Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil lost 1.23% as disappointing report on U.S. new homes sales overweighed bullish jobless claims data. As a result, light crude reversed once again and corrected most of Wednesday’s increase. Will we see something new in the near future?

Yesterday, the U.S. Department of Labor showed that the number of individuals filing for initial jobless benefits in the week ending July 19 declined by 19,000, while analysts had expected an increase by 5,000. Despite these bullish numbers, the U.S. Census Bureau report showed that new home sales dropped by 8.1%, missing expectations for a 5.3% decline and underlying weakness in the housing sector, which fueled worries that U.S. economy may demand less fuel and energy than anticipated. What impact did these fundamental factors have on the technical picture of crude oil? Let’s check (charts courtesy of http://stockcharts.com).

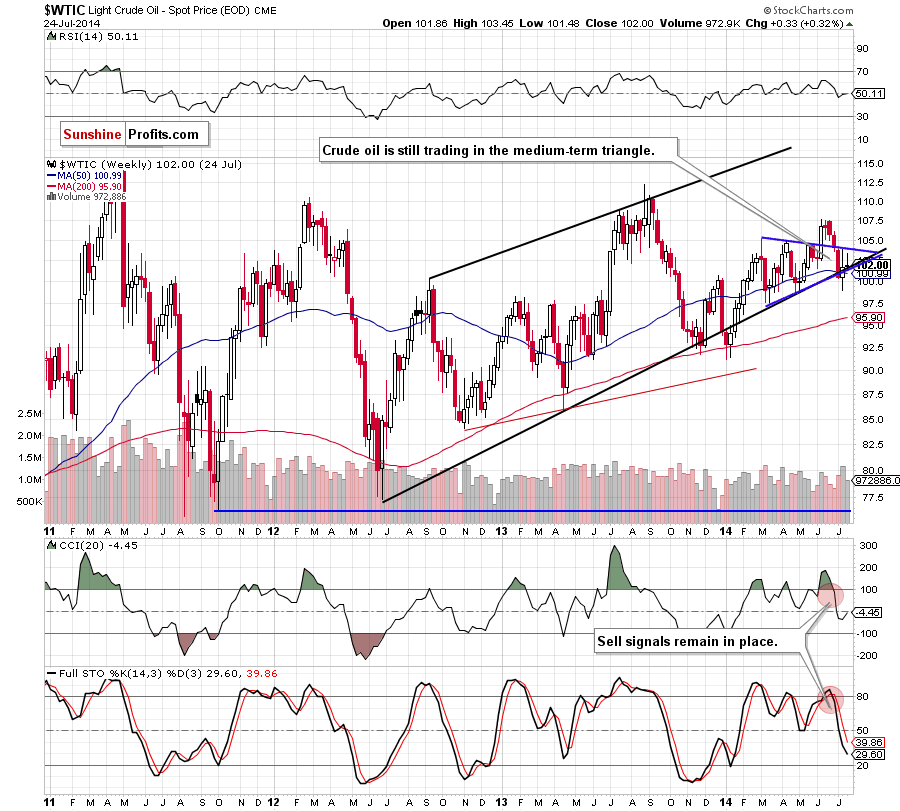

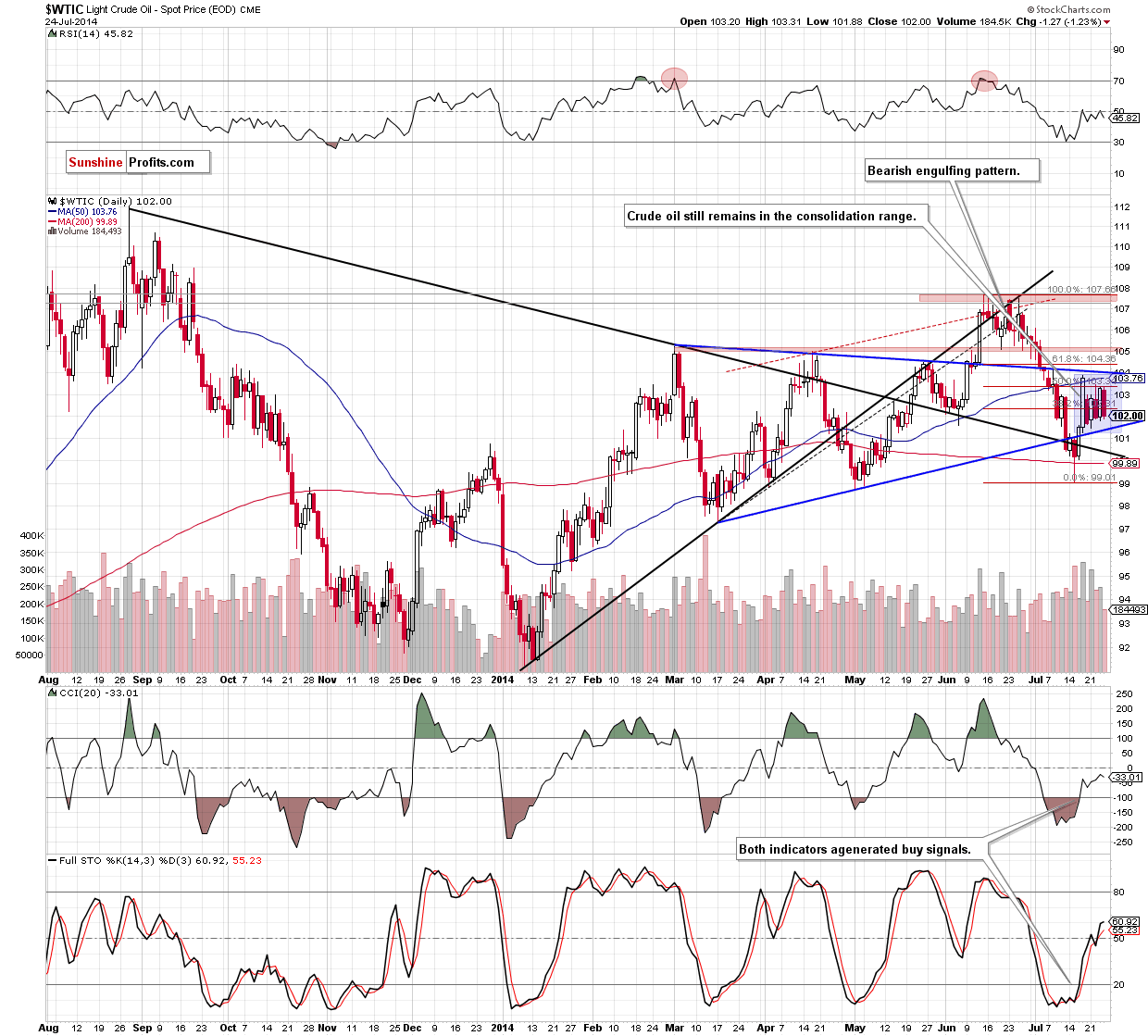

Looking at the above charts, we see that although crude oil moved lower and corrected all Wednesday’s increase, yesterday’s price action didn’t change the very short-term picture (not to mention the short- or medium-term outlook). Therefore, what we wrote in our previous Oil Trading Alert is up-to-date:

(...) We saw similar moves in the previous days and from today’s point of view we can summarize the recent week in one simple sentence: although a lot happened, nothing really has changed. (...) the commodity is still trading inside the Thursday’s candclestick between the strong support zone (created by the Thursday’s low and the blue support line) and the strong resistance area (based on the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonacci retracement). Nevertheless, we should keep in mind that buy signals generated by the indicators are still in play, which suggests that oil bulls may take their chance to improve the very short-term picture in the coming day (or days).

Summing up, just like we wrote in the recent days, yesterday’s price action didn’t change anything. Therefore, we remain convinced that as long as there is no breakout above the resistance zone or a breakdown below the support zone another sizable move is not likely to be seen. Opening any position at the moment is not justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts