Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Monday, crude oil gained 1.03% as the combination of better-than-expected U.S. personal spending data and news of refinery closures supported the price. Thanks to these circumstances, light crude climbed above the last week’s high and closed the day above $94 for the first time since Sep 16. Are there any bearish factor on the horizon that could stop the rally?

Yesterday, the Commerce Department showed that U.S. personal spending rose 0.5% in the previous month, beating expectations for an increase of 0.4%. The report also showed that personal income, reflecting income from wages, investment, and government aid, rose 0.3%, up from 0.2% in July, and broadly in line with forecasts. These solid numbers boosted the commodity, fueling hopes that a more robust U.S. economy will consume more fuel and energy.

Additionally, the price of light crude increased ahead of seasonal maintenance and unplanned closures at refineries in Canada and Texas. Will we see further rally? (charts courtesy of http://stockcharts.com).

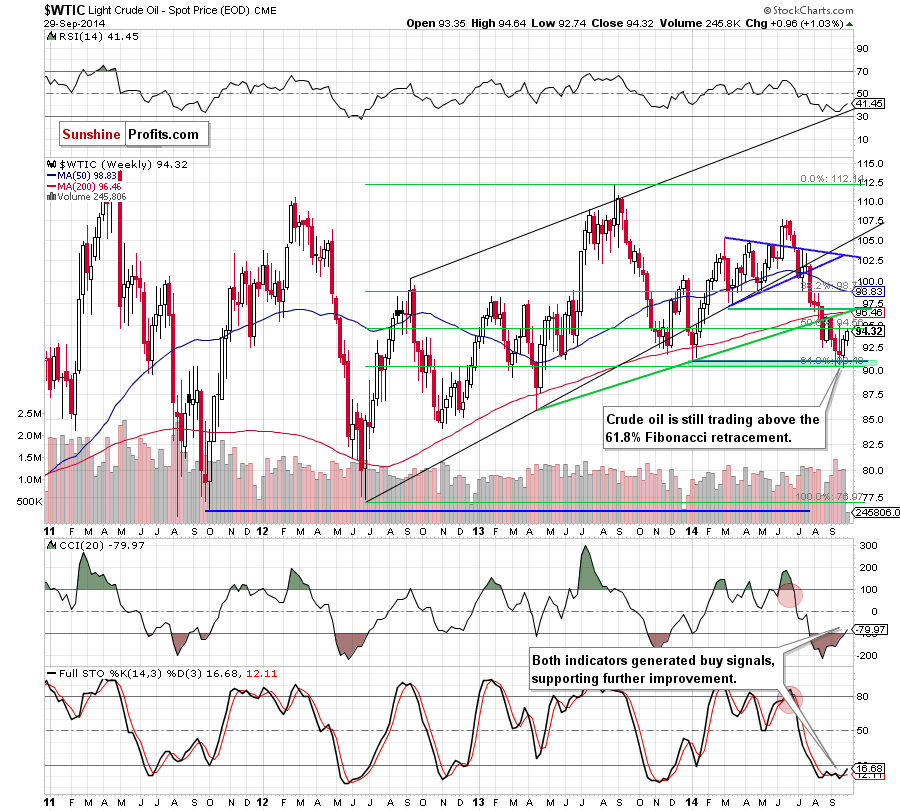

The medium-term picture has continued to improve as crude oil extended rally and broke above the last week’s high, moving away even more from the strong green support zone. On top of that, the CCI and Stochastic Oscillator generated buy signals, supporting further improvement. All the above provides us with bullish implications and means that our last commentary is up-to-date:

(…) we think that oil bulls will try to break above (…) $95.19 and test the strength of the resistance zone created by the green support/resistance line and the previously-broken 200-week moving average (currently around $96.40).

Having say that, let’s focus on the very short-term changes.

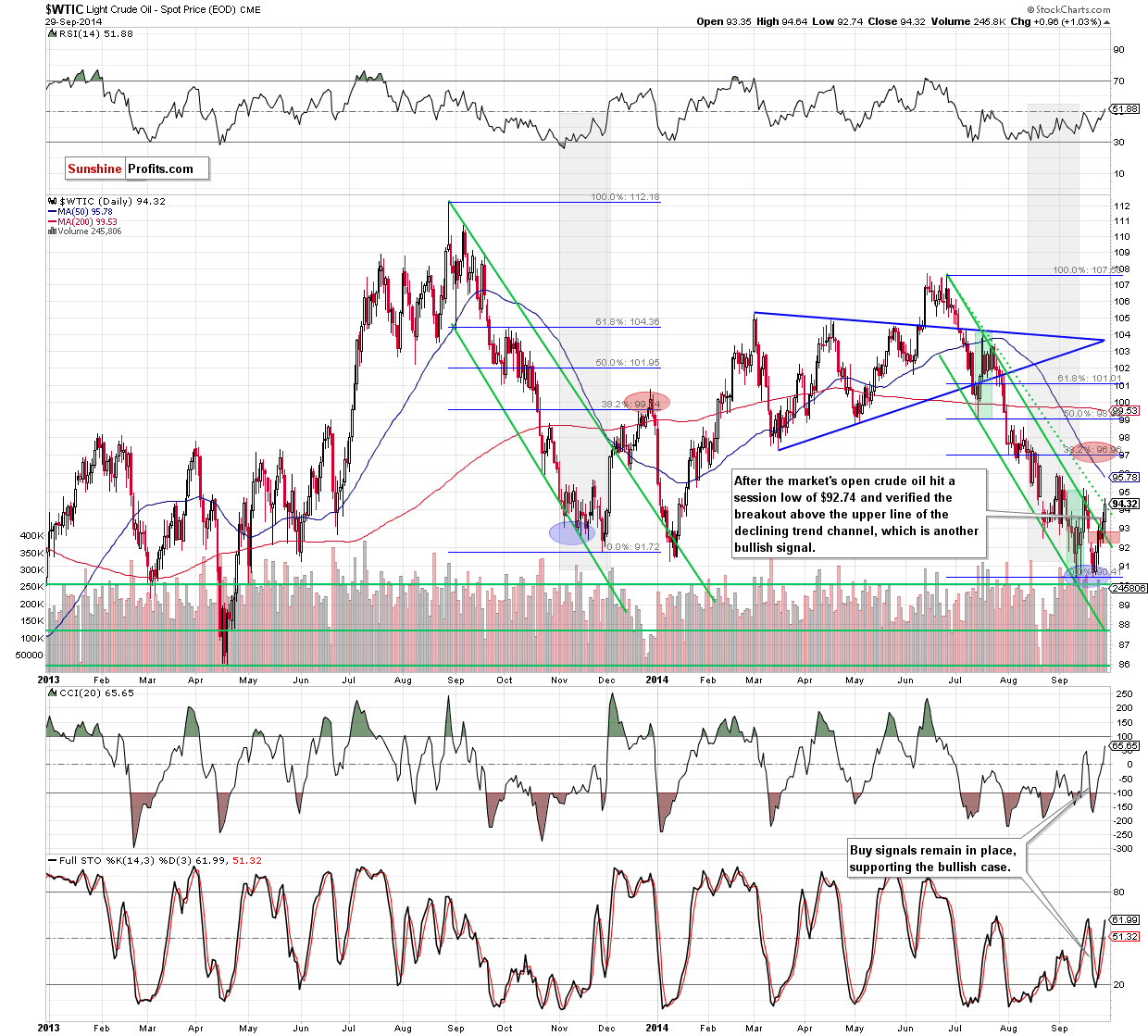

From this perspective, we see that crude oil declined after the market’s open, hitting an intraday low of $92.74 and reaching the previously-broken upper border of the declining trend channel. To us, this signifies that the breakout above this key support/resistance line was verified. As you see, this strong bullish signal triggered a sharp rally, which took the commodity above $94 and the green dashed resistance line. Taking these positive signs into account, we believe that what we wrote yesterday remains valid:

(…) buy signals generated by the indicators remain in place, supporting the bullish case. What’s next? If the breakout is not invalidated, we’ll see further improvement and an increase to at least $95.19, where the Sep 16 high is. If this resistance is broken, the next upside target for oil bulls will be around 96$, where the 50-day moving average intersects the resistance level based on the Aug 29 high.

Summing up, we are convinced that keeping long positions (which are already profitable) is justified from the risk/reward perspective as the breakout that occurred on Friday was verified and is still in effect, supporting further rally (to at least $95.19).

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed with bullish bias

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts