Trading position (short-term; our opinion): No positions.

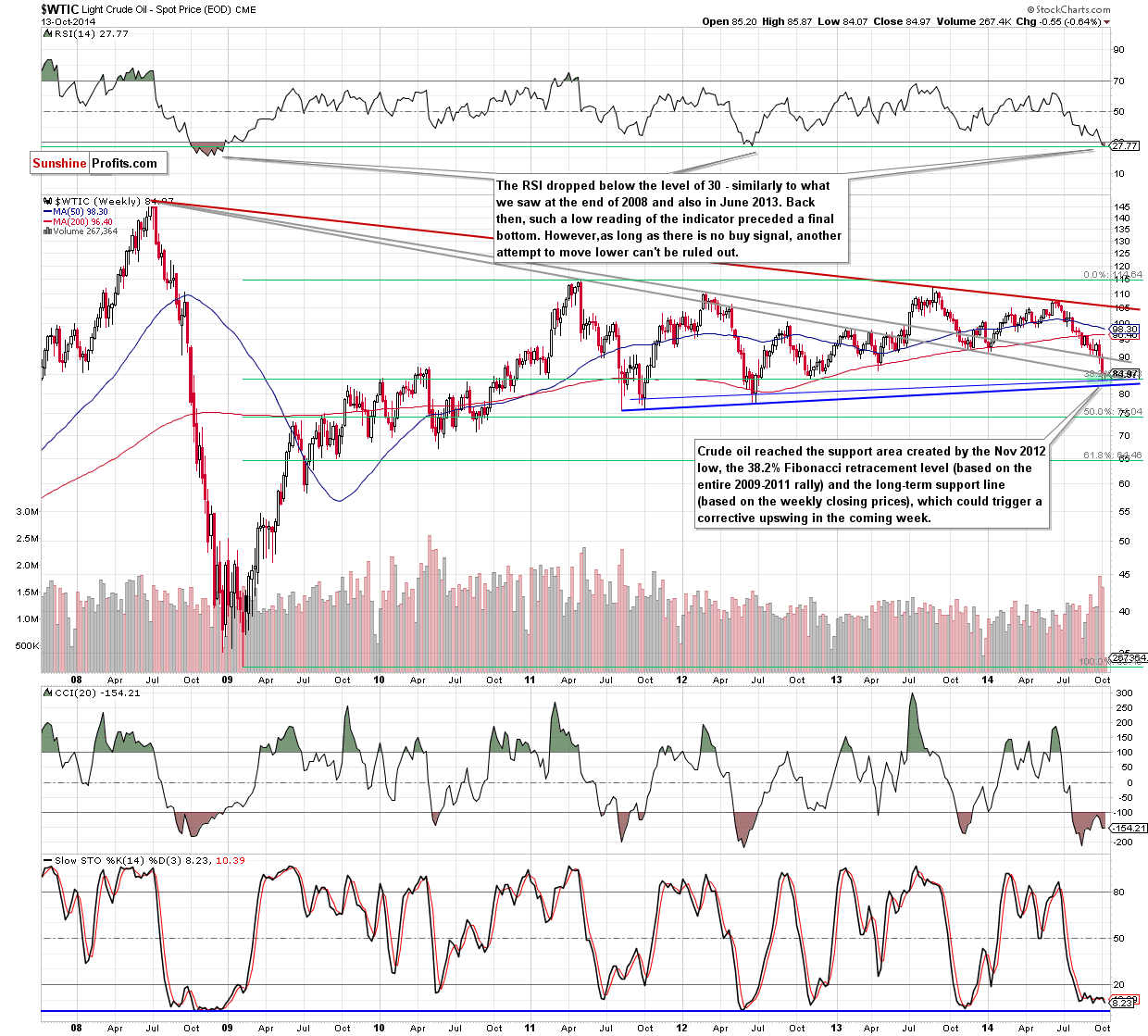

On Monday, crude oil lost 0.64% on indications that global supplies would remain ample as OPEC may not cut output at its next meeting in November to support prices. Because of these circumstances, light crude slipped to the long-term support line. Will it withstand the selling pressure and encourage oil bulls to act?

At the weekend, Iraq's State Oil Marketing Company cut the oil price of Basrah Light crude in November for Asian and European buyers by 65 cents to a discount of $2.50 a barrel below the Oman/Dubai benchmark for Asian customers and $4.75 below the Brent benchmark for European customers (as a reminder, Saudi Arabia and Iran have also cut their selling prices). In addition, Kuwait's oil minister said that OPEC is unlikely to cut output to support prices, which fueled worries among market participants that global supplies would remain ample and pushed the price below $85 once again. What’s next? (charts courtesy of http://stockcharts.com).

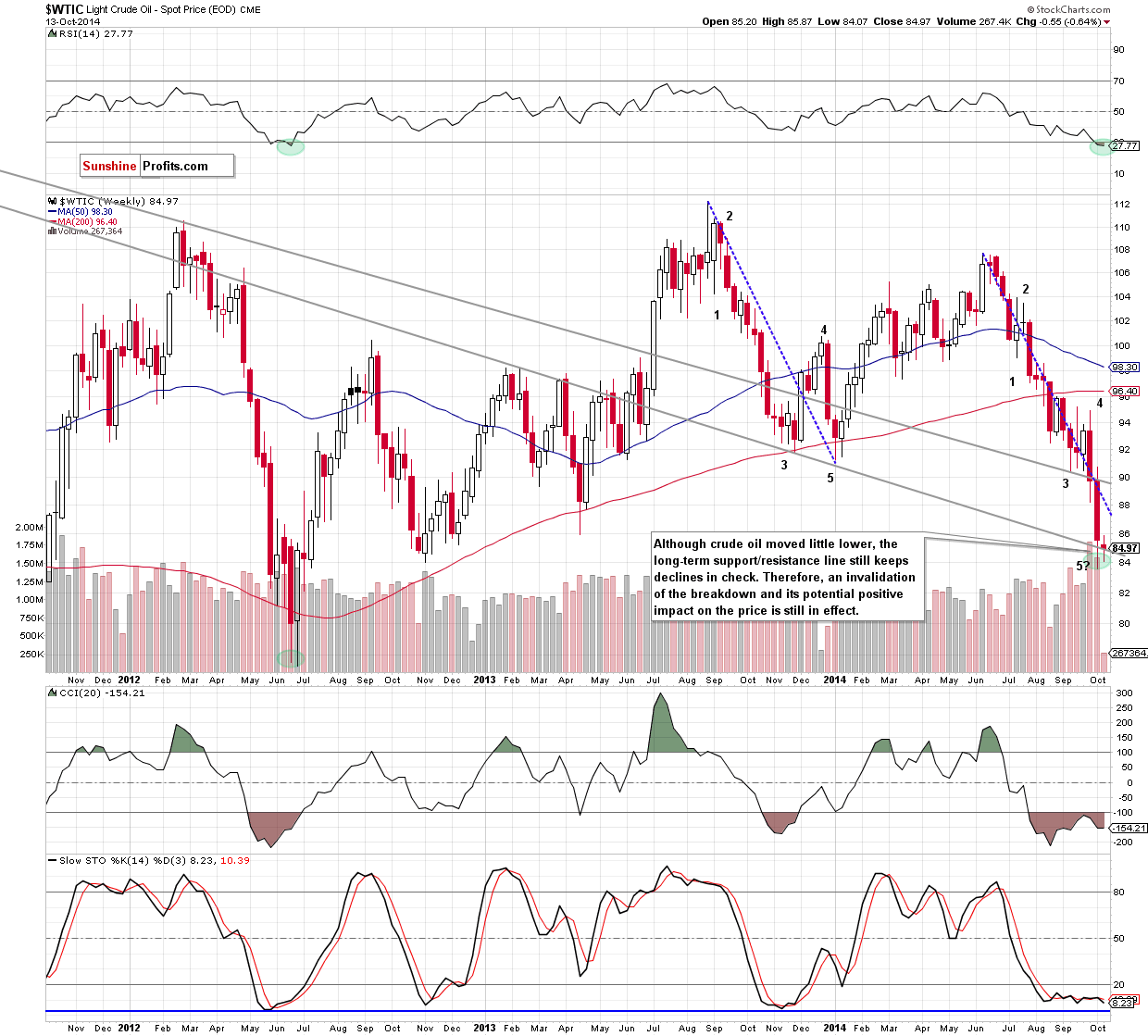

As you see on the weekly chart, although crude oil moved little lower, the long-term support/resistance line still holds, keeping declines in check. Therefore, last week’s invalidation of the breakdown below this line and its potential positive impact on the price of light crude is still in effect. Taking this fact into account, it seems that crude oil will move higher in the coming weeks (especially when we factor in the strong support zone that we discussed on Friday - marked with green on the first chart). If this is the case, the initial upside target would be the previously-broken upper long-term grey resistance line (currently around $89.60), which together with the 61.8% Fibonacci retracement and the recent lows creates a solid resistance area. In our opinion, as long as this resistance is in play (and there are no buy signals, which could support the bullish case), the space for further growth is limited.

Summing up, an invalidation of the breakdown below the lower long-term support/resistance line and its potential positive impact on the price of light crude is still in effect, which suggests that crude oil will move higher rather sooner than later. It seems that the coming move will be rather significant (tradable), therefore, we are planning to re-enter the long position at lower prices or after seeing a confirmation that the final bottom is indeed in.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts