Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil gained 1.66% as supply disruptions in Nigeria eased some concerns over the supply glut on the energy market and supported the price of the commodity. Thanks to these circumstances, light crude rebounded and climbed to the previously-broken support/resistance line. Will it be strong enough to stop oil bulls?

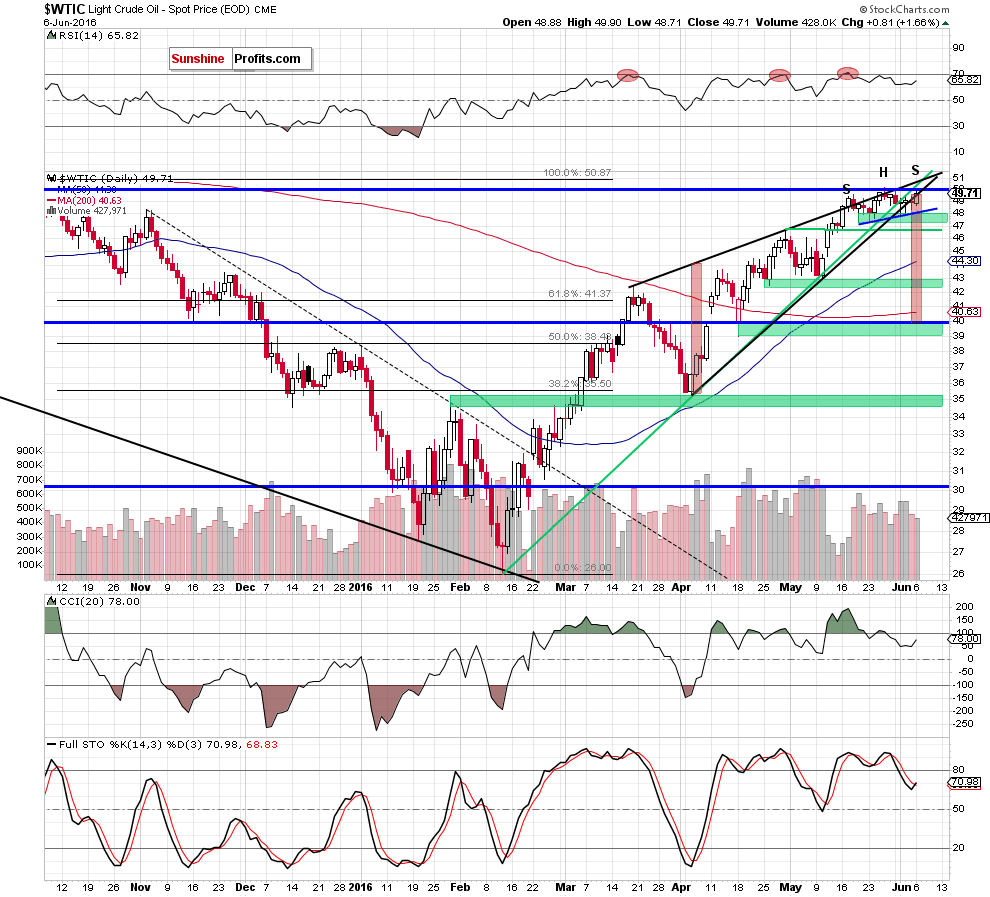

Let’s examine charts below and find out what are they telling about future moves (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil reversed and re-approached the barrier of $50, hitting an intraday high of $49.90. With this move, the commodity also climbed to the previously-broken lower border of the black rising wedge and closed the day on it, which could be a verification of earlier breakdown. Additionally, the size of volume that accompanied yesterday’s increase was smaller (compared to what we saw in the previous week), which increases the probability of reversal in the coming day(s).

Nevertheless, in our opinion, as long as light crude remains above the blue support line based on the May 19, May 23 and Jun lows another re-test of the barrier of $50 (or even the May 26 high of $50.21) is likely. Why this line is important from our point of view? If we take a closer look at the daily chart, we can notice a potential head and shoulders formation. Therefore, in our opinion, if the commodity drops below the blue line (the neck line of the pattern), we’ll likely see acceleration of declines – especially if black gold closes the day below the green support zone created by the May 19 and May 23 lows.

At this point, it is also worth noting that if yesterday's growth is actually a verification of the breakdown under the lower border of the black wedge, we may see declines even to the barrier of $40 in the coming days. Why here? Because, in this area the size of the downward move will correspond to the height of the black rising wedge and in this area is also the mid-Apr low of $39.

Summing up, crude oil moved higher and climbed to the lower border of the black rising wedge, which may be a verification of earlier breakdown. However, as long as the commodity is trading above the neck line of the potential head and shoulders pattern another test of the barrier of $50 or even the May 26 high s likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts