Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

In today’s Oil Trading Alert we will focus on the most important perspective and the most timely question that oil traders are asking themselves today. These are: the long-term perspective and the question at what price level is the crude oil likely to finally bottom.

These issues are connected, as it is the long-term picture that provides the strongest support. Let’s take a closer look (charts courtesy of http://stockcharts.com).

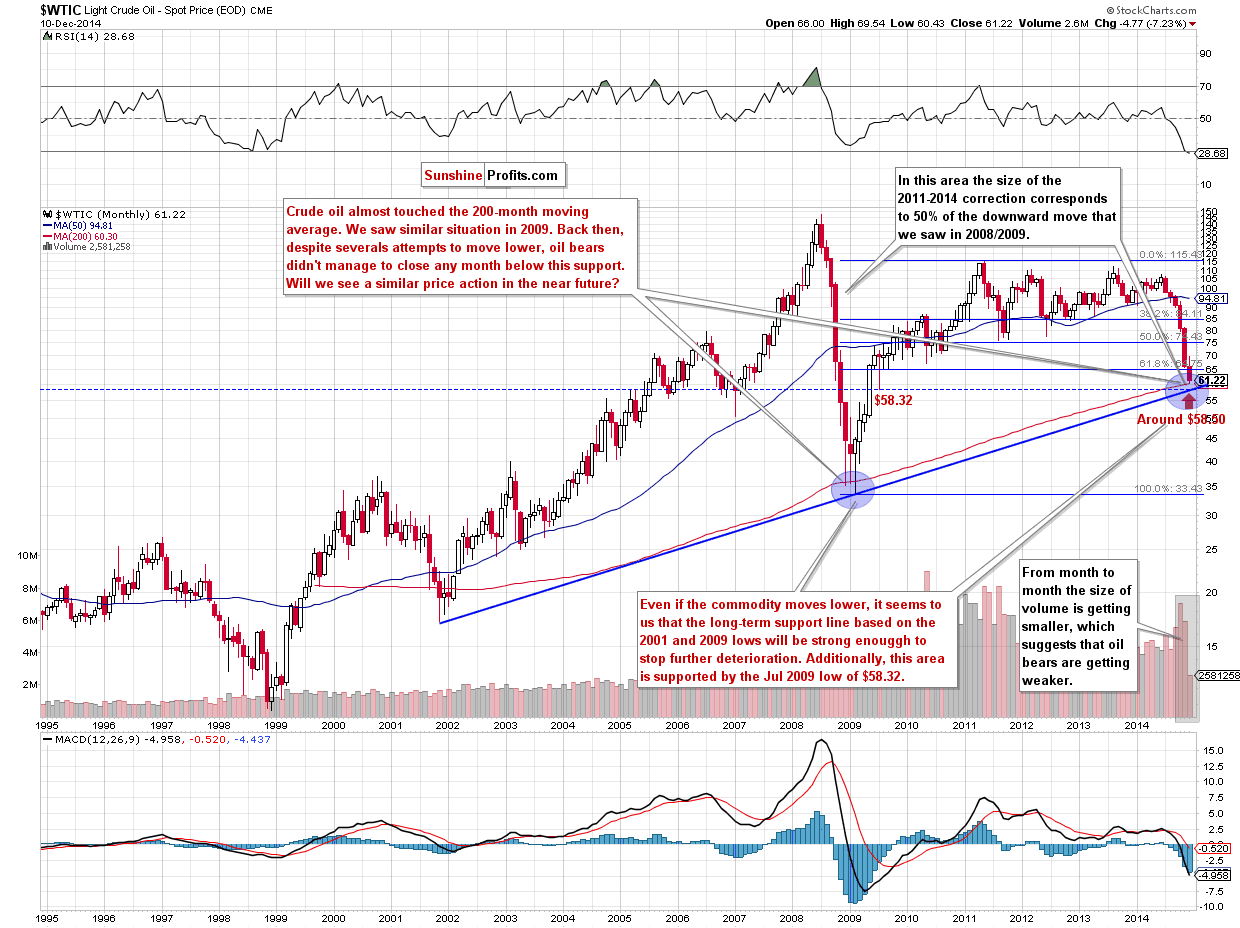

The long-term picture provides us with similar implications as it did yesterday. The rising long-term support line was not reached yet, so we could see some weakness in the following days, but the downside seems limited.

Our comments from the previous alert remain up-to-date:

If crude oil extends losses and brakes below the (…) support zone, we could see a drop even to around $58.32-$60, where the Jul 2009 lows (in terms of intraday and weekly closing prices) are.

There is a strong long-term support line at $58.50 (within the above target range), which is another reason to expect a turnaround relatively soon.

The second long-term chart shows that the mid-2009 bottom is about to be reached, so we have another reason to see a local bottom shortly. The long-term support is more important, but since they both point to a similar outlook, the latter is confirmed and thus more probable to become reality.

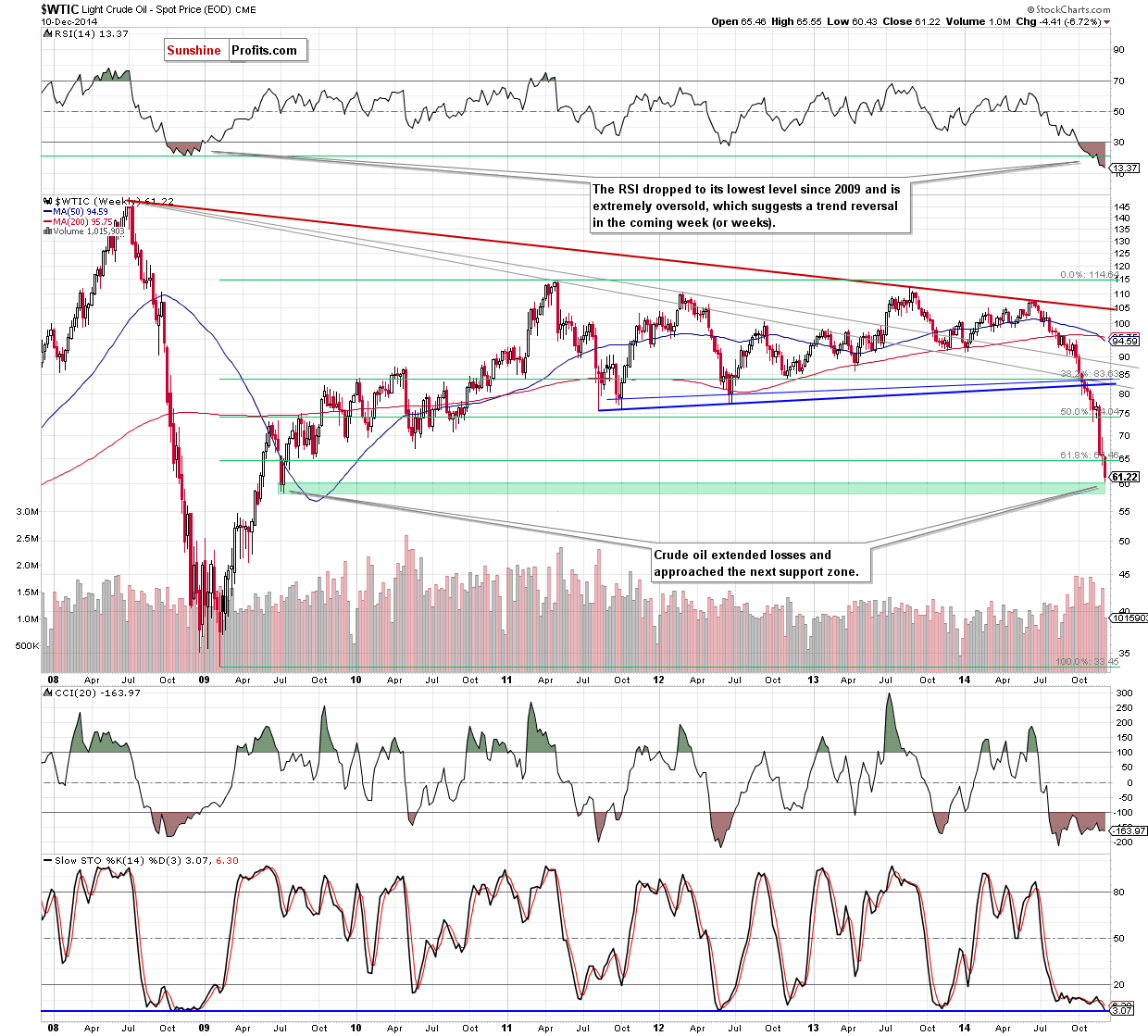

Summing up, although crude oil rebounded slightly and moved away from the new low, this upswing didn’t change anything in the short term (not to mention the medium term, where this move is barely visible) as the commodity still remains not only below the Dec 1 low, but also under the previously-broken 61.8% Fibonacci retracement. All the above provides us with bearish implication). Nevertheless, we do not recommend opening short positions as the space for further declines seems limited – especially when we factor in the current situation in the USD Index (we wrote more about it on Monday).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts