Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Monday, light crude extended losses after oil investors reacted to bearish Friday’s Baker Hughes’ report, which showed that U.S. drillers added oil rigs for a 14th week in a row. In these circumstances, the black gold lost 0.79% and slipped to the 200-day moving average. Will this support manage to stop oil bears in the coming day?

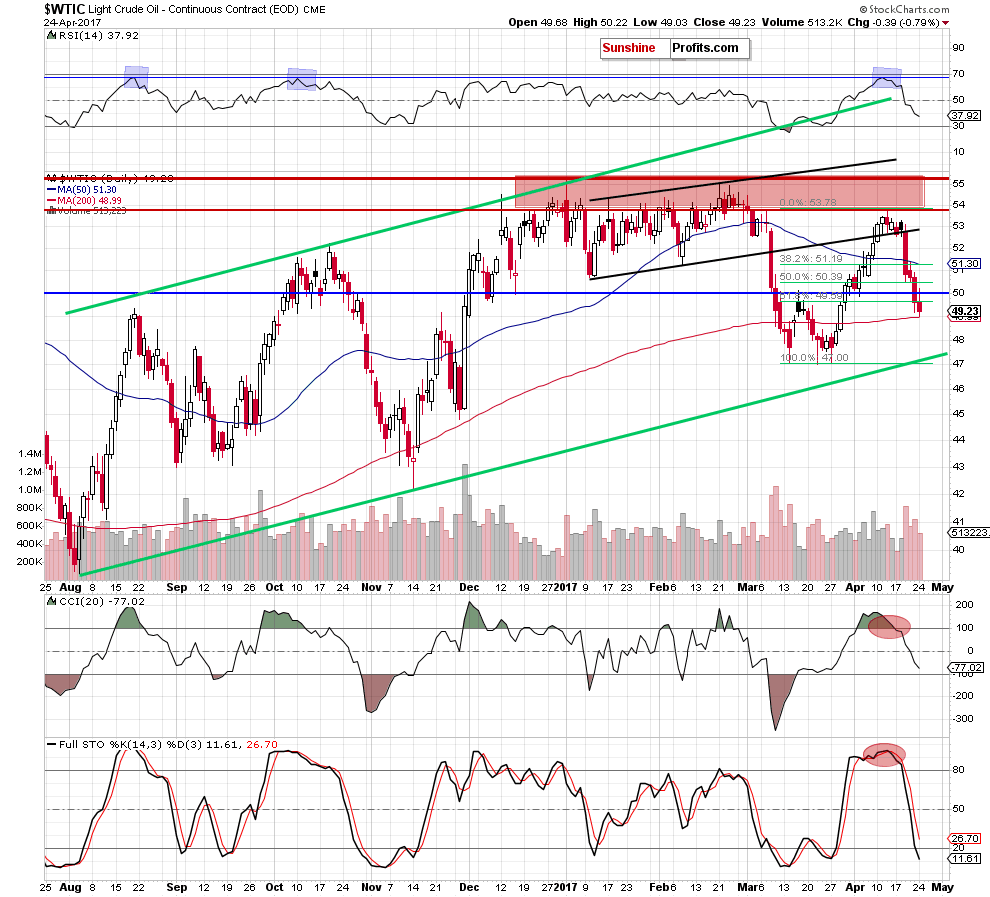

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) an invalidation of the breakout above the long-term red resistance line triggered a sharp decline, which took light crude below the barrier of $50. Last week’s move materialized on bigger volume than earlier increases, which confirms oil bears’ strength and suggests further deterioration in the coming week (…)

From today’s point of view, we see that oil bears pushed the commodity lower as we had expected. Thanks to yesterday’s decline the Stochastic Oscillator generated the sell signal, increasing the probability of further declines.

How low could crude oil go in the coming days? Let’s examine the daily chart and find out.

Looking at the daily chart, we see that although crude oil moved a bit higher after the market’s open, the previously-broken barrier of $50 encouraged oil bears to act. As a result, the commodity reversed and declined, closing yesterday’s session under the 61.8% Fibonacci retracement and approaching the 200-day moving average. Although this support could trigger a rebound, the sell signals generated by the indicators remain in place, supporting oil bears and lower prices of crude oil.

How low could the black gold go in the coming days? In our opinion, if light crude extends losses and drops below the 200-day moving average, the next downside target will be around $47-$47.15, where the recent lows and the lower border of the long-term green rising trend channel currently are.

Summing up, short (profitable) positions continue to be justified as crude oil verified the breakdown under the barrier of $50, which could encourage oil bears to act and trigger another downswing in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts