Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

Although crude oil hit a two-month low after the market’s open, the commodity reversed and gained 0.56% as protests in a Libyan oil port over the weekend fueled doubts over the country's return to the export market. As a result, light crude bounced off the psychological barrier of $100 and invalidated earlier breakdown. Are these circumstances bullish enough to trigger a rally?

Renewed protests in Libya over the weekend caused one of the country's recently opened oil ports to shut down. The demonstration comes less than a week after the government reopened long-shut oil fields and terminals, which fueled doubts over the country's return to the export market, pushing the price of crude oil above $101. As a reminder, the promise of the country's return to the oil export market had contributed to a sharp decline in the commodity, which fell more than $7 a barrel from the 2014 high hit a month ago. Therefore, protests are worrisome because they could trigger disruptions once again, which may translate to higher prices of crude oil.

How did these circumstances affect the technical picture of crude oil? Let’s check (charts courtesy of http://stockcharts.com.)

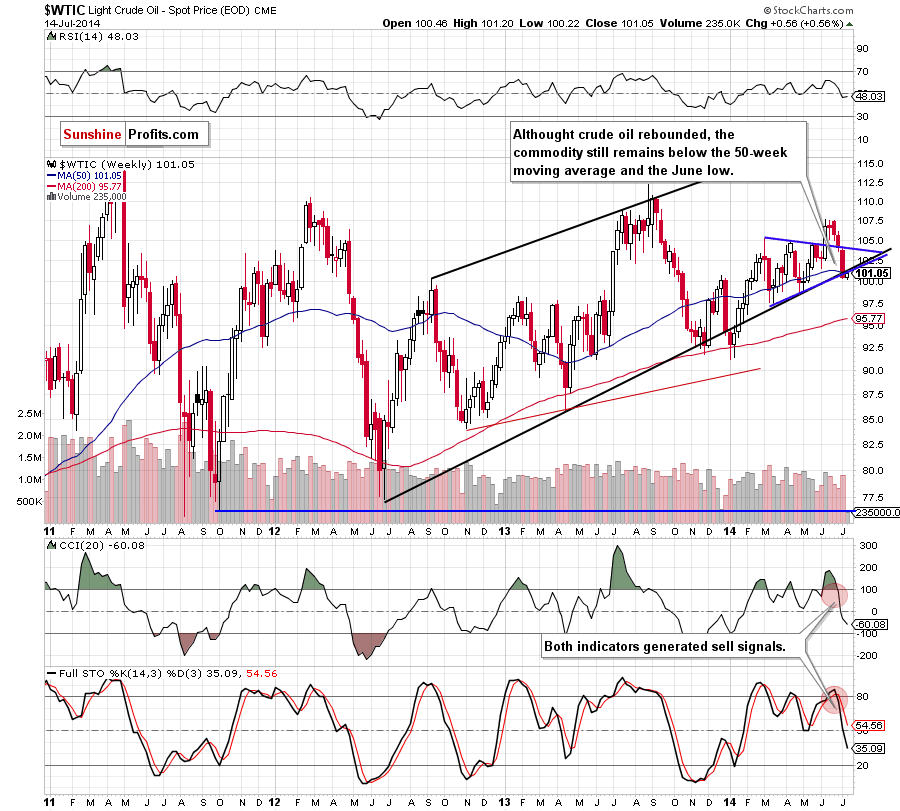

From this perspective, we see that crude oil moved higher and invalidated the breakdown under the lower border of the blue triangle. Although this is a strong bullish signal, the commodity still remains below the resistance zone created by the June low and the 50-week moving average, while sell signals generated by the indicators favors oil bears. Therefore, in our opinion, as long as there is no visible move above this area, another attempt to move lower can’t be ruled out. Please note that if light crude breaks below this week’s low, the next downside target will be around $98.74, where the April low is.

Will the very short-term picture give us more clearly clues where the commodity head next? Let’s find out.

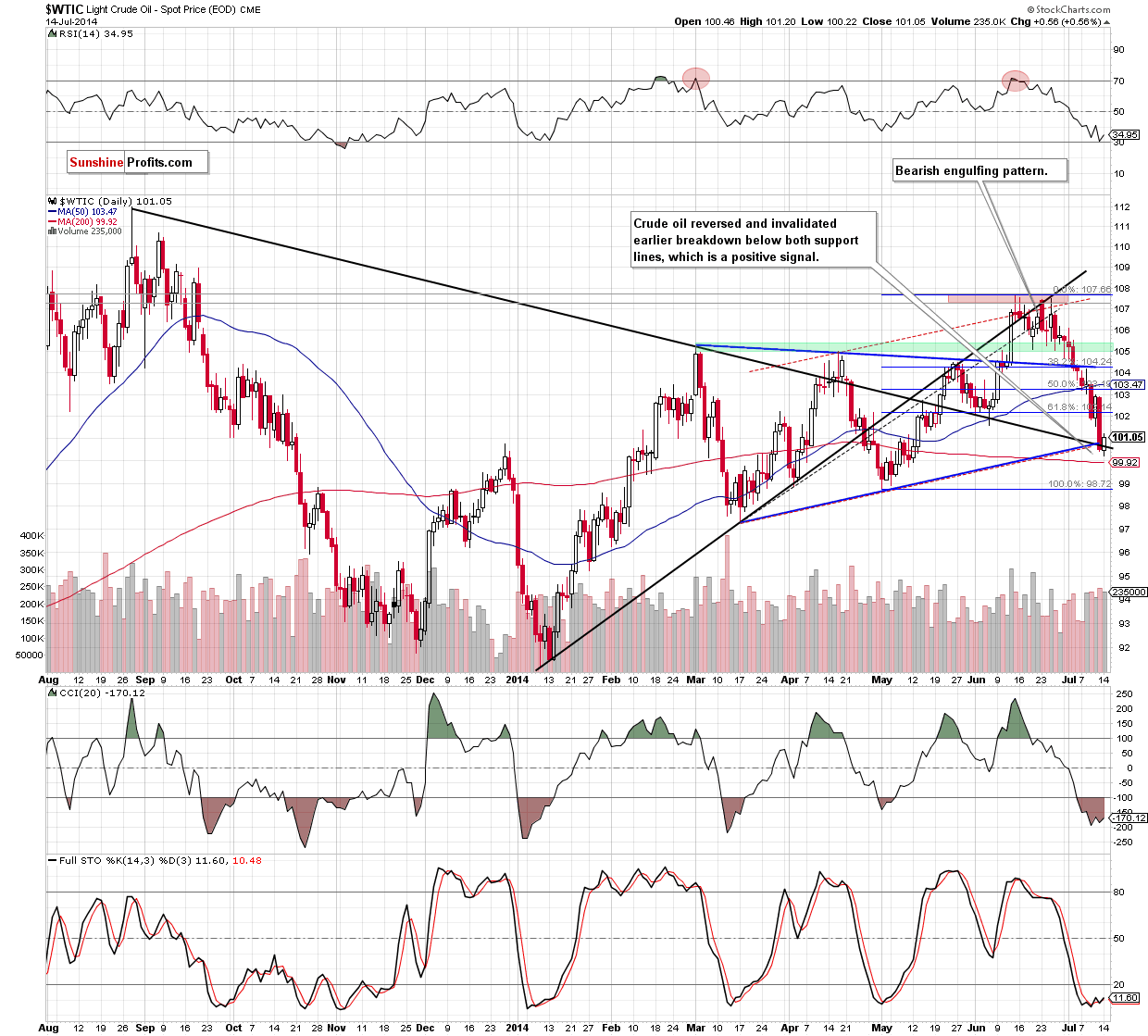

Looking at the daily chart, we see that although crude oil hit a two-month low of $100.22 after the market’s open, the psychological barrier withstood the selling pressure and encouraged oil bulls to act. As a result, light crude rebounded and climbed above the long-term declining line and the blue support line, invalidating the breakdown below these lines. Without a doubt this is a positive signal, but taking into account the size of yesterday’s move (it’s smaller than Thursday increase, not to mention the corrective upswing that we saw between June 19 and June 25) and the medium-term picture, we are skeptical and think that we’ll see another attempt to drop below the key-level of $100 in the nearest future. Please note that if this important support is broken, the commodity will correct to at least $99.92, where the 200-day moving average is.

Summing up, although crude oil rebounded and invalidated the breakdown below two important support lines, the size of the upswing and the medium-term picture suggests that we may see another test of the strength of the psychological barrier of $100. If this key-level holds, we’ll see a corrective upswing to around $103, but if oil bulls fail, the commodity will drop to at least $99.92, where the 200-day moving average is. This might provide us with another favorable shorting opportunity - stay tuned.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts