Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95.

On Monday, crude oil lost 1.03% as tensions between Russia and Ukraine eased and U.S. manufacturing activity data disappointed investors. Because of these circumstances, light crude reversed and closed the day slightly below $98 per barrel.

On Sunday, over 90% of Crimean voters chose to break with Ukraine and join Russia. Crimea's Parliament on Monday formally asked to join the Russian Federation. These circumstances resulted in sanctions as expected. European Union foreign ministers imposed travel bans and asset freezes on 21 people they have linked to the push to have Crimea secede from Ukraine to be annexed by Russia. U.S. President Barack Obama also imposed sanctions on several Russian officials involved in the incursion of Crimea, which included freezing assets in the U.S. Despite these decisions, it seems that the oil market expected more widespread action from the West because the price of light crude reversed and declined.

Another bearish factor, which pushed the price of light crude lower was disappointing U.S. manufacturing activity data. The Federal Reserve Bank of New York said that its Empire State manufacturing index moved higher to 5.6 this month, from a reading of 4.5 in February, missing expectations for a rise to 6. Although today’s data also showed that U.S. industrial production rose 0.6% in February (beating expectations for a 0.1% increase), crude oil extended losses and hit a fresh March low.

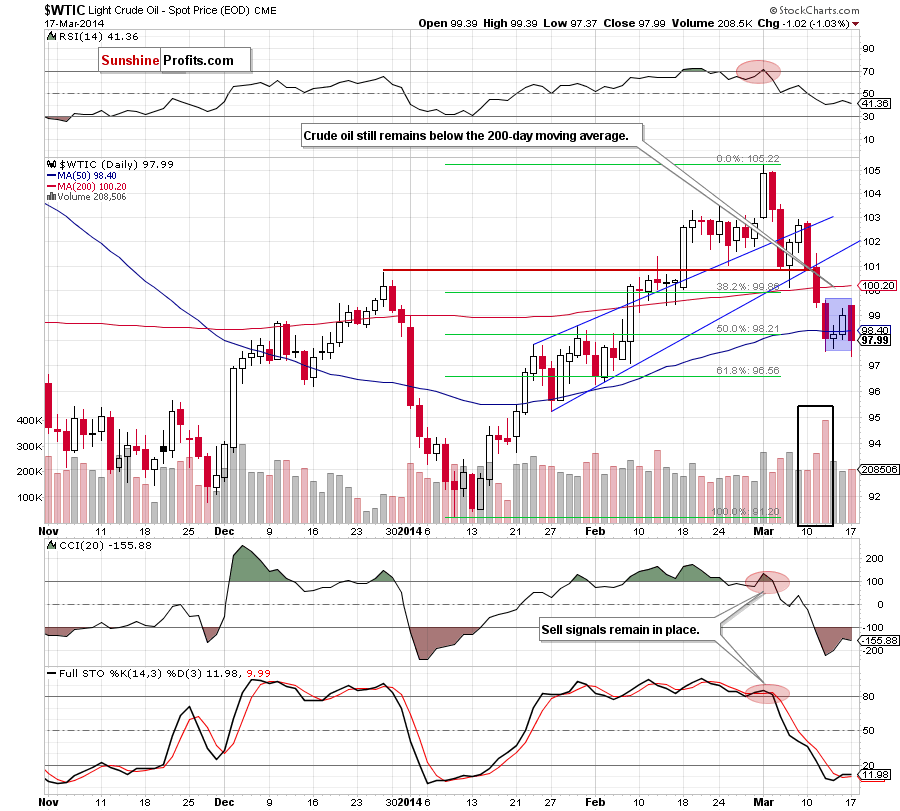

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

On the above chart, we see that the situation hasn’t changed much as light crude still remains in a consolidation (marked with a blue rectangle). Although crude oil declined and dropped below Wednesday low, the commodity reversed in the following hours and came back to the consolidation range. Despite this upswing, light crude still remains below the 50-day moving average, the 38.2% Fibonacci retracement based on the recent decline (around $100.45) and the 200-day moving average (which serves as the major resistance). Additionally, as you see on the daily chart, two recent candlesticks created a bearish engulfing pattern, which supports sellers at the moment.

Please keep in mind that according to theory, if the price climbs above $99.60, we may see an upswing to around $101.65. However, if the buyers fail and crude oil declines below $97.55, the price target for oil bears will be around $95.50 (please note that the nearest support is the 61.8% Fibonacci retracement, which corresponds to this level).

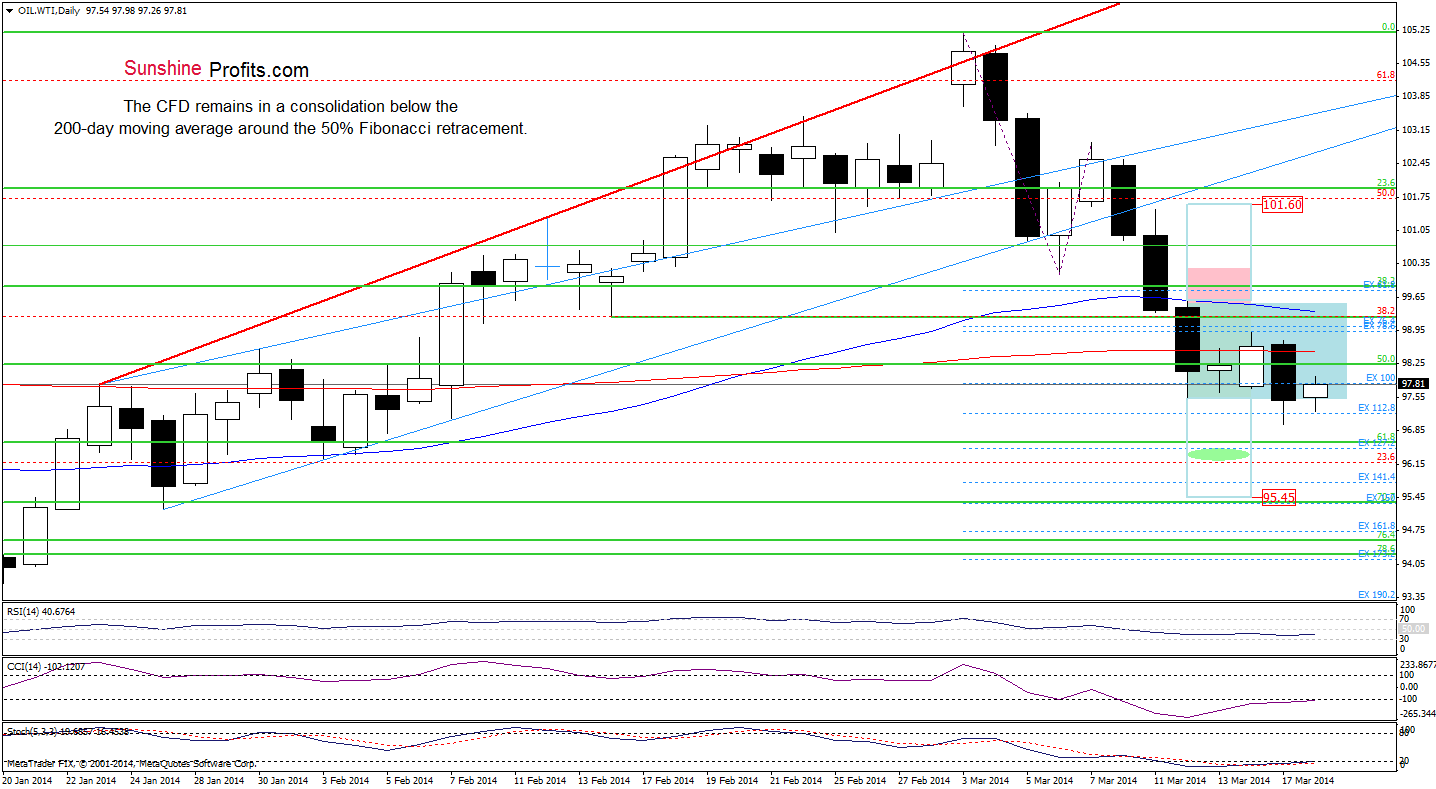

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see a situation (just like in the case of crude oil) hasn’t changed much. Although the CFD moved little lower yesterday, it still remains in a consolidation below the 200-day moving average around the 50% Fibonacci retracement. Therefore, what we wrote in our last Oil Trading Alert is still up-to-date.

(…) From this perspective, it seems that as long as this resistance is in play, a bigger corrective upswing is not likely to be seen and another attempt to move lower should not surprise us. Nevertheless, taking into account the fact that the CFD remains in a consolidation, we should consider two scenarios. On one hand, if oil bulls break above the nearest resistance and push the price above Wednesday high (which is currently reinforced by the 50-day moving average), we may see an upward move to around $101.60. On the other hand, if they fail and the CFD drops below Wednesday low, we may see a downward move not only to the first downside target (the 61.8% Fibonacci retracement around $96.55), but even to around $95.45, where the 70.7% Fibonacci retracement and the Jan.27 low are. Looking at the position of the indicators, we see that they are still overbought, but there are no buy signals at the moment.

Summing up, the very short-term outlook remains bearish and the overall situation hasn’t changed much. The current situation in WTI Crude Oil suggests that we may see another attempt to move higher after the market open, but as long as light crude remains below the 200-day moving average another downswing can’t be ruled out (especially when we take into account the size of the volume that we saw in recent days and the position of the indicators).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95. We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts