Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Monday, crude oil lost 0.61% as stronger greenback weighed on the price. In this way, light crude slipped below the support line, but oil bulls managed to invalidate the breakdown in the following hours. Does it mean that investors’ sentiment is improving and we could see further growth in crude oil?

Yesterday, the U.S dollar moved higher after news of Japan's recession. As a reminder, official data showed that annualized Japan’s gross domestic product dropped by 1.6% in the third quarter, missing economists‘ forecast of a 2.3% growth and following a 7.3% drop in the second quarter, which puts the country in a recession.

Additionally, the Federal Reserve Bank of New York showed that its manufacturing index increased to 10.2 in November from a reading of 6.2 in the previous month, while a separate report showed that U.S. industrial production rose 0.2% last month. In this environment, a stronger greenback made crude oil less attractive commodity for investors holding other currencies, which resulted in a drop to an intraday low of $74.71. Despite this deterioration, the commodity rebounded in the following hours. What impact did this move have on the very short-term picture of crude oil? (charts courtesy of http://stockcharts.com).

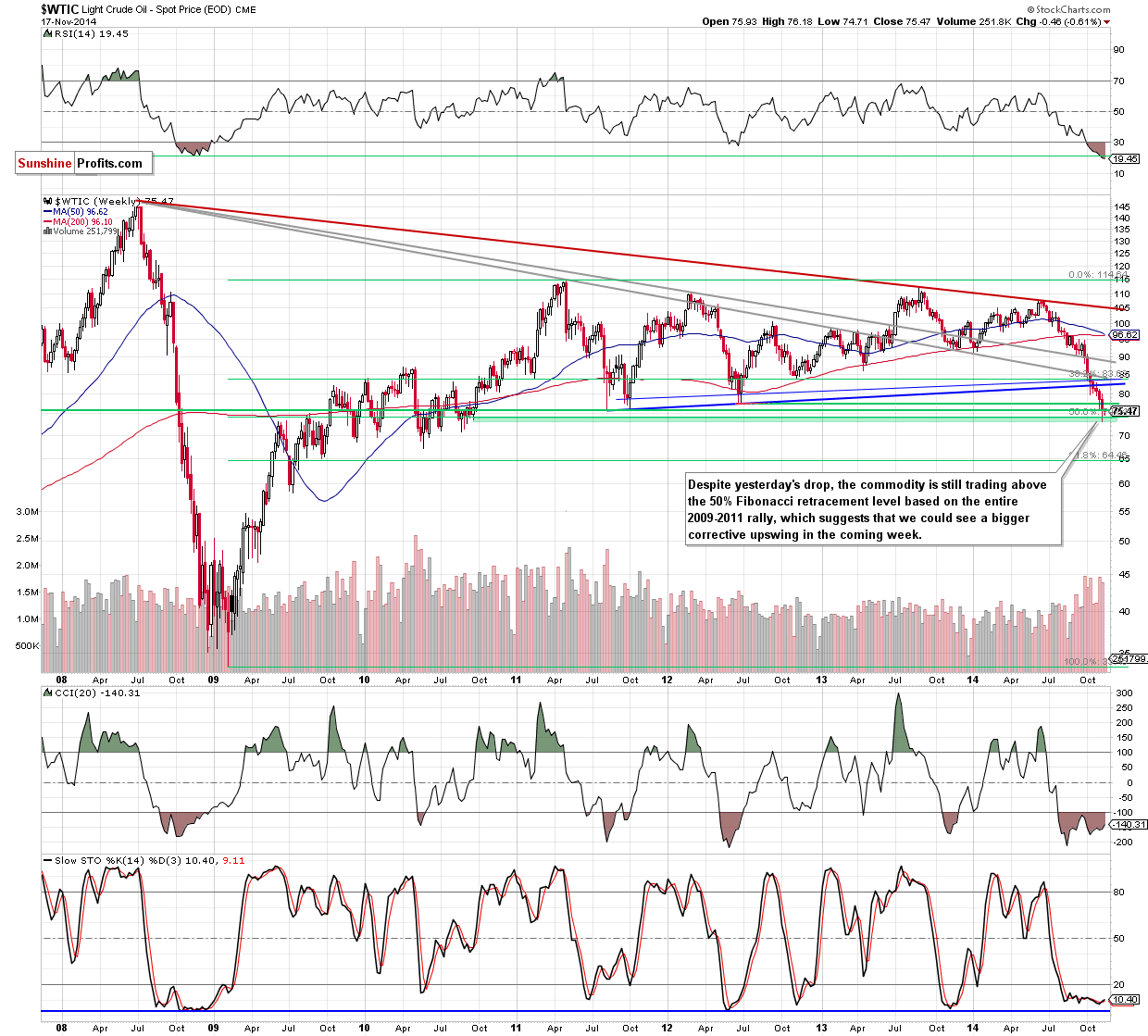

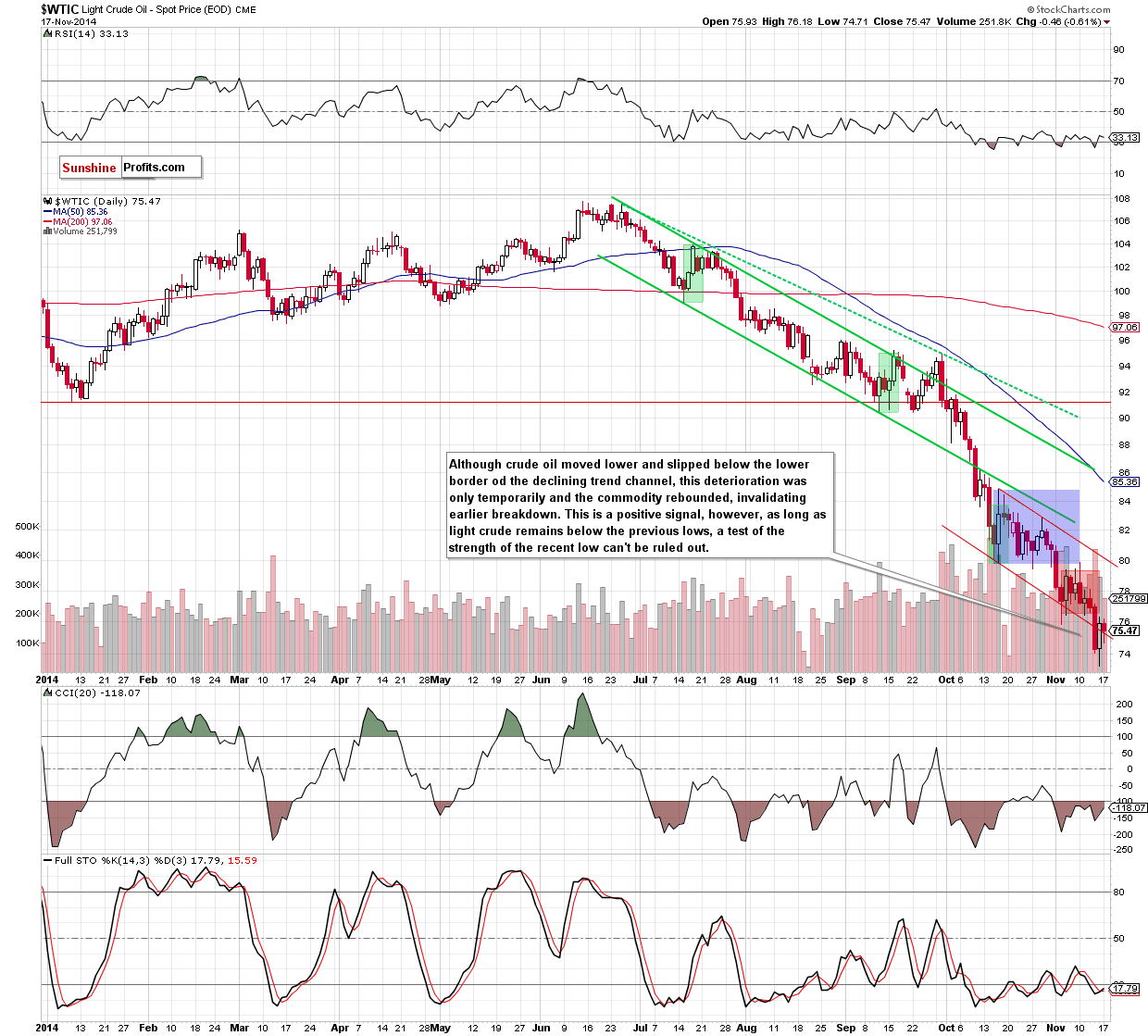

Looking at the above charts, we see that although crude oil slipped below the lower border of the declining trend channel (seen on the daily chart), the commodity reversed and rebounded in the following hours, invalidating earlier breakdown. This is a bullish signals (especially when we factor in last week’s invalidation of the breakdown under the 50% Fibonacci retracement and the fact that crude oil closed the previous week above this key support), which suggests further improvement in the coming week. If this is the case, initial upside target would be the barrier of $80 and the previous lows. Nevertheless, we should keep in mind that as long as the commodity remains under these levels, another test of the strength of the 50% Fibonacci retracement and the recent low can’t be ruled out.

Summing up, the major event of yesterday’s session was a breakdown below the lower border of the declining trend channel and its invalidation in the following hours. As we have pointed out before, this is a positive signal, which suggests further improvement in the coming week even if crude oil re-test the strength of this key support level.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts