Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 0.45% on expectations that U.S. crude inventories would drop once again. In this environment, light crude closed another day above $53, but is as bullish development as it seems at the first sight?

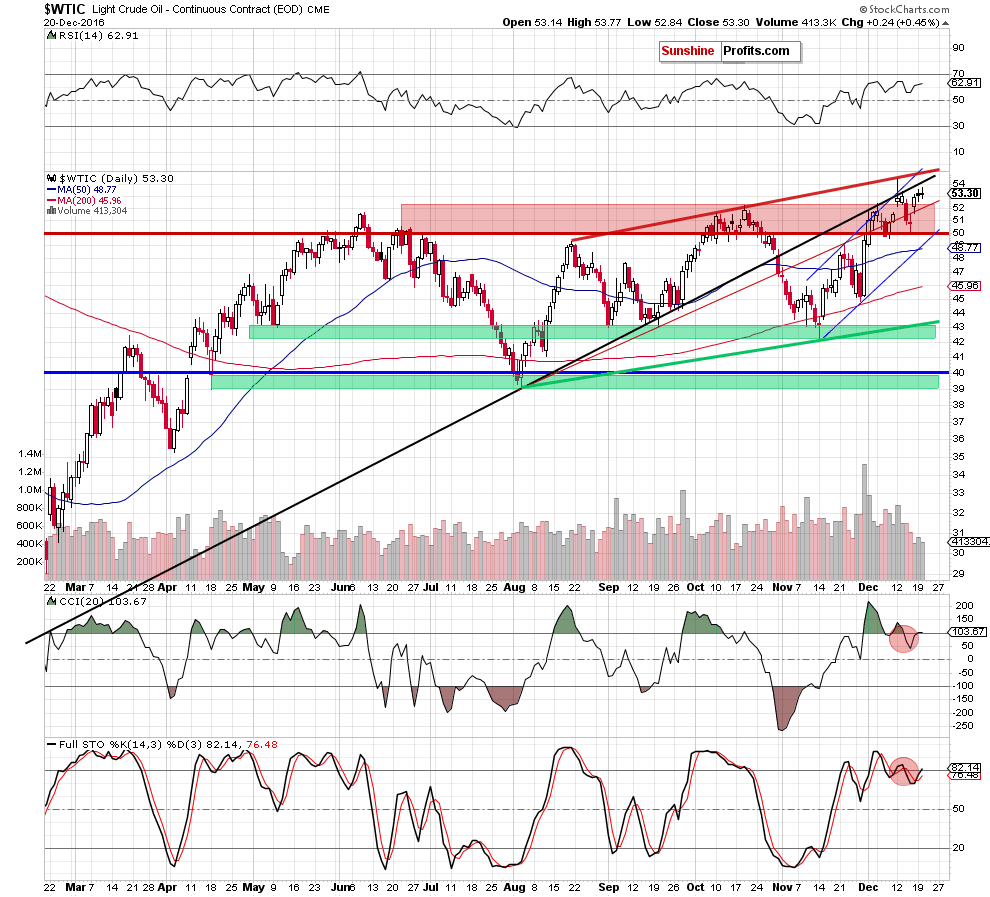

Let’s check the charts below to find out (charts courtesy of http://stockcharts.com).

On Monday, we wrote the following:

(…) crude oil moved higher, climbing above the red resistance line and invalidating earlier breakdown (…) this is a positive event that suggests further improvement and a test of the medium-term black resistance line (…)

From today’s point of view, we see that although indicators invalidated sell signals and light crude moved little higher in previous days, oil bulls didn’t manage to push it even to the medium-term black resistance line (not to mention an increase to higher resistance lines), which doesn’t bode well for further improvement. Additionally, the size of volume that accompanied yesterday’s move was quite small, which suggests that oil bulls may not be as strong as it seems at the first sight and reversal is just around the corner.

At this point, it is worth noting that the American Petroleum Institute reported yesterday that crude inventories in the U.S. dropped by 4.15 million barrels, gasoline inventories fell by 2.0 million barrels, while distillates declined by 1.55 million barrels in the previous week. Despite these bullish numbers, crude oil futures didn’t surge earlier today, which increases the probability of reversal in a very near future (maybe even later in the day).

Summing up, although crude oil moved little higher once again, the outlook for the commodity is still more bearish than bullish as the black gold remains below 3 resistance lines, which increases the probability of reversal in a very near future.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts