Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

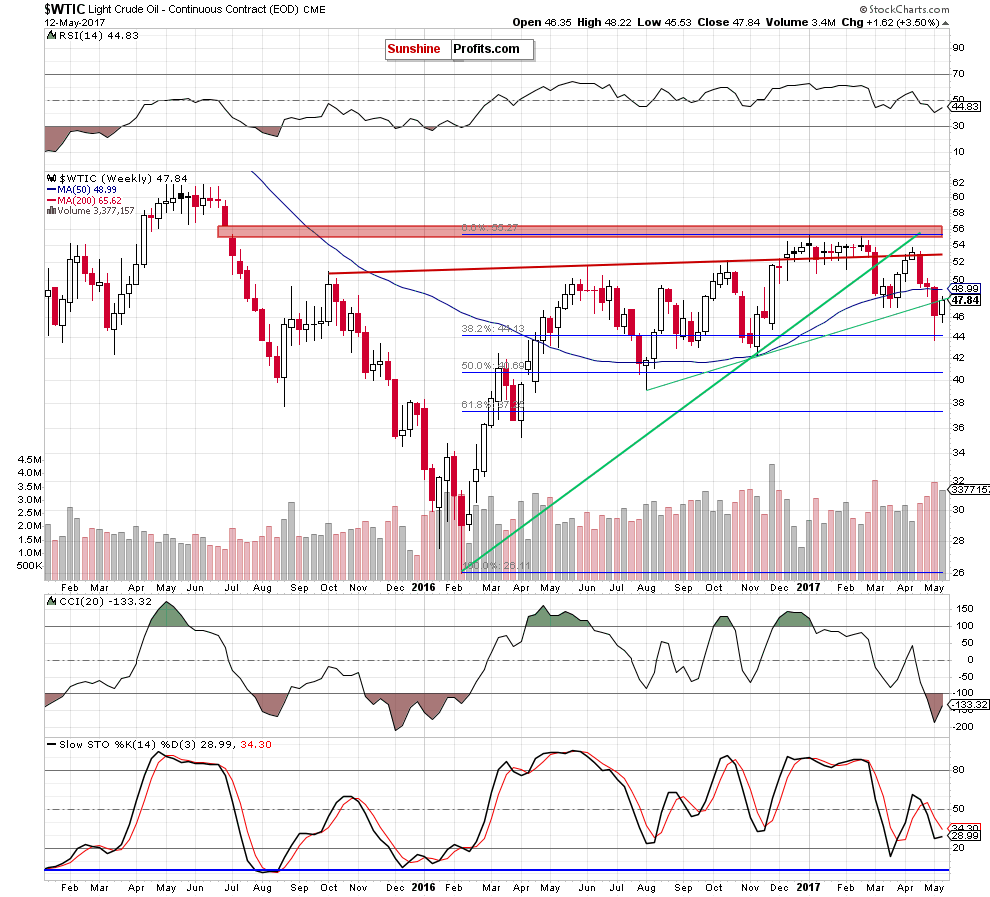

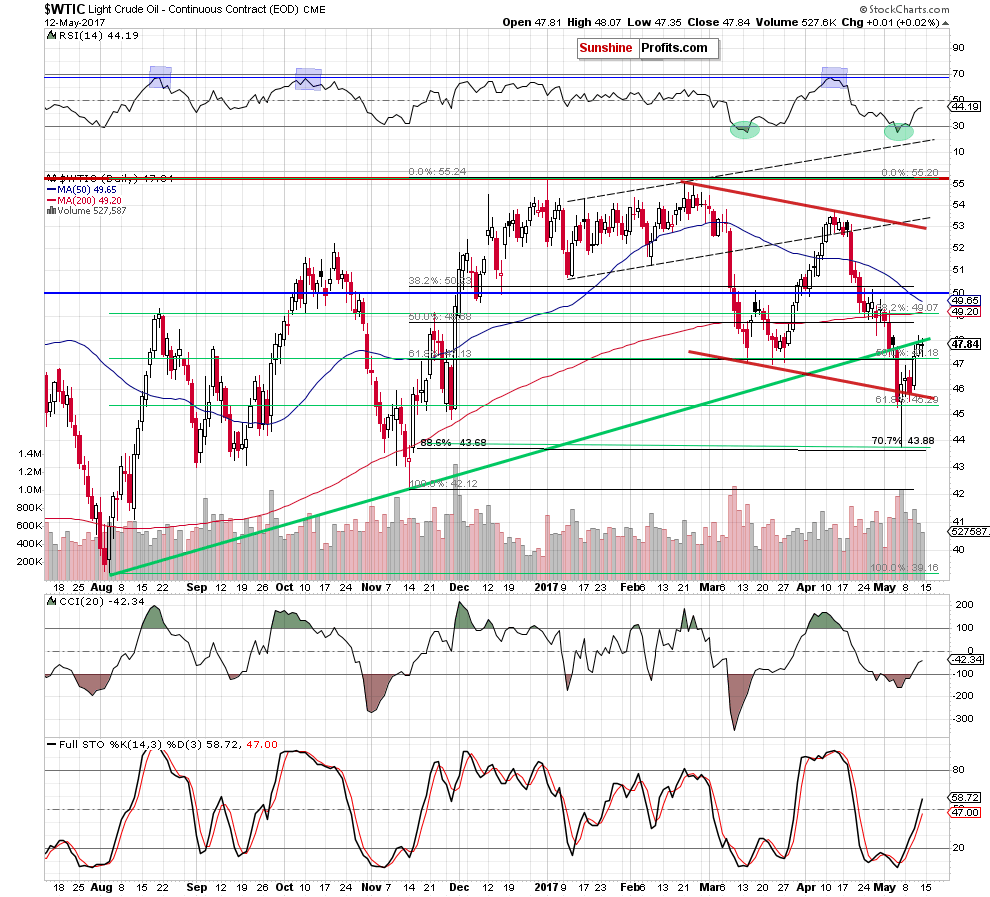

On Friday, crude oil wavered between small gains and losses, but finally closed the day under the long-term resistance line. What can we expect in the coming days?

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Today’s alert will be quite short, because based only on the Friday’s price action, we could write that the overall situation hasn’t changed much. However, earlier today, light crude extended gains and broke above the long-term green resistance line, which is a bullish development. Nevertheless, we should keep in mind that the size of volume, which accompanied recent upward move, was decreasing, which suggests that as long as do not see today’s closing price and the volume, waiting at the sidelines is justified from the risk/reward perspective. We will provide you with a bigger update tomorrow.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts