Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

Although crude oil moved a bit higher and gained 0.57% on Friday, the commodity is still trading under $48 and well below the 38.2% Fibonacci retracement. What does it mean for the black gold?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

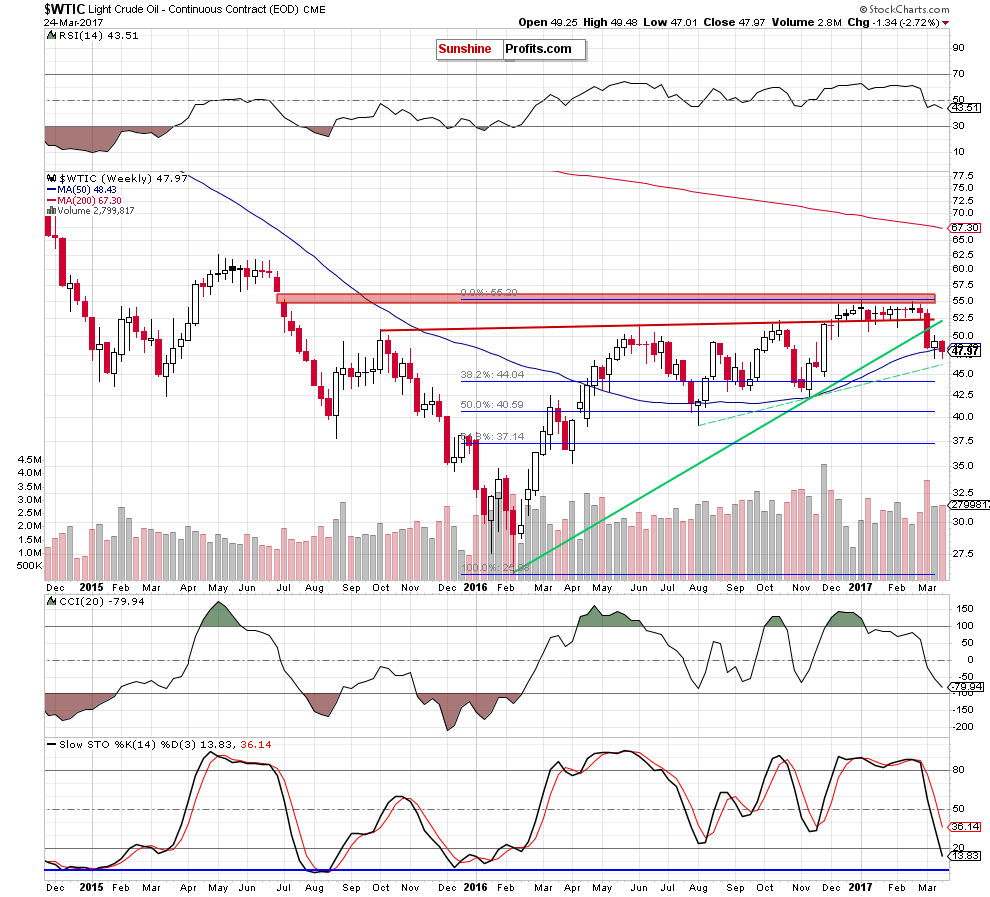

Looking at the weekly chart, we see that crude oil lost 2.72% in the previous week and closed it below the 50-week moving average, which suggests further deterioration – especially when we factor in the sell signals generated by the indicators. Additionally, when we take a closer look at the volume, we see that it was a bit bigger than week before, which means that oil bears still have power.

Will the very short-term chart give us more negative factors? Let’s check.

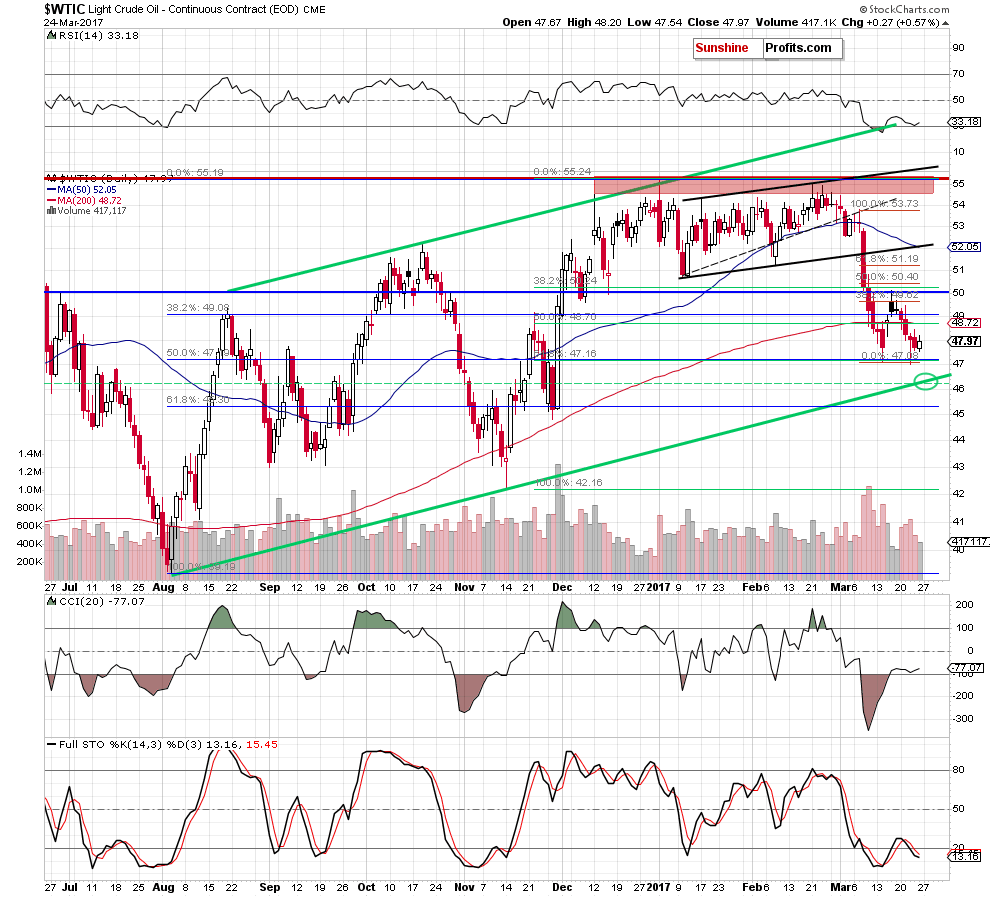

From this perspective, we see that although crude oil moved a bit higher on Friday, the commodity is still trading under the 38.2% Fibonacci retracement, below the previously-broken 200-day moving average and the sell signal generated by the daily Stochastic Oscillator remains in play, supporting oil bears and suggesting lower prices of the black gold in the coming week. This scenario is also reinforced by the size of volume, which accompanied Friday’s increase – it was visibly smaller than earlier - during declines, which confirms oil bears the direction of the move.

Taking all the above into account, we believe that if light crude drops from current levels, we’ll see not only a test of the recent lows, but also a drop to the next downside target - the medium-term green support line based on the August and November lows (currently around $46.43).

Finishing today’s alert, please not that Friday’s Baker Hughes’ report showed that U.S. drillers added oil rigs for a 10th week in a row, which could encourage oil bears to act in the coming day(s).

Summing up, short (profitable) positions continue to be justified as crude oil remains under the 200-day and 50-week moving averages and the sell signals generated by the indicators are still in play, which suggests another attempt to move lower.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts