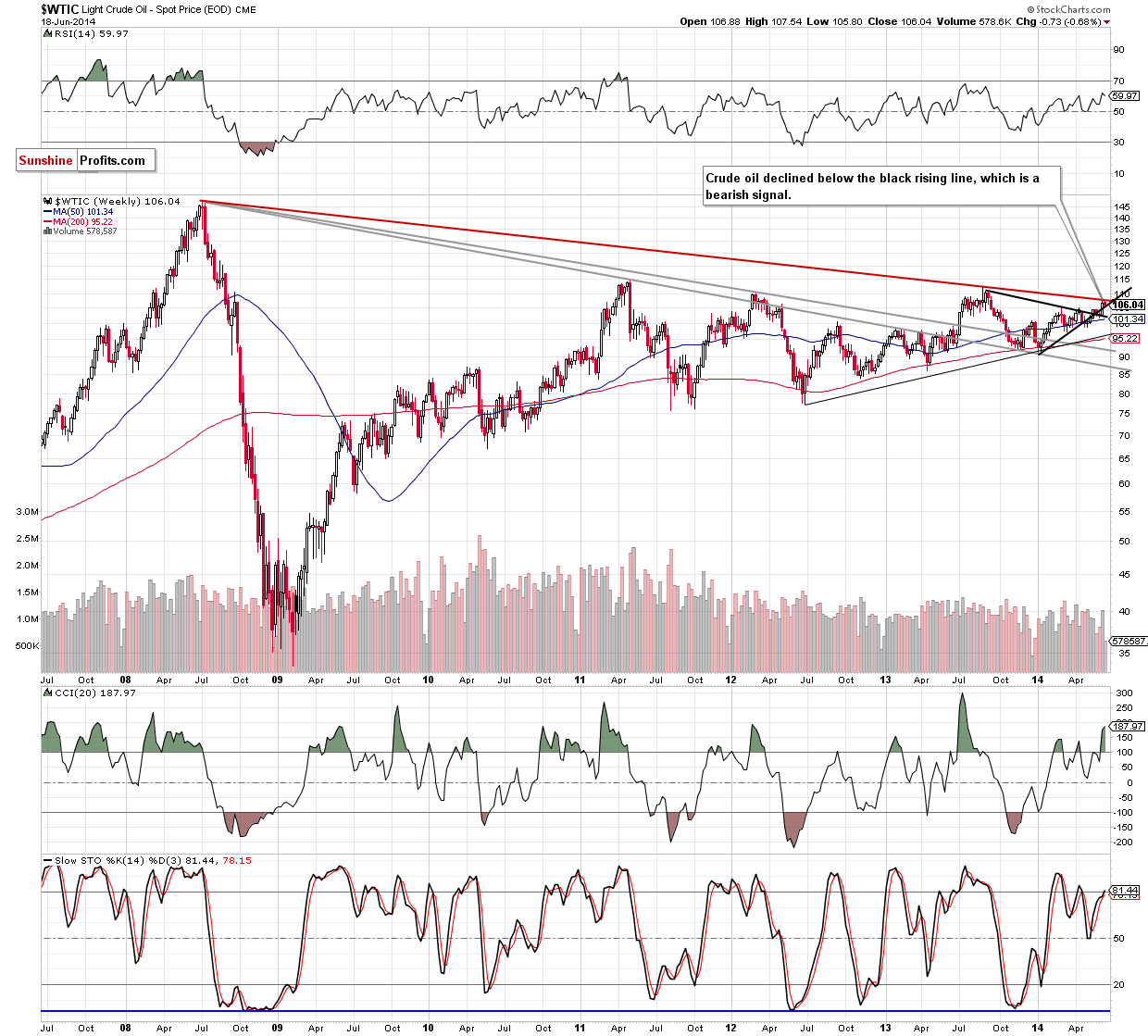

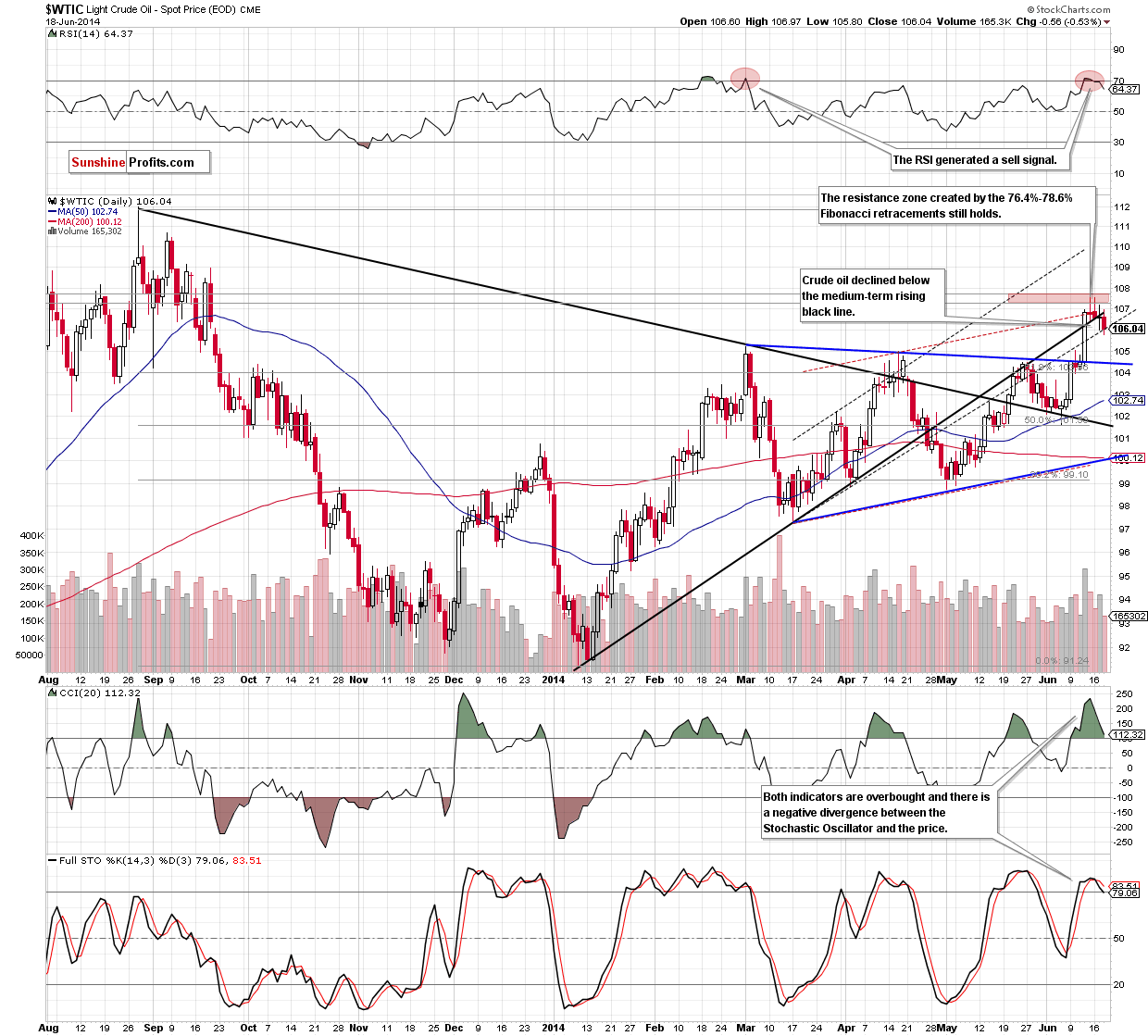

Looking at the above charts, we see that the situation has deteriorated as crude oil moved lower and closed the day below the rising black support line for the second day in a row. Taking this fact into account and combining with the current position of the weekly and daily indicators, what we wrote in our last Oil Trading Alert is up-to-date:

(…) the commodity declined under the medium-term black rising line, closing the day slightly below it. In our opinion, this is a bearish signal, which suggests further deterioration. We are convinced that the current correction will accelerate, if light crude drops under the black dashed support line (currently around $105.95) and the CCI and Stochastic Oscillator generate sell signals. In this case, the (…) downside target around $104.55 will be in play.

Summing up, we remain bearish as crude oil extended losses below the medium-term black line and moved away from the strong resistance zone created by the long-term declining line and two important Fibonacci retracement levels. In our opinion, we’ll see a realization of the above-mentioned bearish scenario in the coming day (or days).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts