Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

Although crude oil moved higher after the market’s open on expectations that U.S. weekly supply data will be bullish, a stronger greenback limited the rally. As a result, light crude gave up gains and finally lost 0.40%. Did this downswing change the very short-term picture?

Yesterday, the price of light crude hit an intraday high of $93.94 supported by expectations that the EIA weekly report will show another drop in crude oil supplies and inventories at a key storage hub of Cushing, Okla. would stay low for longer than previously expected. At this point, it’s worth mentioning that inventories at Cushing have fallen to multiyear lows in recent months, which have supported prices on concerns that supplies could fall too low for oil to be easily delivered out of the storage hub. Meanwhile, new pipelines from Canada and the Northern U.S. into Cushing could rise supply levels and weighed on the price. Therefore, news that one of those pipelines, the Pony Express, will be delayed from its scheduled opening in September or October was supportive for the commodity.

Despite these circumstances, gains were limited as ongoing expectations that U.S. interest rates will be rise sooner rather than later supported the U.S. dollar, making crude oil more expensive for holders of other currencies. As a result, the commodity reversed and came back to the lower border of the consolidation. Will we see another breakdown in the coming days? (charts courtesy of http://stockcharts.com).

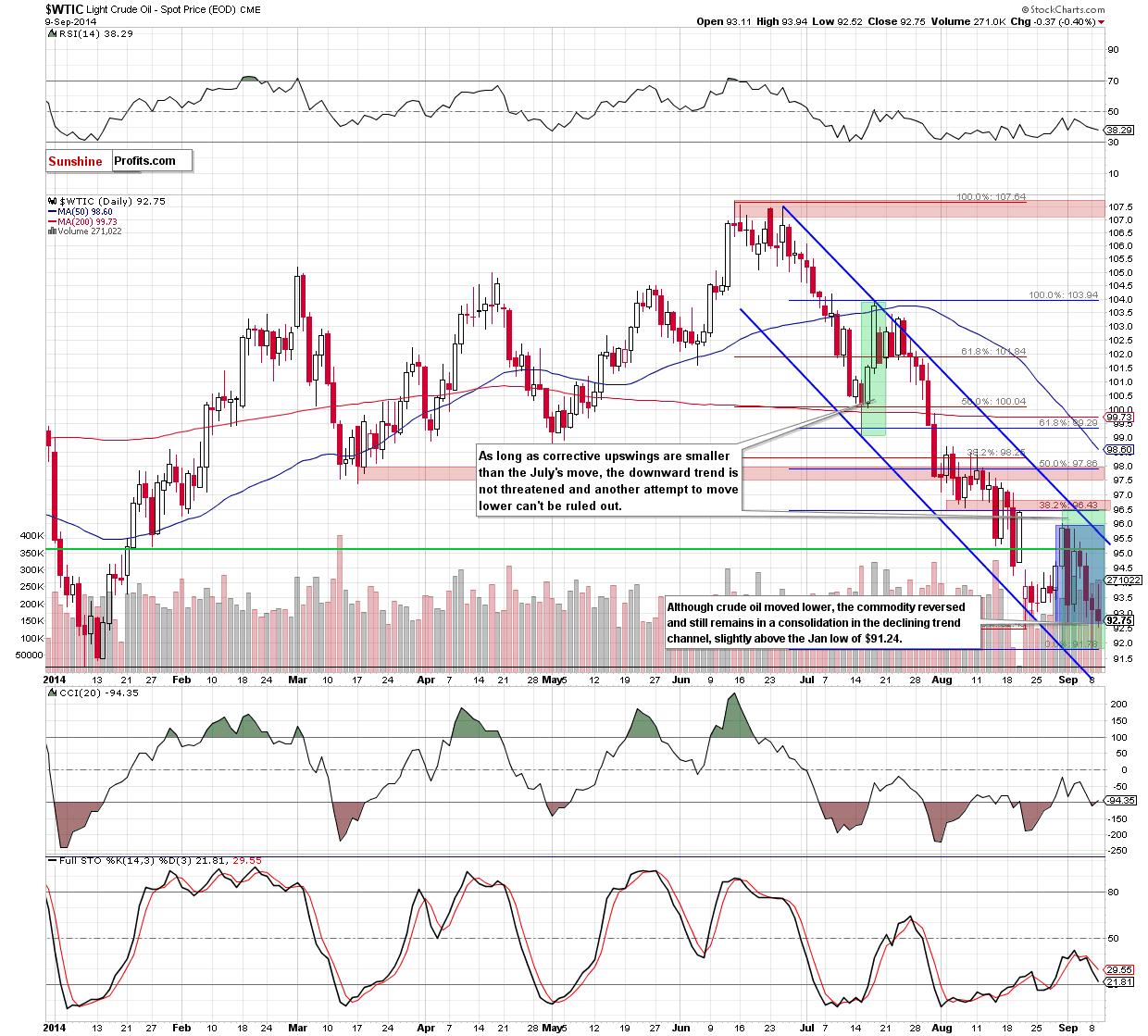

The situation in the medium term hasn’t changed much as crude oil is still trading in a consolidation between the Aug low and the strong resistance zone created by the previously-broken 200-week moving average and the rising, long-term support line. Today, we’ll focus only on the very short-term changes.

From this perspective, we see that although crude oil bounced off the eight-month low after the market’s open, the size of the upswing was too small to change the very short-term picture (it didn’t even reach the upper line of the declining trend channel). As a result, the commodity gave up the gains and came back to the lower border of the consolidation range. Will we see further deterioration? In our opinion, even if currency bears manage to push the price lower, the space for further declines seems to be limited. The reason? We believe that the best answer to this question will be our yesterday’s commentary:

(…) the proximity to the strong support zone created by the Jan low of $91.24, the 61.8% Fibonacci retracement level based on the Jun 2012-Aug 2013 rally and the lower border of the declining trend channel (…) as long as this area is in play, another sizable downward move is not likely to be seen. Nevertheless, we should keep in mind that even if crude oil rebounds from here, the combination of the upper line of the blue trend channel and the 38.2% Fibonacci retracement (based on the Jul-Aug decline), will likely stop further improvement.

(…) we would like to drive your attention to the fact that as long as corrective upswings are much smaller than the July’s move (which means that oil bulls are weaker than they were in July), we think that the downward trend is not threatened and another attempt to test the strength of the above-mentioned support zone should not surprise us.

Summing up, although crude oil moved higher after the market’s open, this improvement was only temporarily and the commodity came back to the lower border of the consolidation range, increasing the risk of another breakdown. Therefore, we still think that opening long positions is currently not justified from the risk/reward perspective. Nevertheless, we do not recommend opening short positions either as the space for further declines might be limited (especially when we factor in the strong support zone created by the Jan low of $91.24, the 61.8% Fibonacci retracement level based on the Jun 2012-Aug 2013 rally and the lower border of the declining trend channel).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts