Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

On Wednesday, the price of light crude shuffled between gains and losses as investors weighed economic data from China, the increase in U.S. crude oil inventories and rising tensions between Russia and Ukraine. Because of these circumstances, light crude hit a 6-week high, but then reversed and gave up all earlier gains. Will oil bulls find support with the tensions in the background? Or maybe, the biggest one-week build in crude oil supplies will encourage oil bears to show their claws. Who has more technical arguments?

Yesterday, official data showed that China’s gross domestic product rose 7.4% on year in the first quarter, slowing from 7.7% in the fourth quarter last year. Despite this fact, the data came in slightly above expectations for growth of 7.3% and supported the demand outlook in the world’s second largest energy consumer.

The price of light crude was also supported by rising tensions between Russia and Ukraine as Ukrainian troops continued operations to recapture state buildings from armed pro-Russia separatists in the east of the country. These circumstances fueled fears over possible supply disruptions and pushed crude oil to its highest level in six weeks.

Nevertheless, this improvement didn’t last long. Light crude erased earlier gains after the Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 10.01 million barrels in the week ended April 11 (well above expectations for a build of 2.25 million barrels). As mentioned earlier, it was the biggest one-week build in crude oil supplies in 13 years.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

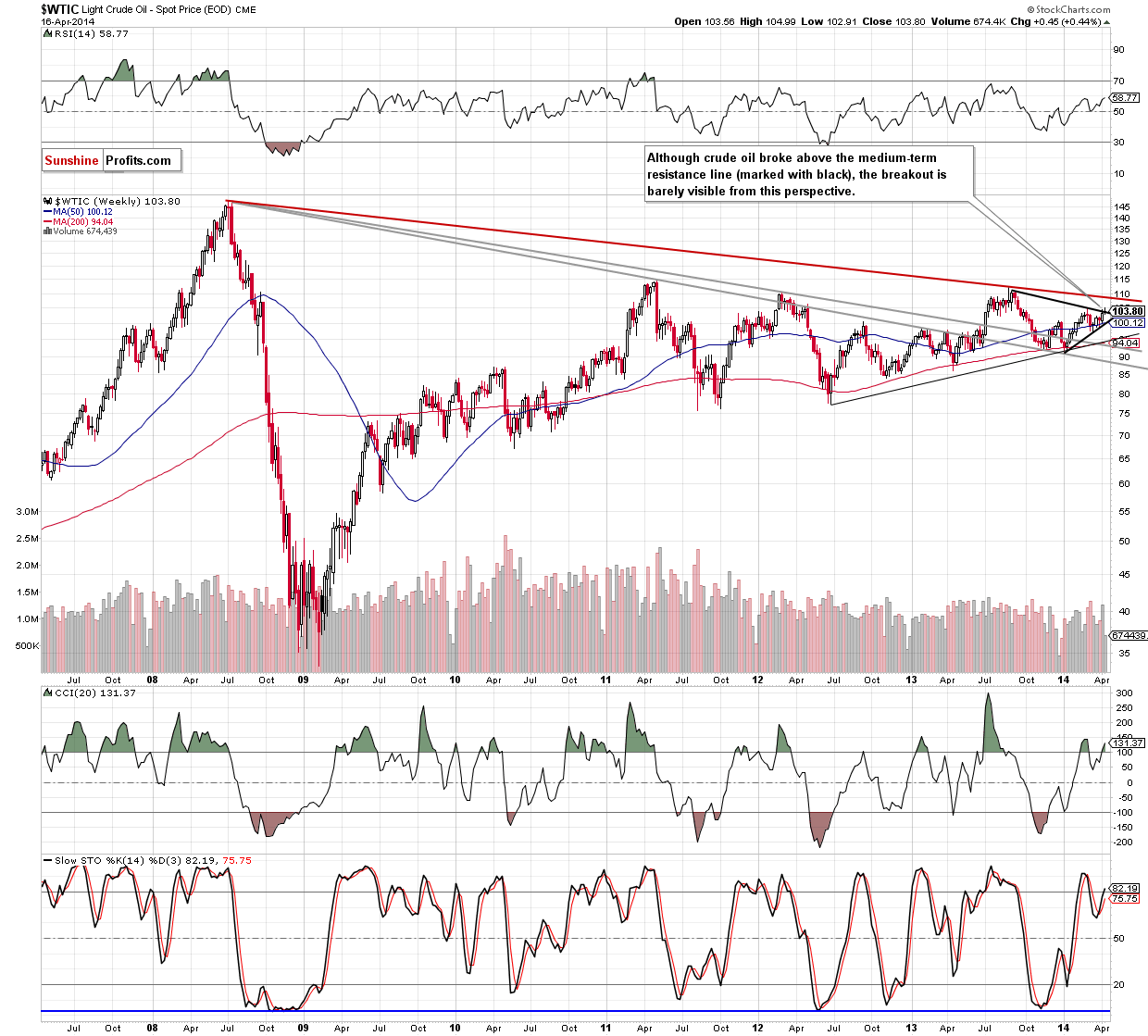

As you see on the weekly chart, the situation hasn’t changed. Therefore, what we wrote in our previous Oil Trading Alert, is still up-to-date.

(…) crude oil broke above the medium-term resistance line based on the September and March highs (which is also the upper line of a triangle) (…). According to theory, such price action should trigger further improvement and an increase to around $108, where the long-term resistance line (marked with red) is (you could read this bullish scenario in our Oil Trading Alert posted on Monday). However, taking into account the size of the upswing it’s too early to say that this breakout is reliable.

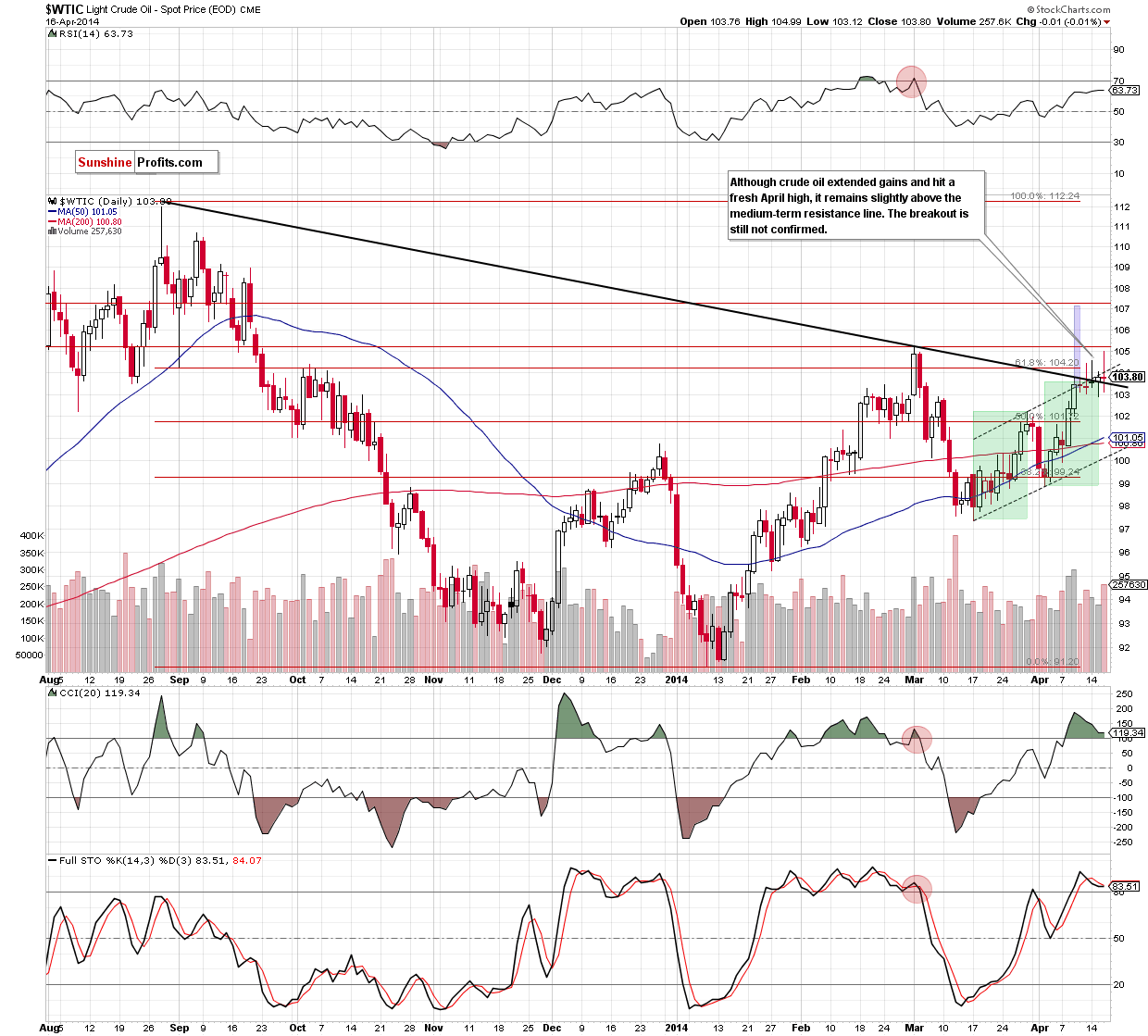

Before we summarize today’s Oil Trading Alert, let’s zoom in on our picture and move on to the daily chart.

In our last Oil Trading Alert, we wrote the following:

(…) crude oil closed the day above the medium-term resistance line, which is a strong bullish signal. Despite this positive event, we should keep in mind that the breakout is not confirmed at the moment. Additionally, as mentioined earlier, the size of the upswing is too small to say that this breakout is reliable. If we see two consecutive daily closes above this line (or a significant upward move on high volume), the breakout will be confirmed and we likely see further improvement and an increase to (at least) the 2014 high. Nevertheless, the volume that accompanied yesterday’s upswing was smaller than the day before, which questions the strength of the buyers.

Yestarday, after the market open oil bulls pushed the price higher, which resulted in a 6-week high of $104.99. With this upswing, crude oil reached the 2014 high. As you see on the daily chart, this resistance level encouraged sellers to act and triggered a pullback that took light crude below the upper line of the rising trend channel (marked with dashed line). Additionally, the price dropped to slightly above the previously-broken medium-term support/resistance line. If it holds, we may see another attempt to break above the March high. However, if oil bears show their claws and push the price lower, we will likely see an invalidation of the breakout and further deterioration in the near future. At this point it’s worth noting that increased volume during yesterday's sideways trading suggests increased tension - investors seem to be fighting for this particular resistance line - after today's session, we should know if the breakout is confirmed or invalidated.

Summing up, although crude oil hit a six week high, the commodity reversed and closed the day slightly below Tuesday closing price. If oil bulls do not give up and light crude extends gains, we will likely see another upward move to the 2014 high. However, if they fail, we may see an invalidation of the breakout and further deterioration in the near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, it seems justified to wait for a confirmation of the breakout before opening long positions. In our last Oil Trading Alert, we wrote that the breakout would be confirmed after two consecutive daily closes above the medium-term support/resistance line. However, taking into account the recent price action, it seems that three consecutive closes might be more appropriate. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Finishing today’s Oil Trading Alert, we would like to let you know that we won’t publish Oil Trading Alert on Monday due to the Holiday travel plans.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts