Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

The crude oil price moved higher today and at the moment of writing these words it’s trading at $104.15.

Will crude oil extend gains in the near future? Let’s check technical picture of crude oil (charts courtesy of http://stockcharts.com).

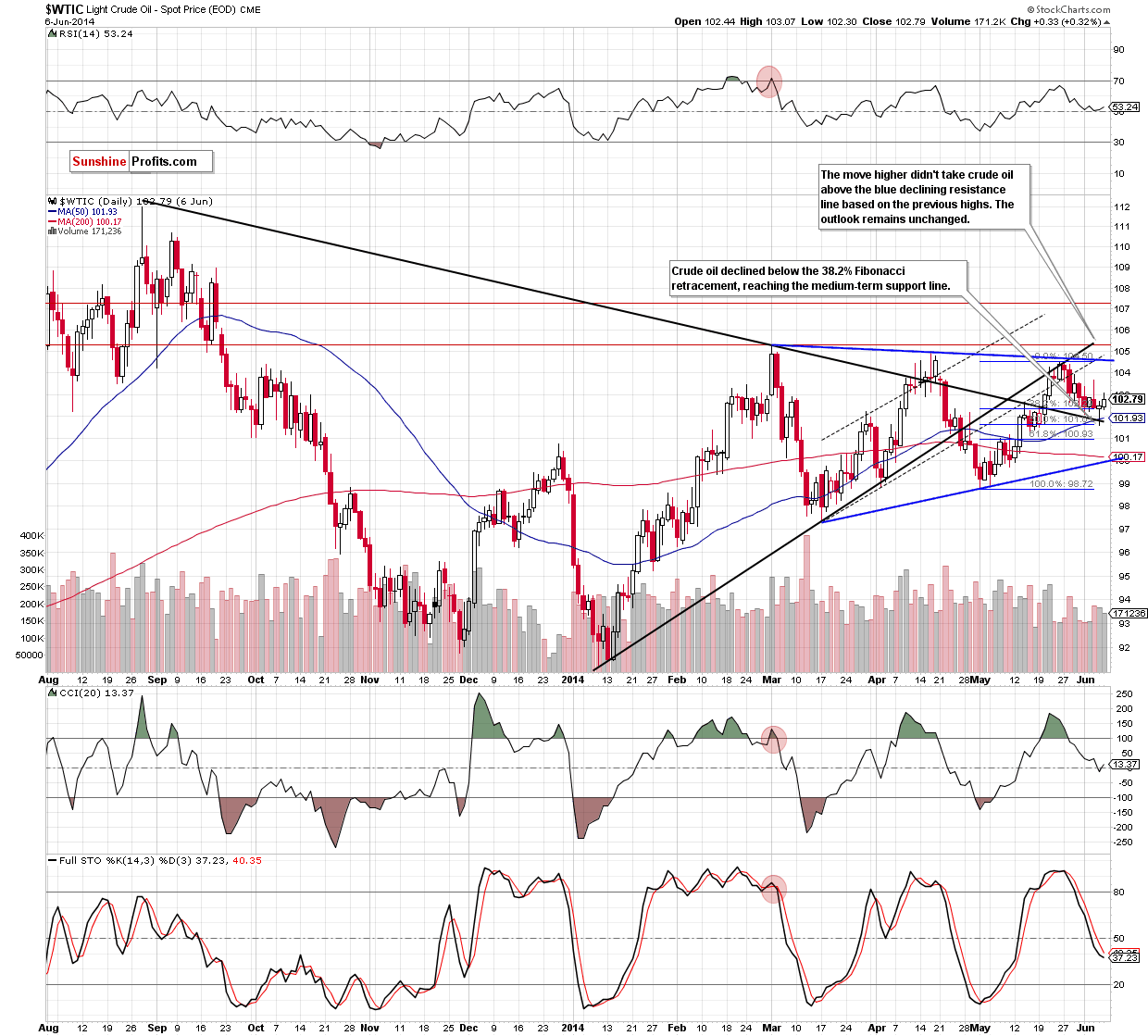

Today’s price move is not visible on the above chart, but we can see that the key short-term resistance line (marked with blue) is above the current price. This means that there was no breakout, and without breakout, we can’t say that the outlook has changed. We are still after the breakdown that we saw in late April and possibly within the head-and-shoulders formation. Consequently, the situation remains bearish.

Our previous comments remain up-to-date:

The medium-term situation hasn’t changed much as crude oil remains below the blue resistance line based on the recent highs (the upper border of the triangle). Therefore, we still believe that the proximity to this line will continue to be supportive for oil bears and we’ll see futher deterioration and a pullback to around the 50-week moving average (currently at $101.08) in the coming week (or weeks).

Summing up, although crude oil rebounded after a drop to the medium-term declining support line, the size of the corrective upswing is too small to say that the situation in the very short-term improved. There will be no meaningful implications unless we see a confirmed breakout – and that was not the case so far. Therefore, we remain bearish as 3 major technical factors that we mentioned yesterday (sell signals generated by the indicators remain in place, the breakdown below the lower border of the rising trend channel was verified and light crude remains well below the strong resistance zone) still suggest that further deterioration and lower values of crude oil are just around the corner.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $105.50. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts