Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 3.49% as the combination of weaker greenback and productions cuts by major oil companies supported the price. Thanks to these circumstances, light crude extended rally and broke above important resistance levels. Did the commodity reach the final bottom?

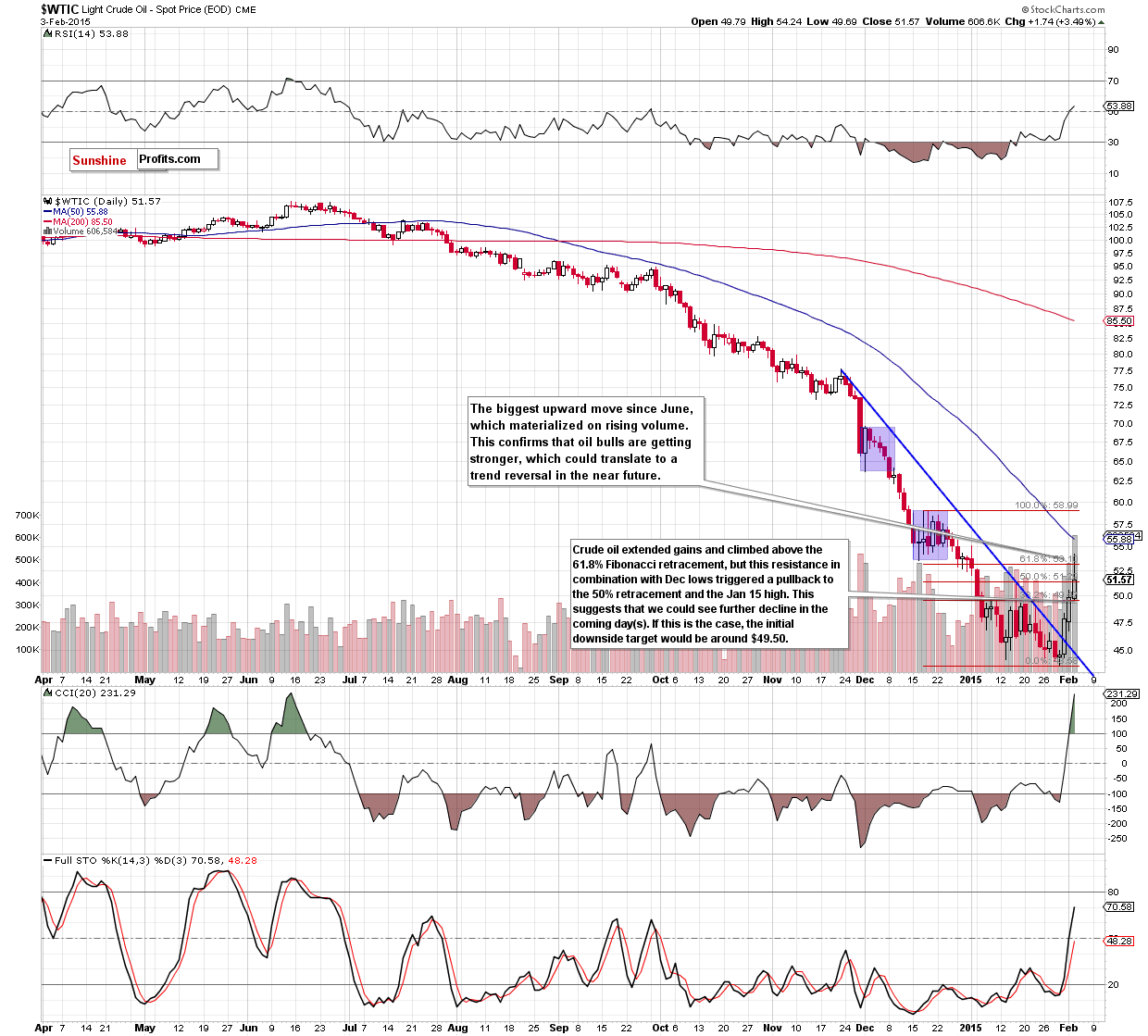

Yesterday, the U.S. Census Bureau showed that factory orders dropped by 3.4% in December, missing expectations for a decline of 2.2%. In response to these disappointing numbers, the U.S. dollar moved sharply lower, making crude oil more attractive for buyers holding other currencies. Additionally, BP announced it would cut capital expenditure by 13% to $20 billion in 2015, following a similar decision by Chevron. This news fueled hopes that such moves will alleviate a glut in global supplies faster than thought, pushing light crude to an intraday high of $54.24. Will oil bulls be strong enough to hold gained levels in the coming days? (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

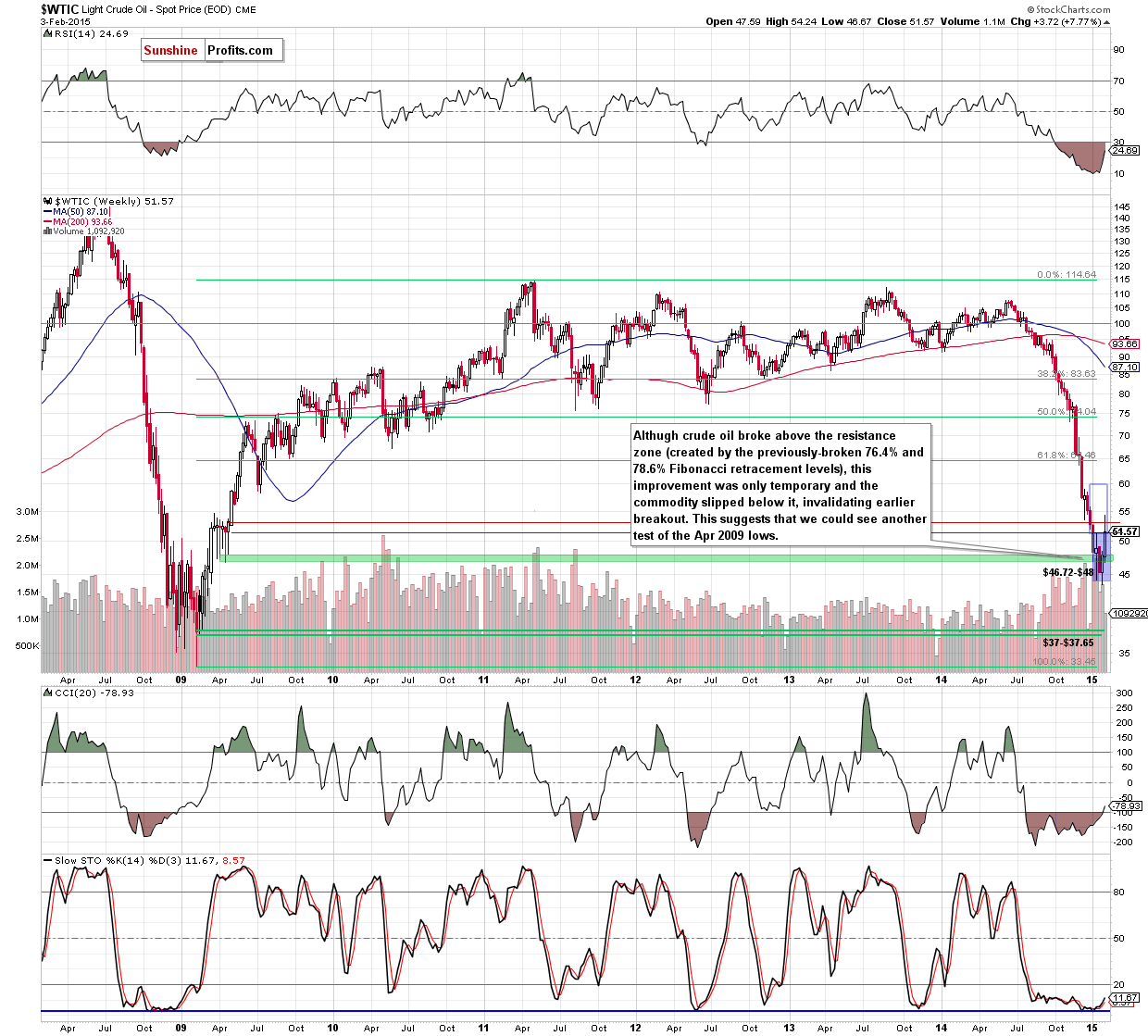

(…) yesterday’s move materialized on huge volume, which confirms the growing strength of oil bulls. Therefore, we believe that crude oil will climb to its key resistance zone (…) created by the previously-broken 76.4% and 78.6% Fibonacci retracement levels marked with green on the weekly chart, the 50% Fibonacci retracement based on the mid-Dec-Jan decline and the Jan 15 high

Looking at the charts, we see that oil bulls took crude oil not only to our upside target, but also managed to push the commodity slightly above the 61.8% Fibonacci retracement and the Dec lows. As you see on the daily chart, yesterday’s upswing materialized on the highest volume since Apr, which confirms oil bulls’ strength. At this point it’s worth noting that we saw consecutive volume’s increases in the last three days, which is a solid positive signal. Nevertheless, we would like to draw your attention to the fact that, despite the rising volume, white candles were getting smaller, which in combination with yesterday’s long upper shadow and an invalidation of the breakout above the 76.4% and 78.6% Fibonacci retracement levels (marked on the weekly chart), suggests a reversal and further declines (especially after an invalidation of the breakout above the 50% retracement and the Jan 15 high, which will likely accelerate deterioration). If this is the case, the initial downside target for oil bears would be around $49.50, where the previously broken 38.2% Fibonacci retracement is. In our opinion, as long as the volume is low, even a deeper pullback (to the Feb 2 low of $46.67 or the blue support line), will not have a negative connotation, which could lead to a fresh 2015 low. Taking all the above into account, we think that a trend reversal is just around the corner.

Summing up,although crude oil extended gains and climbed above the 61.8% Fibonacci retracement and its key resistance zone, the commodity reversed invalidating earlier breakout. This is a bearish signal (especially when we factor in the size of white candles and the long upper shadow of yesterday’s candlestick), which suggests another attempt to move lower. Taking these facts into account, we think that opening long positions is too risky at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if we see another daily close above the Jan 15 high of $51.27, we’ll consider opening long positions. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts